Brighthouse Life Insurance Sales Up 44% In First Quarter

Brighthouse Financial is back. Back making noise in the life insurance market, that is, with a 44% increase in year-over-year sales in the first quarter.

Created in 2017 as a spinoff from MetLife, Brighthouse primarily focused on annuities in its initial product development. That changed in 2019, when the company offered SmartCare, an indexed universal life with a long-term care benefit.

Brighthouse continues to broaden distribution and grow life insurance sales, CEO Eric Steigerwalt said on a conference call with analysts this morning.

"We said we were going to get back in this as a new business proposition," he explained. "We kept all of our infrastructure as we were coming up with our flagship product SmartCare and we intend to grow it year over year over year."

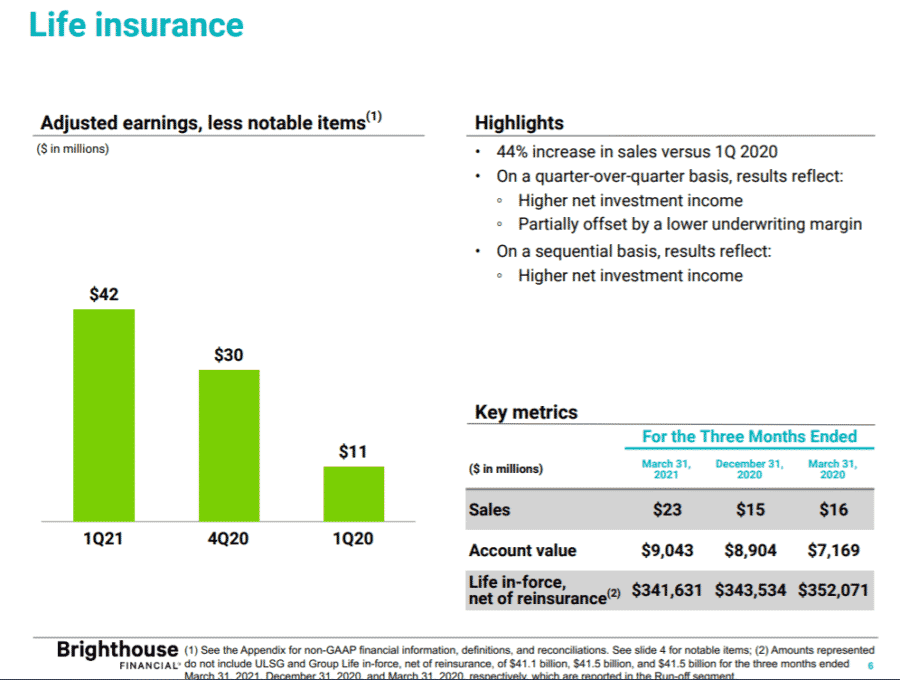

Adjusted earnings in the Life segment were $42 million in the current quarter, compared with adjusted earnings of $11 million in the first quarter of 2020 and $13 million in the fourth quarter 2020.

On a quarter-over-quarter basis, adjusted earnings reflect higher net investment income, partially offset by a lower underwriting margin. On a sequential basis, adjusted earnings, less notable items, reflect higher net investment income.

Brighthouse reported a first-quarter loss of $585 million, after reporting a profit in the same period a year earlier.

The Charlotte, North Carolina-based company said it had a loss of $6.96 per share. Earnings, adjusted for one-time gains and costs, were $4.86 per share. The results beat Wall Street expectations. The average estimate of three analysts surveyed by Zacks Investment Research was for earnings of $2.42 per share.

The annuity and life insurance company posted revenue of $938 million in the period. Its adjusted revenue was $2.37 billion.

Annuity Peaks And Valleys

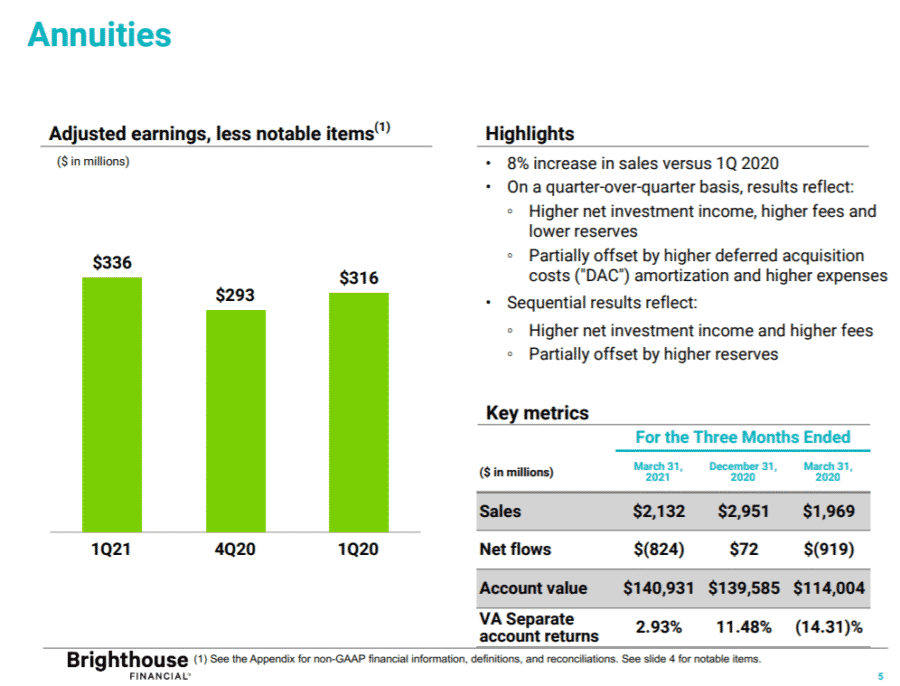

Brighthouse similarly reported an 8% year-over-year quarterly increase in annuity sales. Those sales were led by its top-selling Shield index-linked annuity line and the FlexChoice variable annuities.

"We do expect a decline in fixed-deferred-rate annuities," said Myles Lambert, chief distribution and marketing officer. "This juncture we feel like the growth in our core product sales should be able to offset the decline that we should see with fixed rate deferred annuities."

Annuity sales decreased 28% from the fourth quarter 2020, "mainly driven by lower sales of fixed deferred annuities, which offset the growth in Shield Level Annuities and variable annuities with FlexChoice Access," Brighthouse said.

However, adjusted earnings in the annuities segment were $336 million in the first quarter, a 15% increase over the fourth quarter 2020.

On a quarter-over-quarter basis, adjusted earnings reflect higher net investment income, higher fees and lower reserves, partially offset by higher deferred acquisition costs, amortization and higher expenses.

Brighthouse Financial shares have risen 35% since the beginning of the year. In the final minutes of trading on Monday, shares hit $48.92, a rise of 70% in the last 12 months.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Rising Interest Rates Spur 9% Annuity Sales Growth In 1Q: LIMRA

Record-Breaking Life Insurance Application Activity Continues in April

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

- iA Financial Group Partners with Empathy to Deliver Comprehensive Bereavement Support to Canadians

More Life Insurance News