A Social Dilemma

Social Security is the bedrock of retirement for a large majority of Americans. The question going forward is: Should it be?

And, more important, will Social Security remain that transformational senior living benefit when today’s millennials are ready to retire?

There are big questions about Social Security and the changes that are happening to it. But advisors say those changing dynamics are more about the evolution of well-rounded retirement strategies to supplement Social Security.

Then there are the “so-called” threats to the future of the Social Security program itself. Advisors say it’s a lot of angry talk about a very small problem. A future legislative fix for the long-term funding of Social Security is inevitable, advisors say.

That does not mean there aren’t a lot of things happening within the framework of Social Security. Changing rules, new claiming strategies and evolving holistic planning principles are all areas of change affecting Social Security recipients.

While Social Security might be taking some hits, advisors say it remains a key pillar of retirement income.

“Social Security can be viewed as a form of insurance protecting against longevity, market and inflation risk,” wrote Wade Pfau, a professor of retirement income at The American College of Financial Services.

And those risks are all key planning concerns in 2022.

Risky Environment

Advisors already are dealing with clients who are skeptical about the future of Social Security. And this is not a new trend.

According to a 2016 survey, only 35% of Americans said that they were “very” or “somewhat” confident that Social Security would pay them at least as much as today’s retirees receive, the Employee Benefit Research Institute found.

Thirty percent said they were “not very confident” in Social Security, and 33% said they were “not at all confident” in the program. This confidence shortfall is stark considering how many retirees are reliant on Social Security to live.

Half of retired married couples and about 70% of retired singles rely on Social Security for at least half of their income, the Social Security Administration reported. About 21% of married and 45% of unmarried retirees receive at least 90% of their income from the program.

Given what is at stake for clients, advisors are sure to receive a lot of questions about Social Security benefits, claiming strategies and future viability this year. Here are three big risks to retirement income generating news headlines.

• Inflation. Even good news is not always what it seems when it comes to Social Security. In October, the SSA announced a whopping 5.9% annual cost-of-living adjustment for 2022, the highest benefit increase in four decades. Unfortunately, the rate of inflation stood at 6.8% as of press deadline, based on the November Consumer Price Index.

• The stock market. The current bull market treated the worldwide COVID-19 pandemic as a mere speed bump. Market values are racing higher and higher as the already record bull market will celebrate its 13th anniversary in March. That has some economists concerned, with several predicting a market crash in 2022.

• Social Security Trust Funds. In a late-August report, the Social Security trustees adjusted the projected year in which the trust funds will be depleted and the program will no longer be able to pay out full promised benefits. The new depletion date is 2033, when payments will be reduced to 78% of what was promised, the trustees said.

