After a blistering 2022 in life/annuity sales, expect a cooler 2023, S&P says

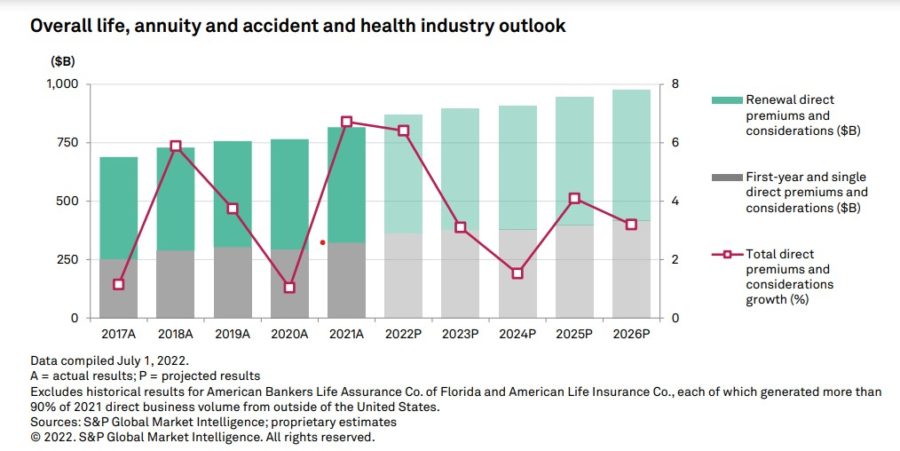

The life insurance and annuity industry were definite winners in the pandemic with their highest growth in premium in a decade, but that momentum might slow into the next four years, according to the latest market report from S&P Global.

Even before the Federal Reserve started raising interest rates, the industry was benefiting from conditions around the COVID-19 pandemic, often because of greater mortality awareness boosting life sales. The equity market crash of 2020 prompted flights to safety, such as annuities.

Into 2022, the long-awaited boost in interest rates unleashed a wave of annuity sales, pushing products such as fixed-rate deferred annuities to all-time highs. That momentum will likely lose steam into the next few years, according to the report, partly because of the high bar that sales have set.

“The combination of difficult year-over-year comparisons and increasing distance from the two most compelling growth catalysts the business has experienced in many years — a heightened focus on end-of-life planning amid the pandemic and a favorable federal income tax change — will drag on the pace of expansion,” according to the report.

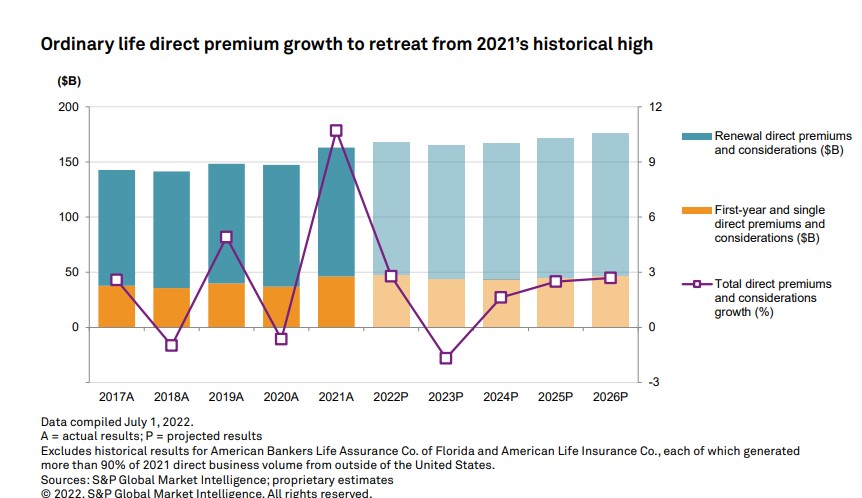

Life insurance to simmer down

S&P expects ordinary life direct premium will drop to 2.8% this year, down from 10.7% in 2021. Since 2003, the annual rate had only approached 5% twice.

Several factors coalesced in 2021 to allow the industry to defy history: heightened consumer awareness of the need for end-of-life financial planning amid the pandemic, relatively easy year-over-year comparisons to a 2020 in which production slowed during the spring and summer, and a favorable change to the U.S. Internal Revenue Code that made certain types of ordinary life policies more attractive as a wealth management tool.

The tax code change updated Section 7702 to allow policyholders to add premium without losing its tax advantage by becoming a modified endowment contract. This had a significant impact on whole life, which saw a policy count increase of nearly 6.3% in 2021 in the second-largest increase in more than two decades. In citing LIMRA data, although the policy count increased by more than 6%, the annualized premium on those contracts represented a 20% increase, reflecting the tax law change. While universal life had an impressive 15% increase in policy count, the associated premium increased 18%.

The bad news is that analysts expect the overall slowdown this year will probably turn into a slight negative next year in premium. But the good news is they expect sales to pop back up into historic territory.

