Amid The Cicada Chirps, Hear The Dull Roar Of Inflation

As Americans emerge from the pandemic lockdown, they might be delighted (or blighted) to run into the wall of sound from the 17-year cicadas, but maybe not so thrilled to see something else arise from its slumber – inflation.

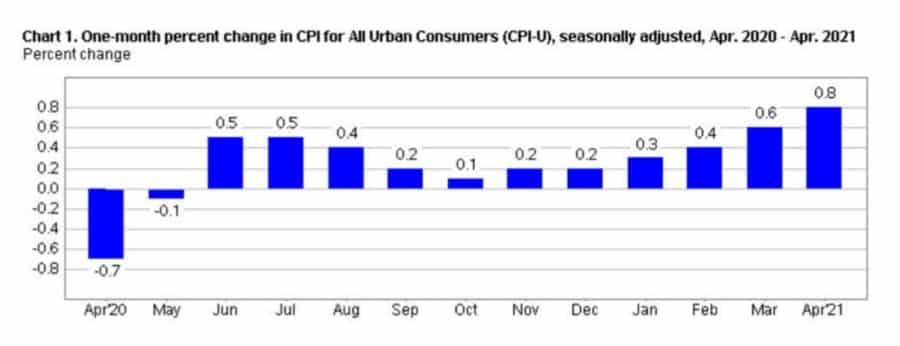

The Labor Department confirmed last week what grocery shoppers were already starting to notice. The Consumer Price Index in April popped up 4.2% since the same time last year.

The last time the CPI grew that much was the summer of 2008, when it hit 4.9% just before the financial meltdown toasted inflation for the next decade.

The good news is that inflation did not lift all prices in a flash flood. Two unusual factors pushed the overall number – unusual but instructive.

The first was the eye-popping increase in used car prices, 10% in one month, totally 21% over the previous year. That was largely due to the shortage of new vehicles. Car makers deaccelerated production as demand dropped during the pandemic. The rapid turn toward normalcy over the past few months caught manufacturers flatfooted.

Not only did auto companies need to fire up factories in a hurry, manufacturers also had to contend with supply shortages. Although shortages were found throughout the parts inventory, a primary holdup has been microchips, which had been outsourced by U.S. manufacturers to China long ago to cut costs. The chip shortage is causing production sluggishness elsewhere, particularly in building computers. This illustrates how directly the U.S. economy is attached to China.

Another pop in prices was in gasoline, and this was before the Colonial Pipeline ransomware attack (in itself another subsection of systemic risk). The price of energy has been creeping up since the middle of 2020, with gasoline climbing 49.6% and fuel oil 37.3% since last year. In fact, energy prices had dropped 1.4% month over month in April. Next month, expect headlines to blare another dizzying inflation number driven by the Colonial Pipeline dramatic effect on energy prices.

Although food prices did not bounce as high, they are growing, popping 2.1% over the year. More important is the trend upward month over month. Last month, it was 0.4% over the previous month, the highest increase in at least a half-year.

Food prices are expected to rise even more as demand to eat outside the home increases, just as companies struggle to replace the low-wage workers they let go during the pandemic.

The Magic Inflation Number

Besides being a broad metric of hotter demand, the CPI’s 4.2% increase has particular significance for stock prices and bond spreads, according to The Wall Street Journal. The article credits the 4% inflation number as a signal that triggered a drop in stock prices and an increase in bond yields last week.

“When inflation is low, rising inflation is a good thing for stocks. A pick up from 1% to 2% means the risk of falling into deflation — a serious threat to the stock market — has gone down, so share prices should go up,” James Mackintosh wrote. “As inflation rises further, the gains for stocks decrease, because deflation risk is forgotten and the prospect of a more active Fed counteracts the continued benefit from a stronger economy.”

Things get hairy when inflation crosses 4%, according to Mackintosh. That is when the Fed is more likely to take action. Higher bond yields are no longer considered good for stocks.

“The 4% logic isn’t written in stone, but it has reasonable historic support,” according to the article. “Since the S&P 500 was created in 1957, U.S. inflation has risen above 4% nine times, and in eight of those cases stocks were lower three months later.”

Hocus-pocus or not, institutional investors were already worried about inflation in March, according to a Bank of America fund manager survey. In fact, higher-than-expected inflation became the top tail risk among the investors, followed by disruption in the bond market. That fear replaced COVID-19 for the first time since the pandemic started.

Investors were still bullish on stocks though – 55% said it was still a late-stage bull market, with 25% believing it was an early-stage bull market and 15% saying stock prices were in a bubble.

A prominent investor, Satori Fund founder Dan Niles, recently said he was particularly worried about the Fed cutting its $120 billion asset purchases because of inflation.

“If you’ve got food prices, energy prices, shelter prices moving up as rapidly as they are, the Fed’s not going to have any choice,” Niles said, dismissing the Fed’s reassurances. "They can say what they want, but this reminds me to some degree of them saying back in 2007 that the subprime crisis was well contained. Obviously it wasn’t."

Given all that, it seems that the sudden rise in gas prices in May will push more panic buttons next month when the next CPI report is likely to show another toe-curling inflation number.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

7 Reasons Why Employers Must Offer More Comprehensive Vision Plans

New Bankers Life Annuity Offers Income And Flexibility During Retirement

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Judge tosses Penn Mutual whole life lawsuit; plaintiffs to refile

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

More Life Insurance News