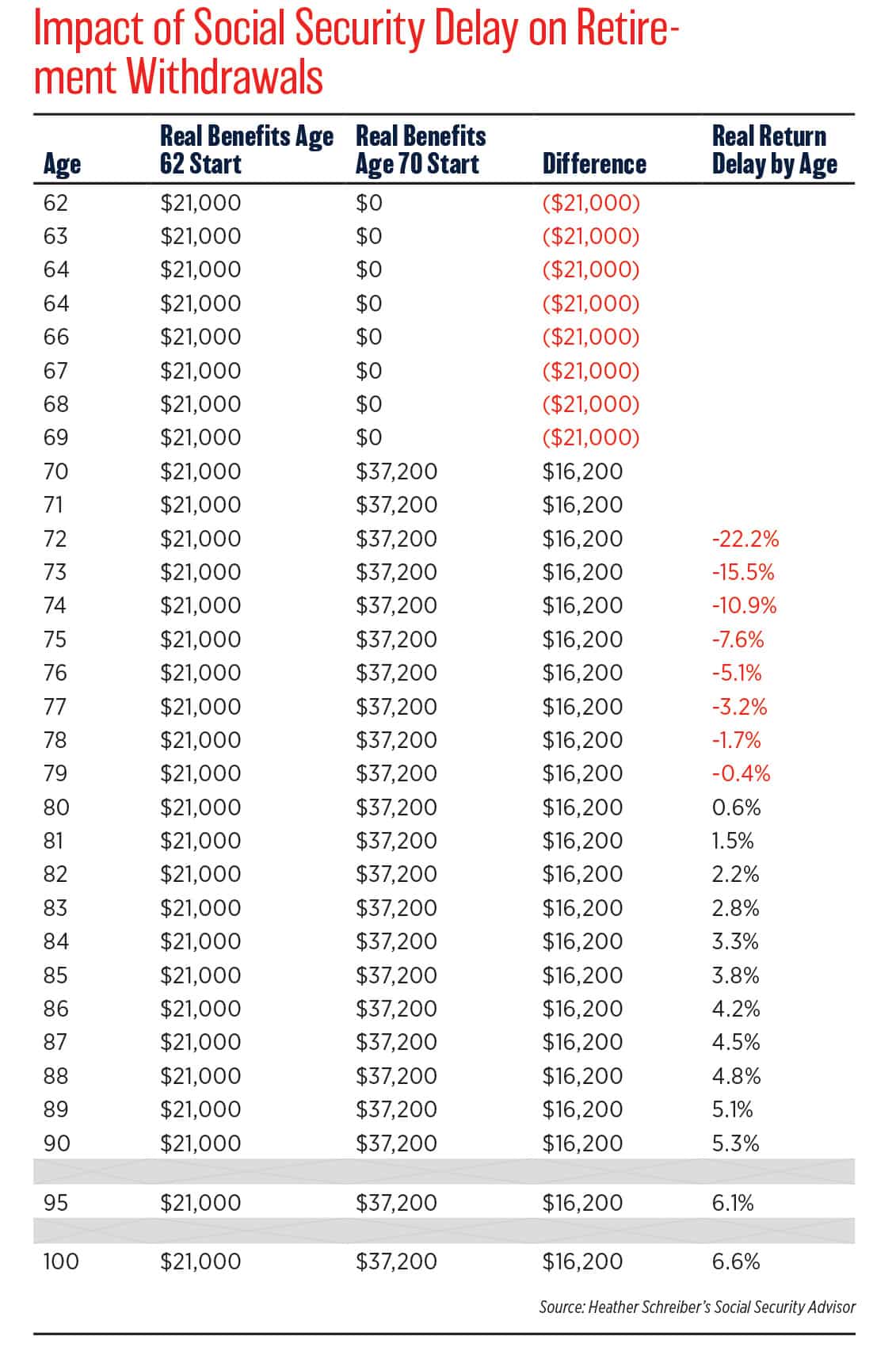

Despite these risk factors, advisors preach delaying benefits as long as possible. Compared with claiming Social Security at the full retirement age (66 for those born from 1943 to 1954: 67 for those born in 1960 or later), claiming early at age 62 reduces the benefit by 30%. But starting benefits at age 70 provides the average retiree a net increase in benefits of $16,200 per year (24% more than full retirement age, or 77% more than at age 62) for as long as they live, Pfau noted.

“The eight years of lost benefits could be viewed as a premium payment for a $16,200 inflation-adjusted lifetime income starting at age 70,” he explained.

‘Higher Wage Earner’

Of course, the decision on when to claim Social Security is not always about dollars and cents. Health factors and other potential financial emergencies require a case-by-case deliberation, said Heather Schreiber, founder of HLS Retirement Consulting in Woodstock, Ga.

“If I have a rule of thumb on claiming, I think when you’re talking to a married couple, I’m always homing in on the higher wage earner,” she said. “That’s because claiming Social Security has a ripple effect, not only on their lifetime income but for the survivor. So I would say if the higher wage earner could wait until at least full retirement age, that’s a good thing.”

A financial professional for 28 years, Schreiber counts Franklin Templeton and AXA Advisors among her past employers. Along the way, she evolved into a holistic planner and found many advisors lack knowledge of Social Security and fail to treat it as a portfolio asset requiring attention.

“About 10 years ago, when all the baby boomers were starting to retire, there was a big push for information from consumers and from the financial professionals who help them,” Schreiber recalled. “So I decided that I was going to dig deep and start really learning about Social Security.”

Today, she is a frequent speaker at industry events, on radio and television, and often quoted as an expert in Social Security strategies. She created Social Security Advisor, a monthly newsletter designed to provide financial professionals and consumers with critical information on the topic.

