58% of life insurers use artificial intelligence or are interested: NAIC survey

Fifty-eight percent of life insurers are either using or have an interest in using artificial intelligence in their businesses, an NAIC working group found.

That data was part of the third in a series of surveys state insurance regulators are conducting across the insurance world. The Big Data and Artificial Intelligence Working Group discussed the findings Friday during the National Association of Insurance Commissioners' fall meeting in Orlando.

The 58% figure is well below the use of AI, or desire to use the technology, expressed during earlier surveys by home (70%) and auto (88%) insurers.

"These surveys were conducted to accomplish three primary goals," said Kevin Gaffney, Vermont insurance commissioner. "To gain a better understanding of the insurance industry's use and governance of AI, to seek information that could aid in the development of guidance or potential regulatory framework to support the insurance industry's use of AI, and to inform regulators as to the current and plan business practices of companies."

The latest survey response was strong, Gaffney said, with 161 life insurers participating. The survey was limited to insurers who wrote at least $250 million in national life insurance premium in 2021, and covered at least 10,000 lives via term insurance the same year.

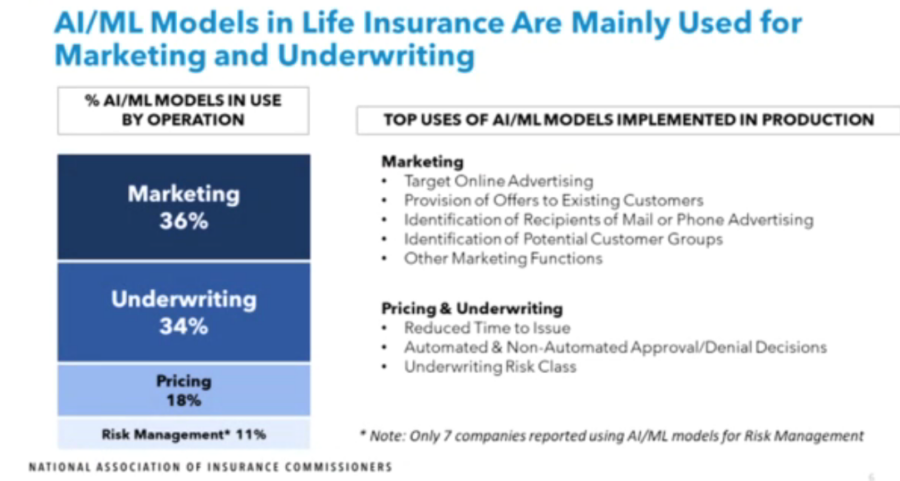

Life insurers reported they are mainly using AI and machine learning for marketing and underwriting.

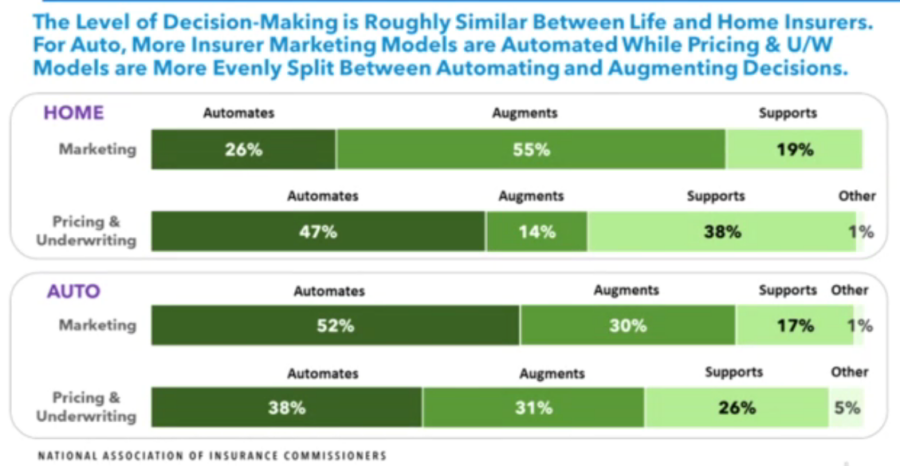

As with earlier surveys, some life insurers are using AI and machine learning to "augment" processes, while others are using the technology to fully "automate" tasks.

"It's interesting to compare the level of decision-making to the models used by auto and home," Gaffney said. "This is why we wanted to kind of bring it all together and contextualize what's happening in each of these marketplaces."

NAIC has third-party concerns

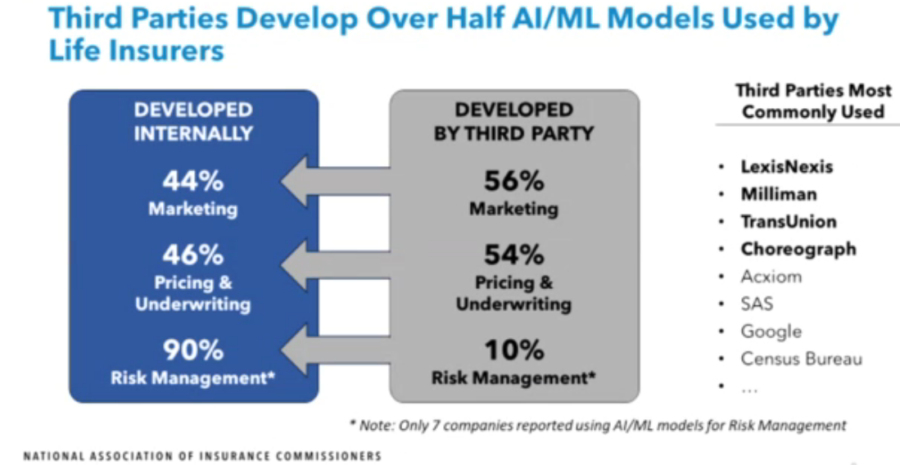

Third-party vendors are developing a lot of the AI and machine learning technology that is proliferating the insurance industry. That creates a lack of control for insurers and regulators. NAIC regulators are concerned enough to establish a 2024 task force devoted to regulation of third-party systems, Maryland Insurance Commissioner Kathleen Birrane announced Friday.

