Accounting standard dampens life insurers’ interest in high-interest bonds

After a decade and a half of hoping, life insurance companies are finally seeing an increase in interest rates that improves yield on assets they can purchase, but carriers might be afraid to exchange their low-rate bonds for higher-rated ones because of an accounting standard.

As rates dropped after the 2008 economic crash, insurers could sell bonds for a gain before their maturity and count as a plus in its interest maintenance reserve (IMR), an accounting standard that helps carriers smooth their annual income across market conditions, according to a recent Conning report. IMR is a reserve held according to standard accounting principles to deal with fluctuations in the interest rate.

Now the 30-year-old IMR standard is traversing rough terrain in an environment of rapidly rising interest rates. Carriers’ IMR balances can drop further as they trade their old bonds for new, eroding their interest maintenance reserve into negative territory, which is not allowed under IMR standards. It’s a particular problem for public companies accountable to shareholder demands.

“A desire to avoid having negative IMR may make insurers increasingly reluctant to trade as they seek to minimize losses and even forgo opportunities that could benefit their long-term economic value,” according to the Conning report, “As Rates Rise, Investment Strategies Must Meet IMR Challenges.” “It has become abundantly clear that accounting for IMR is now a vital constraint that insurers must incorporate when managing their portfolios and setting investment strategy, adding another level of complexity to the process.”

Seeing no negative

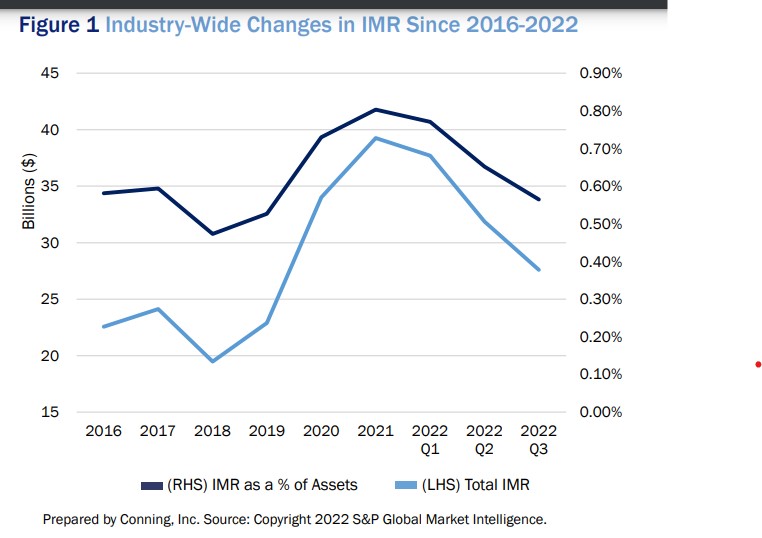

Even in the low-interest rate environment, things were going well for carriers’ interest maintenance reserves. Between 2018 and 2021, the industry’s IMR doubled from $19.5 billion to $39.3 billion, according to Conning.

Rising interest rates in 2022 choked off that increase and is eating into the reserve. Last year, 61 carriers went from a positive IMR to zero.

“Many insurers risk their IMR balances shrinking further or even turning negative should they continue to sell bonds in pursuit of higher yields,” according to the article.

A key problem is that the National Association of Insurance Commissioners’ accounting standard does not allow a negative IMR balance, which inhibits carriers from taking the short-term hit on selling bonds on their books and buying higher-rated bonds for longer-term gains.

“Should the NAIC allow a negative IMR balance in statutory accounting, it could provide insurers more flexibility, limit the capital strain of nonexistent or dwindling IMR balances, and affect the tactical and strategic management of insurance portfolios,” according to Conning.

The American Council of Life Insurers has asked the NAIC to adjust accounting standards for negative IMR.

“Negative IMR balances are expected to become more prevalent in a higher interest rate environment and their continued disallowance will only serve to project misleading opt strength (e.g. inappropriate perception of decreased financial strength through lower surplus and risk-based capital even though higher rates are favorable to an insurer’s financial health) while creating uneconomic incentives for asset-liability management (e.g. discourage prudent investment transactions that are necessary to avoid mismatches between assets and liabilities just to avoid negative IMR),” according to a letter ACLI sent to the NAIC in 2022.

When the IMR accounting standard was developed in 1992, it was supposed to function in declining and a rising interest rate environments, but the NAIC did not finish the work of addressing high interest rate scenarios and the possibility of negative IMR, according to ACLI.

“Over time with the persistent declining interest rates, the issue lost urgency since a negative IMR would not have been a significant issue for any company,” according to the letter. “The NAIC AVR/IMR Working Group ultimately disbanded without ever addressing this longstanding item on their agenda.”

Will life companies offer life insurance?

While the threat of negative IMR dissuades carriers from taking full advantage of higher bond rates, many companies are not positioned to expand their life insurance offerings, according to The Wall Street Journal.

“A lot of these life insurers don’t sell life insurance anymore, at least not to American consumers,” according to an article by Leslie Scism. “They gave up the business and their armies of agents when low interest rates hit both their profits and stock prices.”

The article also traced the steady slide in life and health carriers’ average net yield on investments over the past 20 years, dropping from 7.3% in 2000 to an estimated 3.9% in 2022. Scism added that the earnings crunch is felt acutely by public companies, but mutuals could afford to look at the longer view. The article cited AM Best data showing that between 2007 and 2022, premium volume for non-mutuals dropped 22%, while it doubled for mutuals.

Interest rates would have to rise to about 5% to prompt large public companies to offer more life products, according to Scism’s findings. Rates are now closing in on that mark.

But of course, those companies would also be balancing the effect rates are having on their IMR. According to Conning’s analysis, carriers’ business is healthier if they can trade their low-rate bonds for higher-rate ones. Allowing negative IMR to balance assets and liabilities makes for healthier companies.

“Our analysis highlights how IMR allows insurers to increase both economic value and yield by selling lower-yielding assets in exchange for higher-yielding ones and mitigating the losses via IMR,” according to the report. “Regardless of the company’s IMR balance, the company’s portfolio net book yield will materially increase as a result of this trade.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

What a bank failure means for consumers and retirees

Health insurers say free preventive care will continue while lawsuit is appealed

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- NM fills gap after Congress lets ACA tax credits expire

- Congress takes up health care again − and impatient voters shouldn’t hold their breath for a cure

- On the hook for uninsured residents, counties now wonder how to pay

- Bipartisan Senate panel preparing ACA subsidies bill

- CT may extend health insurance sign-up amid uncertainty over future of ACA subsidies, Lamont says

More Health/Employee Benefits NewsLife Insurance News