76% Of Workers Worry About Retirement Money

Three-quarters of American workers have a financial concern about retirement, according to a recent survey.

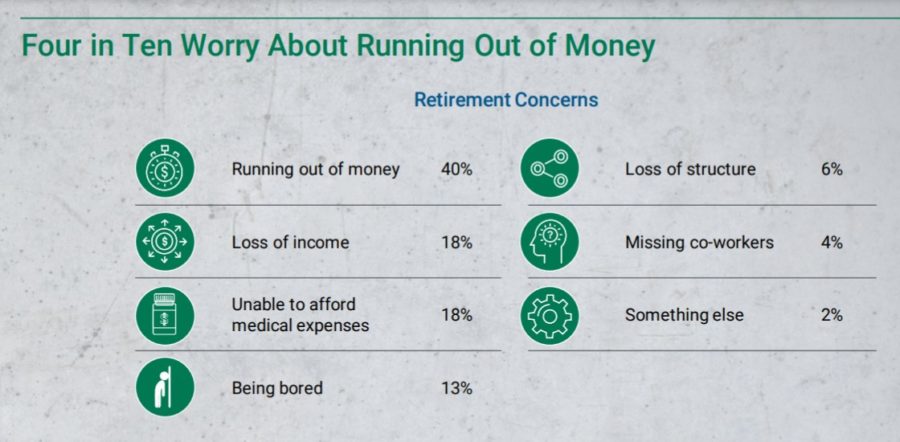

The workers’ concerns are running out of money (40%), loss of income (18%) and being unable to afford medical expenses (18%), totaling 76%, according to the ninth annual American Century survey of retirement plan participants, compiled by Mathew Greenwald and Associates.

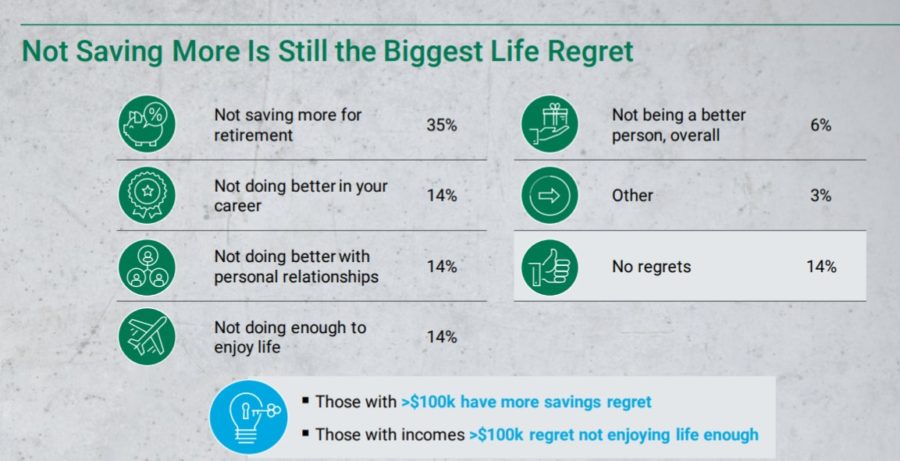

They admitted not saving more earlier in their career, with 60% saying they saved less than they should have in the first five years they worked. And although only about a third expressed regret about not saving more for retirement, it was still by far the top regret, said American Century Senior Retirement Strategist Glenn Dial.

"We found that 35 percent of workers voiced this regret, which was more important to them than doing better in their career, doing better in personal relationships or even doing enough to enjoy life,” Dial said. “This clearly speaks to concerns about being ready for retirement."

That regret might help account for why more Americans have been saving money during the pandemic than they have in the previous half-century, according to the Federal Reserve.

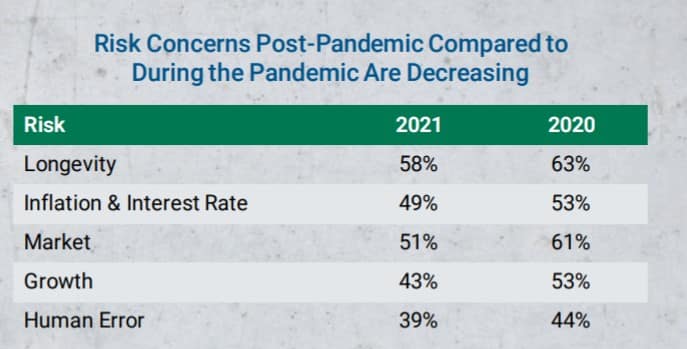

As Americans saved more and the pandemic ebbed, their risk concerns also eased since last year’s survey. Worries about outliving retirement savings fell 5% (58% in 2021 versus 63% the previous year). Inflation and interest rate risk concerns decreased 4%, and market risk worries dropped 10%, as did concerns about growth.

