Agent satisfaction with carrier partners at all-time high, study finds

In spite of disruptions from the digital transformation, economic uncertainty, and the pandemic, independent insurance agents have never been more satisfied with their carrier partners, according to a new study.

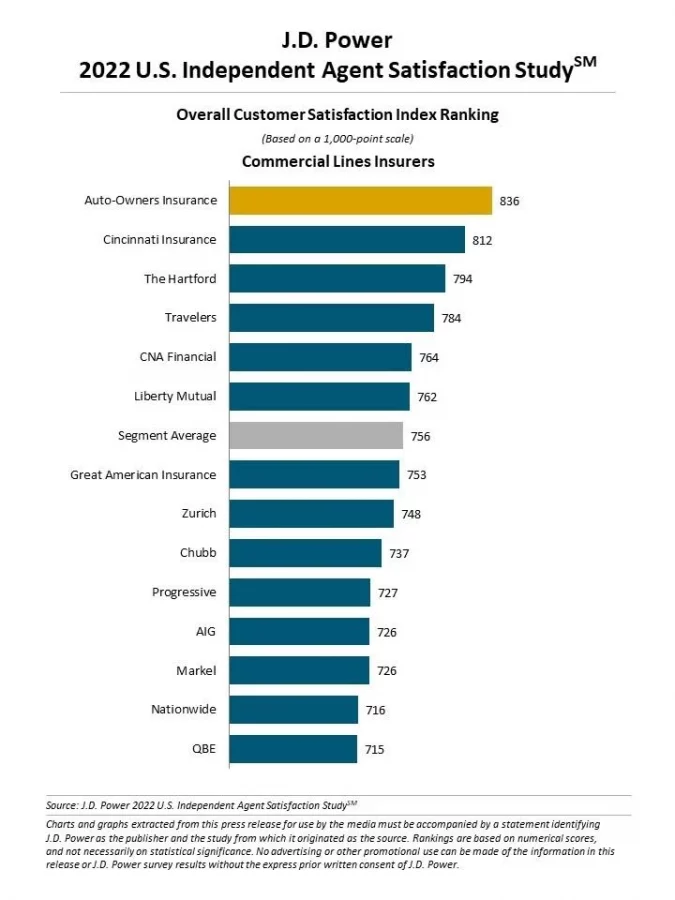

The J.D. Power 2022 U.S. Independent Agent Satisfaction Study, released this week, found overall agent satisfaction with insurers of both personal lines and commercial lines has reached an all-time high. Commercial lines satisfaction achieved a significant 16-point increase, on a 1,000-point scale, from 2021.

“I think the broad theme here is we’re seeing a return to normal.”

— Stephen J. Crewdson, senior director, insurance intelligence at J.D. Power

“I think the broad theme here is we’re seeing a return to normal,” said Stephen J. Crewdson, senior director of insurance intelligence at J.D. Power, in a webinar presentation of the findings. “And a return to more frequent and more positive interactions between agents and carriers. Importantly, we’re also seeing trends that suggest the changes made since the pandemic – such as increased digital engagement and updates to legacy systems with new platforms and portals – are having a positive effect on the agent/carrier relationship.”

The study was developed in alliance with the Independent Insurance Agents & Brokers of America (IIABA). It evaluates the evolving role of independent agents in P&C insurance distribution, general business outlook, management strategy and overall satisfaction with personal lines and commercial lines insurers in the United States.

“The in-person at agency or insurer interactions, of course declined during the COVID era,” said Crewdson. “But that's rebounded this year. Up to 31% of independent agents are telling us they recently had an in-person interaction with their carrier either at the agency or at the office of the insurer. That's the highest one we've seen in our study.”