Schreiber is among the advisors who hear from clients who still think they can use a “file-and-suspend” strategy with their spouses.

File and suspend was a Social Security claiming strategy that allowed married couples of full retirement age to receive spousal benefits and delay retirement credits at the same time. It was ended as of May 1, 2016, by the Bipartisan Budget Act of 2015.

Instead, Schreiber recommends a similar claiming strategy known as “restricted application,” which remains available for some claimants of full retirement age. Restricted application is available to anyone born before Jan. 2, 1954.

“What it allows for someone to do is, instead of taking their own benefit, if they’re married to someone who has already filed or is willing to file, they can say I want half of his or hers right now,” Schreiber explained. “And I’m going to roll up my own benefit on delayed retirement credits until 70. That's still available. So that's the sweet spot of individuals who perhaps are waiting to claim.”

It is one of several important claiming strategies Schreiber talks about in her newsletter.

A Marketing Boon

Tim Dern is the CEO of Mana Financial Group in Schaumburg, Ill. He finds leads and clients by holding free workshops sharing information about Social Security. Dern doesn’t try to sell anything or book clients, and he doesn’t offer a free steak dinner.

Still, his “Retirement for Today” talks remain a popular draw in the Chicago area.

“I feel like Social Security is the topic that people want to hear about,” Dern said. “And they don’t care whether or not they're getting dinner. So that's why I think it's a good topic for advisors to talk about when you're using this to sort of recruit new clients.”

Although Dern doesn’t do a hard sell at his workshops, he gets plenty of business nonetheless. However, it didn’t always work out that way, he said. In the beginning, Dern would offer a lot of information to a room full of retirees, or near-retirees, and do a lot of work.

And get very little business out of it.

“They would say, ‘Oh, Tim, we have a real advisor for that,’” Dern recalled. “You know, like you’re the Social Security guy, but we have a real advisor. I thought, this is putting me in a bad position. I'm doing a lot of work.”

He learned an important lesson: Social Security seminars can be a boon for advisors, but they must be done correctly. Dern massaged his presentation to include an important transition from Social Security content to Medicare and overall retirement planning.

“I tell everybody up front, ‘I’m a financial advisor. I do this five days a week. I’m a fiduciary,’” he said. “I want them to understand that I'm an advisor first. I just happen to know a lot about Social Security because most of my clients are over 60 years old, and they want to know about this.”

When people consider their own real-life circumstances, the in-depth knowledge of Social Security separates Dern from the pack. Some people are in a second marriage and might have a child at home they can collect benefits on, he noted, or they might have a deceased spouse who could be a source of benefits.

“This is the kind of stuff I’m doing in my seminar,” Dern said. “I'm showing them a lot of stuff that they probably wouldn't hear from the average advisor, but it's all information they need to know. Then at the end of the meeting, and I'll have 20-25 people in the room, I'll have a line of people who want to talk to me. I mean, they're engaged. They have questions. They want to meet.”

The Politics Of Social Security

One thing advisors say most clients have heard about is the threat to Social Security solvency. But advisors say it’s not much of a threat. The popularity of Social Security combined with the voting muscle of older Americans virtually guarantees that Congress eventually will pass legislation to shore up the program.

However, politics comes first, and that means any action likely will be delayed much longer than it should.

“I don’t see that happening,” Schreiber said of the insolvency threat. “They will make the changes needed to bring solvency back.”

The COVID-19 disruptions to the workforce resulted in a double dose of collateral damage to Social Security finances.

People left the workforce, trustees reported, sapping the program of income. And a birth dearth has cut into the number of future workers the program had projected in previous reports.

