AIG: Annuity Sales Showing ‘Strong Rebound’ Off Poor 2Q

Projections of COVID-19 losses were as bad as projected, American International Group execs told analysts Tuesday morning, but there are positive signs.

In particular, annuity sales picked up as the quarter wound down, said Kevin Hogan, chief executive officer for life & retirement.

"Toward the end of the quarter, we began to see improvement in retail annuity activity, as our distribution partners responded to the new environment," Hogan said. "As of today, based on early indications, we have seen a strong rebound in sales compared to June and our retail new business pipeline continues to build, suggesting improving volumes from historically low second-quarter levels."

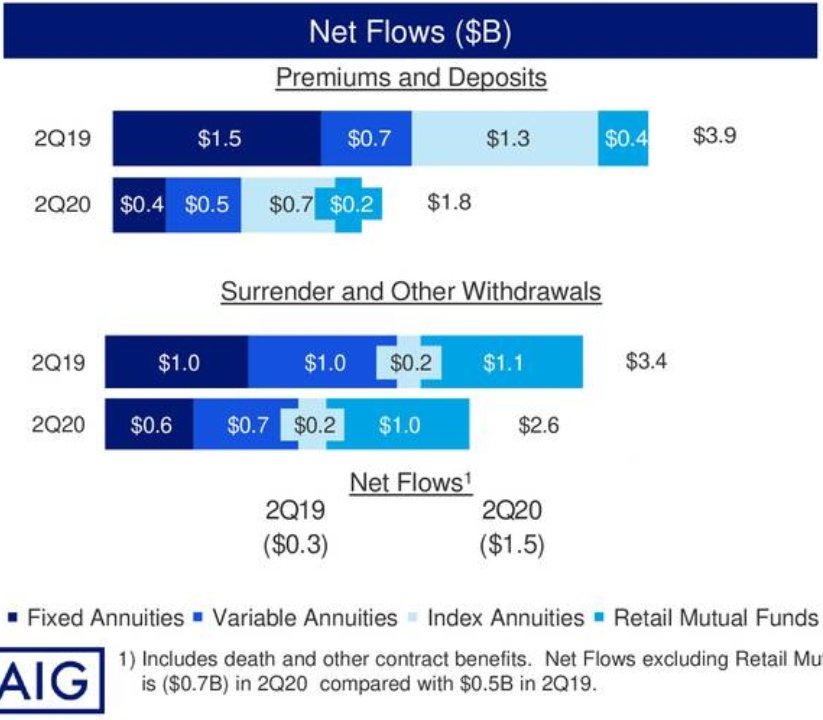

A slide accompanying the presentation shed light on AIG's annuity business struggles in the second quarter:

Across the industry, second-quarter annuity sales were down nearly 25%, the LIMRA Secure Retirement Institute reported last week.

One of the largest U.S. insurers, AIG reported a $9.7 billion net loss for the second quarter off $9.4 billion in revenue. Its life and retirement business was a big bright spot overall, reporting $650 million in adjusted pre-tax income on $4.5 billion in revenue.

"Our broad position across products and channels has been especially advantageous during these times," Hogan said. "For example, as retail annuity sales languished in the second quarter, we expanded our pension risk transfer business, concluding several significant reinsurance transactions."

On the life side, AIG recorded increased revenue from higher international life premiums, Hogan said. The company estimates that about 40% of its COVID-19-related death claims "reflect an acceleration of claims we would have otherwise experienced in the next five years," he added.

The company is undertaking a review of actuarial assumptions in the third quarter.

"We do not currently expect COVID-19 losses to have a large impact on our long-term mortality assumptions," Hogan said.

Major Pandemic Losses

AIG posted a 56% fall in quarterly adjusted earnings, largely because of $458 million in pandemic losses in its general insurance business.

During its first-quarter call, AIG execs warned analysts to expect losses that could top Hurricane Katrina, which produced $61.9 billion in insured catastrophe losses in the U.S – the highest annual insured catastrophe loss tally ever.

AIG's total COVID-19 losses for the year stand at $730 million, said CEO Brian Duperreault. AIG expects to recover some of its losses through reinsurance, executives said.

"While our overall new business is down, primarily in our large account risk management business due to COVID-19, we did see new business growth in North America in lines such as retail property, excess casualty and financial lines," said Peter Zaffino, president and chief operating officer for the company.

The impact was felt across several lines of business, Zaffino said, including travel, property, trade credit, marine, casualty, workers' compensation, accident and health, financial lines, contingency, as well as AIG's reinsurance business, Validus Re.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Morningstar: DOL Investment Advice Rule Needs Work

Americans Favor Aggressive Measures To Stop COVID-19, Poll Finds

Advisor News

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Rep. Howell, Sen. Watson propose health insurance protection legislation

- Braden Draggoo Named New York Life’s 2025 Council President

- Genworth Financial taking the offensive after years of LTCi rate struggles

- Ambler Brook Announces Strategic Growth Investment in Claimify

- Sarepta Therapeutics Announces Commercial Launch of ELEVIDYS in Japan

More Health/Employee Benefits NewsLife Insurance News