Study findings

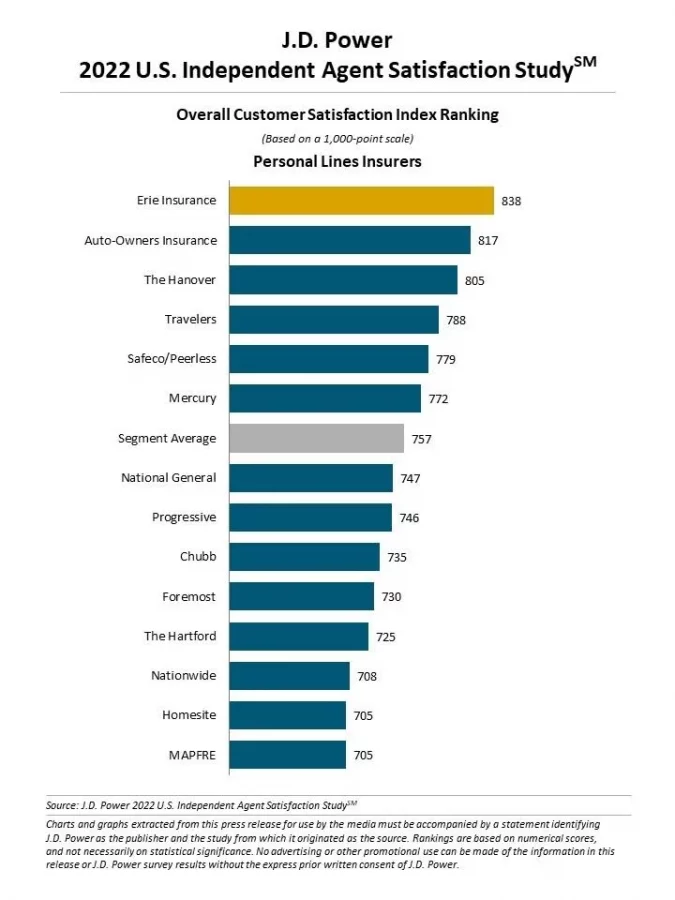

- Overall satisfaction among personal lines agents is 757, up 7 points from 2021, Crewdson said. The largest gains in satisfaction with commercial lines were in product offerings and risk appetite; support and communication; quoting; and commission.

- The use of digital channels for interaction with carriers increased 22 percentage points this year, while in-person interaction increased 8 percentage points. Overall satisfaction is highest when agents interact via digital channels.

- Digital carrier platforms and web portals, which were widely updated by the industry in the past few years, can have a positive effect on agent satisfaction, the survey found, but only if they are fully integrated. Complete seamless integration between carrier portals and agency management systems drives a substantial boost in agent satisfaction, but incomplete or inconsistent integration has a negative effect on satisfaction. Just 51% of personal lines agents and 46% of commercial lines agents say they have seamless integration with carrier portals.

- Agents with the highest levels of satisfaction fall into the relationship tenure sweet spot of 2-10 years. Agents who have been working with carriers for both shorter and longer periods of time are less satisfied overall, suggesting that carriers need to refine their approaches to newer as well as more seasoned agents, Crewdson concluded.

Among individual carriers, Erie Insurance ranked highest among insurers of personal lines, with a score of 838. Auto-Owners Insurance (817) ranked second and The Hanover (805) ranked third.

Auto-Owners Insurance ranked highest among insurers of commercial lines, with a score of 836. Cincinnati Insurance (812) ranks second and The Hartford (794) ranks third.

J.D. Power said it surveyed 4,670 personal and commercial lines insurers in which agents had placed policies during the prior 12 months. The study was fielded from May through July 2022.

“Another good thing here that we're seeing is that in-person and agency or insurer transactions, are increasing where other channels – website dashboard, a portal email, and telephone – are declining in incidents year over year,” said Crewdson,

“They're still the top three in terms of incidents, but they're declining as emerging digital and in-person catches up," he said, adding, "Those other three transactions have lower satisfaction scores. So we’re seeing a decline in the incidence of lower satisfaction, communication channels, and an increase in the incidence of higher satisfaction communication channels.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

NAIC panel inching forward on life insurance illustration reg revision

Beyond the hype: risks and opportunities for insurers in the metaverse

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- New Findings in Managed Care Described from University of Pennsylvania Perelman School of Medicine (Understanding Postpartum Hospital Use Among Birthing People With Medicaid Insurance): Managed Care

- Community Forum: Try something new, back publicly financed universal primary care

- Primary care a key issue this legislative session

- Studies from National Health Insurance Service Ilsan Hospital Provide New Data on Cytomegalovirus (Occult cytomegalovirus infection presents anastomotic leakage after gastrectomy: Two case reports): Herpesvirus Diseases and Conditions – Cytomegalovirus

- WATCH: BALDWIN TAKES TO SENATE FLOOR TO STOP GOP ATTACKS ON AFFORDABLE CARE ACT AND ATTEMPT TO KICK PEOPLE OFF COVERAGE

More Health/Employee Benefits NewsLife Insurance News