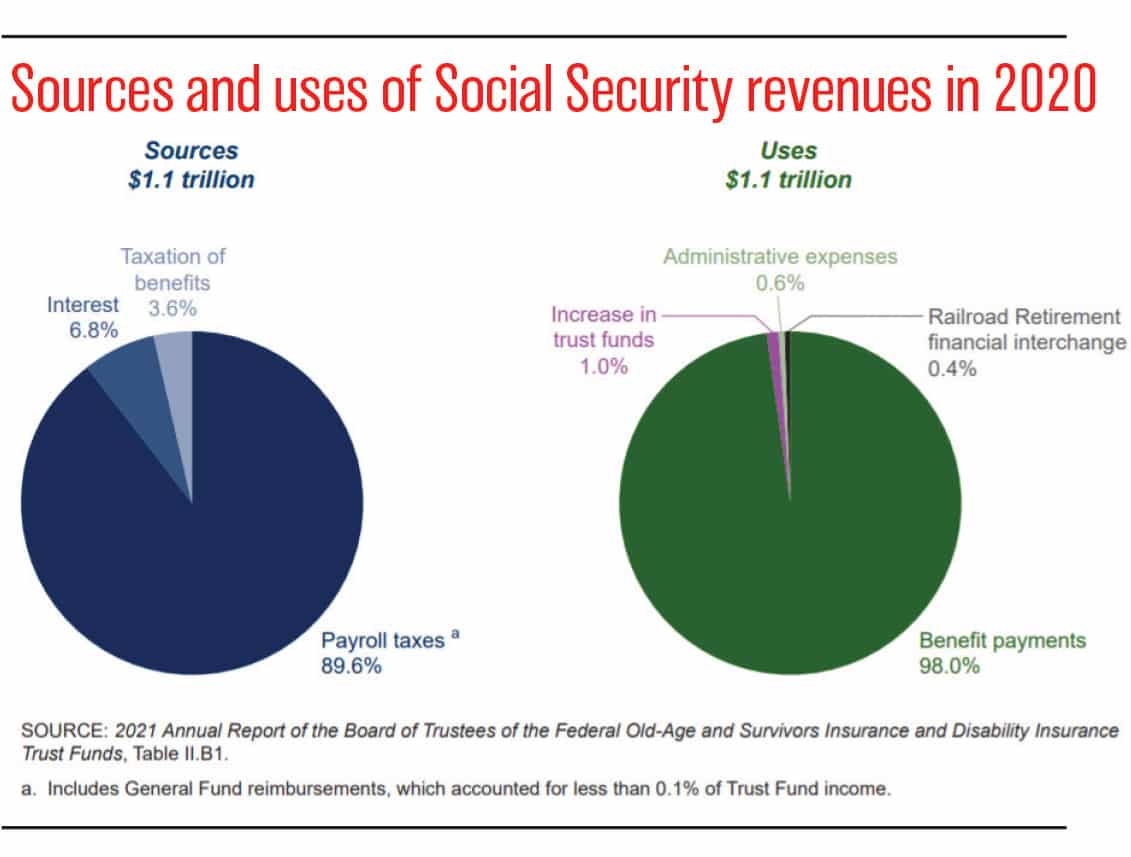

Funded by a payroll tax applied to wages earned, Social Security’s finances have been declining for years, with annual payroll tax income insufficient to cover the program’s benefit payments since 2010.

The program has relied on interest paid into the trust funds over the past 25 years, when revenue was greater than payouts and the excess income was pumped into the trust funds, earning interest from intragovernmental loans.

Last year was the first that the combined income from payroll taxes and interest wasn’t enough to cover promised benefits, the trustees said. That imbalance will continue for the rest of the century, with the two combined trust funds depleted in 2034.

Under the law, Social Security then will have to cut its payments to meet income and will pay out 78 cents on each dollar the program has promised to pay. By 2095, the end of the 75-year actuarial period the trustees studied, the program will pay out 74 cents on each dollar promised.

Chuck Blahous, formerly public trustee for Social Security, told The Washington Times, “If we wanted to fix the system and we wanted to act immediately, we would have to cut benefits 21% next year.”