"Market risk and longevity risk continue to be the top concerns for retirement plan participants," Dial said. "This may explain why, when it comes to taking withdrawals, 76 percent would be more likely to leave their money in their 401(k) plan if given an in-plan withdrawal solution."

As for taking money out of their retirement plans, 70% of the respondents said they could use some guidance on how to withdraw their money. Two out of three said they know how much to withdraw for living expenses, but only six out of 10 knew how long to make their money last in retirement. Four in 10 baby boomers and three in 10 Generation X and Millennials have advisors who could help them plan for retirement.

"The good news is three out of every four workers show at least some interest in holistic financial advice, which has important implications for financial professionals," Dial said.

Half of the respondents were also interested in environmental, social and corporate governance (ESG) in their retirement plan. That broke along generational lines, with Millennials and Gen Xers most interested. Participants with incomes of at least $100,000 also are interested.

But the good will runs out if the returns don’t hold up. The survey showed 65% are interested in ESG if investment performance is comparable versus only 6% interested even if performance is worse.

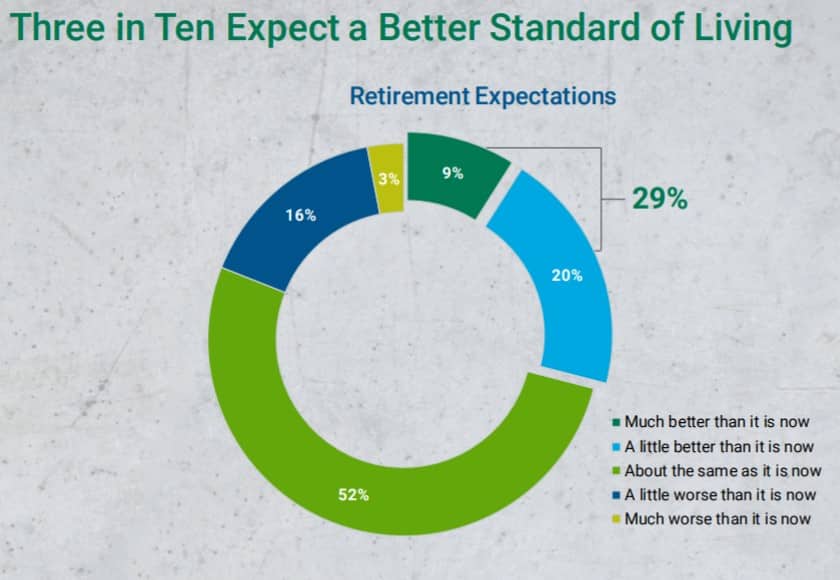

Regardless of the workers’ short- and long-term concerns, about half of them expect to have a comparable lifestyle in retirement as they do now. The next largest group expects a better standard of living, while 19% expect worse.

The plan participant survey was conducted between March 8 and 19, 2021. Survey included 1,500 full-time workers between 25 and 65 saving through their employer's retirement plan. The data was weighted to reflect the makeup of key demographics (gender, income, and education) among all American private sector participants between 25 and 65.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Former Trinity Healthshare Ministry Files For Bankruptcy

LIMRA Sees A More Robust 2021 Life Insurance Sales Forecast

Advisor News

- The silent retirement savings killer: Bridging the Medicare gap

- LTC: A critical component of retirement planning

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- Otsuka Medical Devices/Otsuka Pharmaceutical: Paradise Ultrasound Renal Denervation System for the Treatment of Resistant Hypertension, Now Covered by Insurance and Commercially Available in Japan

- After enhanced Obamacare health insurance subsidies expire, the effects are starting to show

- CommunityCare: Your Local Medicare Resource

- AG warns Tennesseans about unlicensed insurance seller

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

More Health/Employee Benefits NewsLife Insurance News

- Baby on Board

- Kyle Busch, PacLife reach confidential settlement, seek to dismiss lawsuit

- AM Best Revises Outlooks to Positive for ICICI Lombard General Insurance Company Limited

- TDCI, AG's Office warn consumers about life insurance policies from LifeX Research Corporation

- Life insurance apps hit all-time high in January, double-digit growth for 40+

More Life Insurance News