Consultants predict that AI could eventually have widespread application in the insurance industry.

The use of AI and machine learning in conjunction with big data offers immense potential for insurers to sharpen risk profiles and speed up underwriting. But regulators and consumer advocates have concerns that discrimination could creep into the technology.

When insurers were asked whether they informed policyholders about how their data is being used, other than what is required under the Fair Credit Reporting Act, 37% of respondents said they inform policyholders when their data used for marketing, the survey found. Insurers inform policyholders when their data is used for underwriting and pricing 41% of the time, and 23% report for risk management data uses.

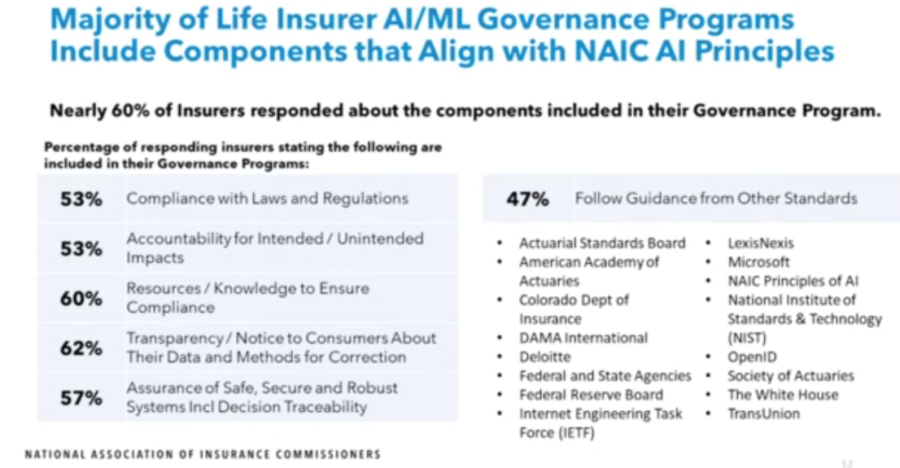

Insurers reported a mixed record of governance with AI and machine learning best practices.

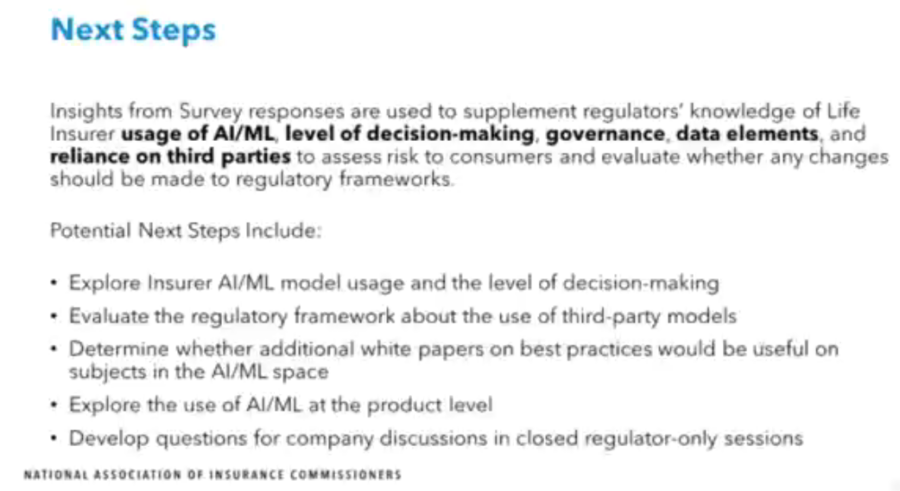

Next steps for the NAIC involve more studying of AI and machine learning and more questions for companies, Gaffney said.

"I feel like the industry is moving very fast in this space," Gaffney said. "We are trying to keep up. It would be nice to say we could stay ahead, but I think the realistic vision right now is to make sure that we're still in the rearview mirror of industry."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Commentary: The NAIC must get its house in order

Long-term care feasibility study participation ‘not what we hoped for’

Advisor News

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- New Multiple Myeloma Findings from Brown University Warren Alpert Medical School Described (A Call for Compassion: How You Can Help Get Multiple Myeloma Added to the Social Security Administration’s Compassionate Allowances List): Oncology – Multiple Myeloma

- New Hampshire Built Its Health Insurance Stability Before the Storm And That Choice Paid Off – Roger Sevigny

- The new frontier in obesity care for seniors

- 30 DAYS, $1.8 MILLION AND ZERO BILLS PASSED: KDP STATEMENT ON WASTEFUL GOP-LED GENERAL ASSEMBLY

- New Vaccines Findings from University of California Riverside Outlined (Emergency Department Survey of Vaccination Knowledge, Vaccination Coverage, and Willingness To Receive Vaccines In an Emergency Department Among Underserved Populations – …): Immunization – Vaccines

More Health/Employee Benefits NewsLife Insurance News