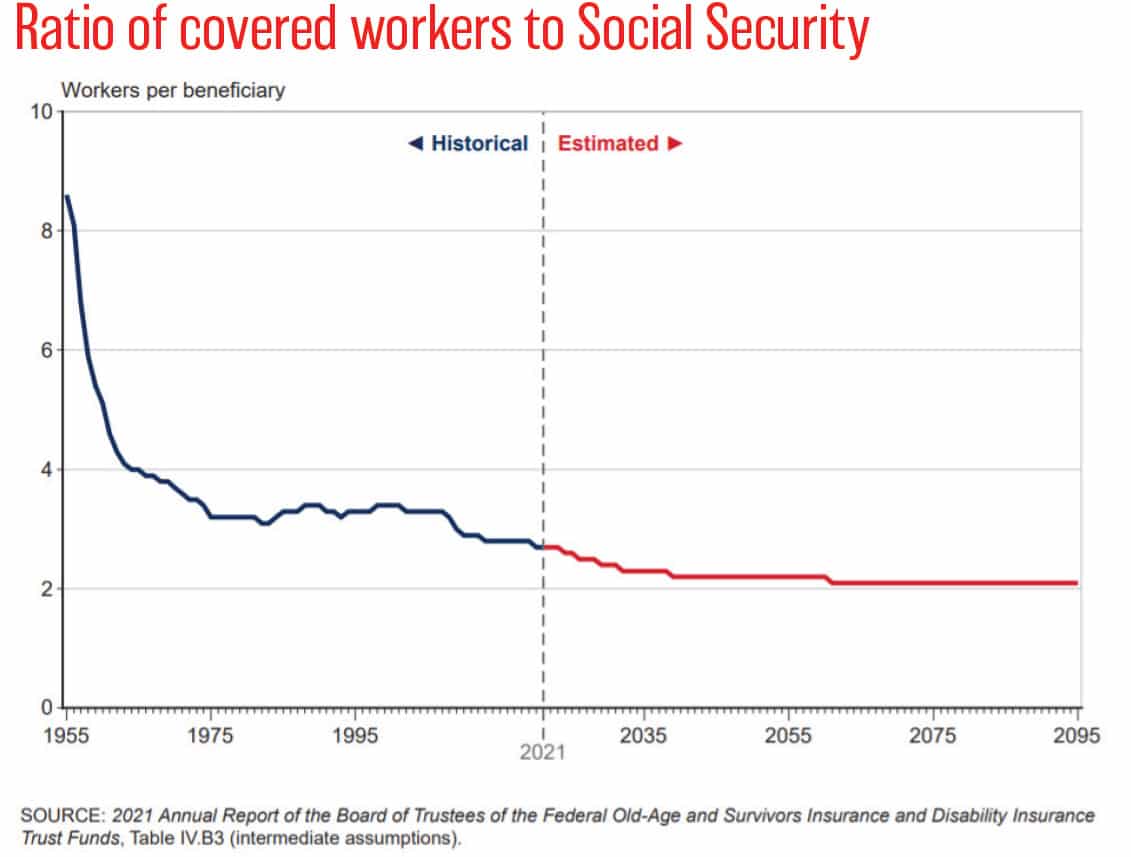

The ratio of workers supporting retirees has flipped, which is another underlying issue impacting Social Security.

From 1974 to 2008, the ratio was 3.2 to 3.4 workers per beneficiary. That began to decline with the Great Recession, and it is now down to 2.7 workers per beneficiary. By 2035, when most baby boomers will have retired, the ratio will be 2.3 workers per beneficiary.

Social Security 2100

While its chances of passage appear dim, House Democrats are hoping for a vote this spring on Social Security 2100: A Sacred Trust. The 2100 Act is cosponsored by 90% of House Democrats, and its chief sponsor, Rep. John Larson, D-Conn., claimed it will shore up the program for decades to come.

The bill includes numerous provisions to improve Social Security, including increasing the minimum benefit for low-income retirees, switching what the consumer-price index benefits are currently tied to so they reflect the expenses of the elderly and offering caregiver credits for people who leave the workforce to care for loved ones.

It is the funding that is controversial. Larson’s bill would expand the payroll tax cap on workers who earn more than $400,000 and phase in workers who earn between the current inflation-adjusted cap of $142,800 and $400,000 over the years.

While the bill has few fans among conservatives, retiree advocates are supportive.

“It is urgent, indeed imperative, that this Congress vote on expanding Social Security to address the nation’s looming retirement income crisis, as well as other challenges confronting our country,” Nancy Altman, president of Social Security Works, told House lawmakers during a fall hearing on the bill.

CLAIMING RULES

Social Security claiming rules can be complicated and are always changing, said Heather Schreiber of HLS Retirement Consulting in Woodstock, Ga.

Although every client’s situation is different, Schreiber has several tried-and-true claiming strategies that she recommends.

Here are three strategies.