Annuity P/E boom attracts scrutiny

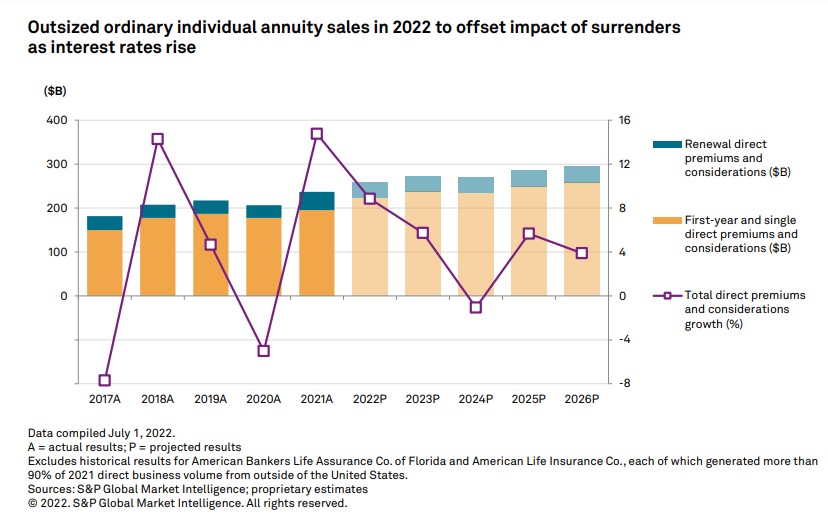

The Fed rate increase was a good dousing rain after a long low-rate drought for the annuity business, which have seen record-breaking sales even after a strong 2021.

But the rising rates also have countervailing effect because they encourage surrenders.

“Growth rates in 2022 and into 2023 will be tempered to some extent by rising surrenders as annuitants seek out products with more favorable rates and more attractive features,” according to the report.

Besides attractive rates, the industry is also benefiting from shifting demographics and market volatility. Consumers still want the upside of equities but have been scared out of direct market investment because of increasingly erratic volatility.

“We anticipate growth in first-year and single premiums, which serve as a measure of new business production, to more than offset a drop in renewal premiums,” according to the report.

An increasingly important element is the injection of private equity cash into the business.

“The impact of these transactions can be viewed in multiple ways,” the analysts wrote. “In the ordinary individual annuity business, for example, the share of gross contract reserves ceded to reinsurers rose to a new high of 18.7% at year-end 2021. It had been less than half of that amount as recently as 2017.”

In the not-so-great corner is increased scrutiny from legislators and regulators. The Senate Banking Committee directed the Federal Insurance Office to investigate whether Labor Department rules sufficiently protect annuity funds.

The National Association of Insurance Commissioners also raised a red flag by issuing its “Regulatory Considerations Applicable (But Not Exclusive) to Private Equity-Owned Insurers” in June. The considerations are:

- Transparency of intercompany contractual relationships.

- The potential for a party to exercise control over an insurer through means other than an ownership stake of 10% or more.

- Possible strengthening of capital maintenance arrangements to ensure an alignment of interests among an owner and the long-tail liability of an insurer.

- Better disclosure of related party-originated investments including collateralized loan obligations and other structured finance securities.

- Possible new reporting to address concerns related to privately structured securities by affiliated and nonaffiliated asset managers.

- Ways to enhance disclosures around pension risk transfer business.

- Transparency on insurers’ broadening use of offshore reinsurers, including captives and complex affiliated sidecar vehicles, to maximize capital efficiency but also with the potential effects of reducing reserves, increasing investment risk and introducing new complexities into group structures.

Industry shows resilience

Sales momentum is likely to continue for annuities such as fixed index and fixed-rate deferred products as rates increase along with volatility anxiety.

But a few factors look to drag sales in the coming years, especially inflation, which leaves consumers with less cash for life and income protection products, even as they recognize the need for retirement savings.

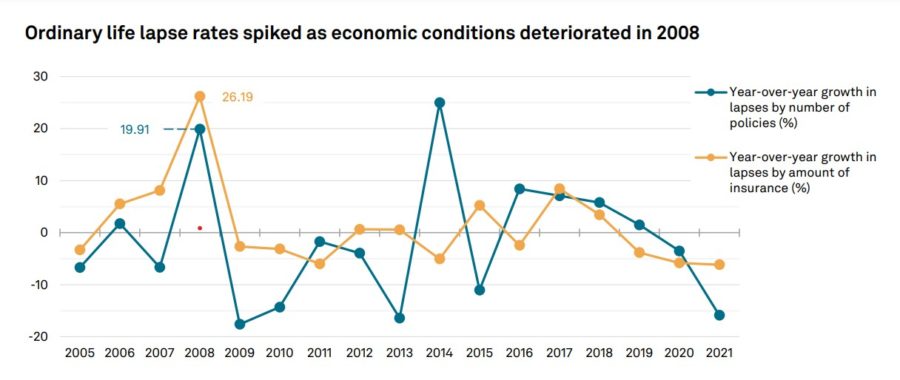

A recession might also change dynamics, such as increasing lapses in life insurance, as they did in previous downturns.

If there is a recession, it would not be like the 2008-09 recession, so a direct comparison cannot be made. The analysts wrote that the pandemic, for example, changed the dynamic this time.

“The stickiness of basic term life coverage sold during the pandemic relative to a more typical environment would add an interesting variable to the situation and creates the potential for incrementally higher lapse rates in a downturn.” According to the report. “But even if lapses were to show outsized growth, we believe that the industry is well-positioned from a balance sheet standpoint to weather the impact.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Most workers say they are satisfied with their employer’s health benefits

National Guardian Life sells Settlers Life

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- New Findings in Managed Care Described from University of Pennsylvania Perelman School of Medicine (Understanding Postpartum Hospital Use Among Birthing People With Medicaid Insurance): Managed Care

- Community Forum: Try something new, back publicly financed universal primary care

- Primary care a key issue this legislative session

- Studies from National Health Insurance Service Ilsan Hospital Provide New Data on Cytomegalovirus (Occult cytomegalovirus infection presents anastomotic leakage after gastrectomy: Two case reports): Herpesvirus Diseases and Conditions – Cytomegalovirus

- WATCH: BALDWIN TAKES TO SENATE FLOOR TO STOP GOP ATTACKS ON AFFORDABLE CARE ACT AND ATTEMPT TO KICK PEOPLE OFF COVERAGE

More Health/Employee Benefits NewsLife Insurance News