1. Restricted application

A Social Security restricted application is a way for an individual to choose which Social Security benefit they wants to collect: his or her own, or half of their spouse’s. But there’s a catch. The number of individuals lucky enough to employ the strategy is dwindling daily. You must have been born by Jan. 1, 1954 to use the strategy. It allows the eligible individual to delay their own benefits to as late as age 70 and collect spousal (or ex-spousal) Social Security income in the meantime.

For example, let’s say Frank was born in 1953 and plans to wait to age 70 to claim his benefit. His wife Joan was born in 1955 and is receiving her income benefit. Frank meets the age cutoff so he can collect 50% of Joan’s full retirement age benefit until age 70 and then switch to his own maximum benefit once he hits that milestone. This opportunity is often missed by eligible individuals, Schreiber said.

2. Survivor benefits

More than 5.8 million people were receiving Social Security survivor benefits in December 2021, AARP reported. These monthly payments typically go to the spouse, former spouse, or children of someone who was receiving or eligible for Social Security benefits.

Survivor benefits are generally based on the amount the deceased was receiving from Social Security at the time of death or was due to receive. However, there are plenty of rules on who can collect benefits and how much.

About two-thirds of recipients are widows and widowers. They can collect survivor benefits as early as age 60 (50 if they are disabled), at rates ranging from 71.5 percent to 100 percent of the late spouse’s Social Security benefit, depending on the survivor’s age. Benefits may be withheld, however, if the survivor earns above a certain amount for claims made prior to full retirement age.

There is an exception for those caring for a child of the deceased who is under 16 or disabled; in this case there is no minimum eligibility age and the survivor benefit is 75 percent of the deceased’s Social Security payment.

A trusted advisor can help immensely in sorting out the best claiming strategy for survivor benefits, Schreiber said.

“When you’re dealing with a widow or widower, they can leverage survivor benefits with their own in a way that’s unique and that people miss most of the time,” she explained. “What I mean by that is they could file first, for example, for the survivor benefit, as early as age 60. And, if their own retirement benefit will be greater at age 70, they can switch over to their maximum benefit at age 70. The opposite is also a viable strategy.”

3. Work earnings strategy

Many clients want to continue working as a part of a fulfilling retirement. But it is important that they know the rules and plan a work schedule in harmony with a Social Security claims strategy, so they aren’t thrown for a loop, Schreiber said.

“People don’t understand that if you try to file for a benefit before your full retirement age, and you continue to work, that you might be sent away by Social Security,” she added. “If earnings exceed a certain level, income in excess of the threshold could cause a portion or all benefits to be withheld. This can come as an unwelcome surprise for claimants who are unaware of the rule.”

For 2022, benefits are reduced by $1 for every $2 a worker earns above $19,560. Reaching full retirement age in 2022 means an earnings limit increase to $51,960, up from $50,520 in 2021.

At that point, benefits are reduced by $1 for every $3 above this limit. Once a worker reaches full retirement age, there are no reductions to their Social Security benefits, regardless of how much they earn. Further, if benefits have been withheld due to excess earnings, those benefits will be restored in the form of a higher monthly income benefit at full retirement age and beyond.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

The Dynamic Duo of Social Security Planning — With Marc Kiner and Jim Blair

Insurance Leaders Predict Economic Recovery Still Far On The Horizon

Advisor News

- Todd Buchanan named president of AmeriLife Wealth

- CFP Board reports record growth in professionals and exam candidates

- GRASSLEY: WORKING FAMILIES TAX CUTS LAW SUPPORTS IOWA'S FAMILIES, FARMERS AND MORE

- Retirement Reimagined: This generation says it’s no time to slow down

- The Conversation Gap: Clients tuning out on advisor health care discussions

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Reports Outline Pediatrics Study Findings from University of Maryland (Reimagining Self-determination In Research, Education, and Disability Services and Supports): Pediatrics

- Rep. David Valadao voted to keep health insurance credits but cut Medicaid. Why?

- Iowa House Democrats roll out affordability plan, take aim at Reynolds’ priorities

- Trump announces health care plan but Congress must OK it

- AM Best Affirms Credit Ratings of Health Care Service Corporation Group Members and Health Care Service Corp Medicare & Supplemental Group Members

More Health/Employee Benefits NewsLife Insurance News