5 Questions To Ask Clients When Discussing Annuities

Annuities — with their rules, riders and variations — can be a mystery to clients. Instead of causing their eyes to glaze over with long-winded explanations of this insurance product’s potential benefits, try asking questions to help clients determine whether an annuity might be right for them and, if so, what kind is most suitable.

Here are some conversation-starting questions that can lead to real solutions.

1. What is your risk tolerance?

In the annuity decision tree, the two main branches are fixed annuities and variable annuities. Clients’ levels of risk tolerance will tell you which options are best for them.

The first type is a fixed annuity, which guarantees a specific, guaranteed interest rate on the contributions. There is no downside with a fixed rate annuity. However, fixed rate annuities may not participate in the potential upside — except for a type of fixed rate annuity called a fixed indexed annuity.

The second type is a variable annuity. With this option, the insurance company offers clients a choice of investments — usually mutual funds — for their annuity’s capital. If those investments grow, the annuity is worth more; if they fall, the annuity is worth less.

2. What is your time horizon?

Find out when your clients will need access to the funds from their annuity. This is important for several reasons. One being that penalties, such as surrender charges and administrative charges, may apply if they need to cash out early.

Here’s an example. If your client signs up for a 10-year variable annuity and then decides to retire and wants the money in three years, they will pay a percentage of the entire annuity’s value for each remaining year that the surrender charge applies, in addition to administrative charges. Surrender charges could be 5% the first year, then 4% the following year, 3% the year after that, and so on.

The time horizon is also important when helping clients choose between immediate and deferred annuities. An immediate annuity can start providing regular payments as soon as a month after the annuity is purchased, and at the latest, within one year. A deferred annuity is a contract with the insurance company to start paying the owner at some date in the future. During the time between the annuity purchase and the first payment, interest or investment earnings accumulate in the account.

3. What is your tax bracket?

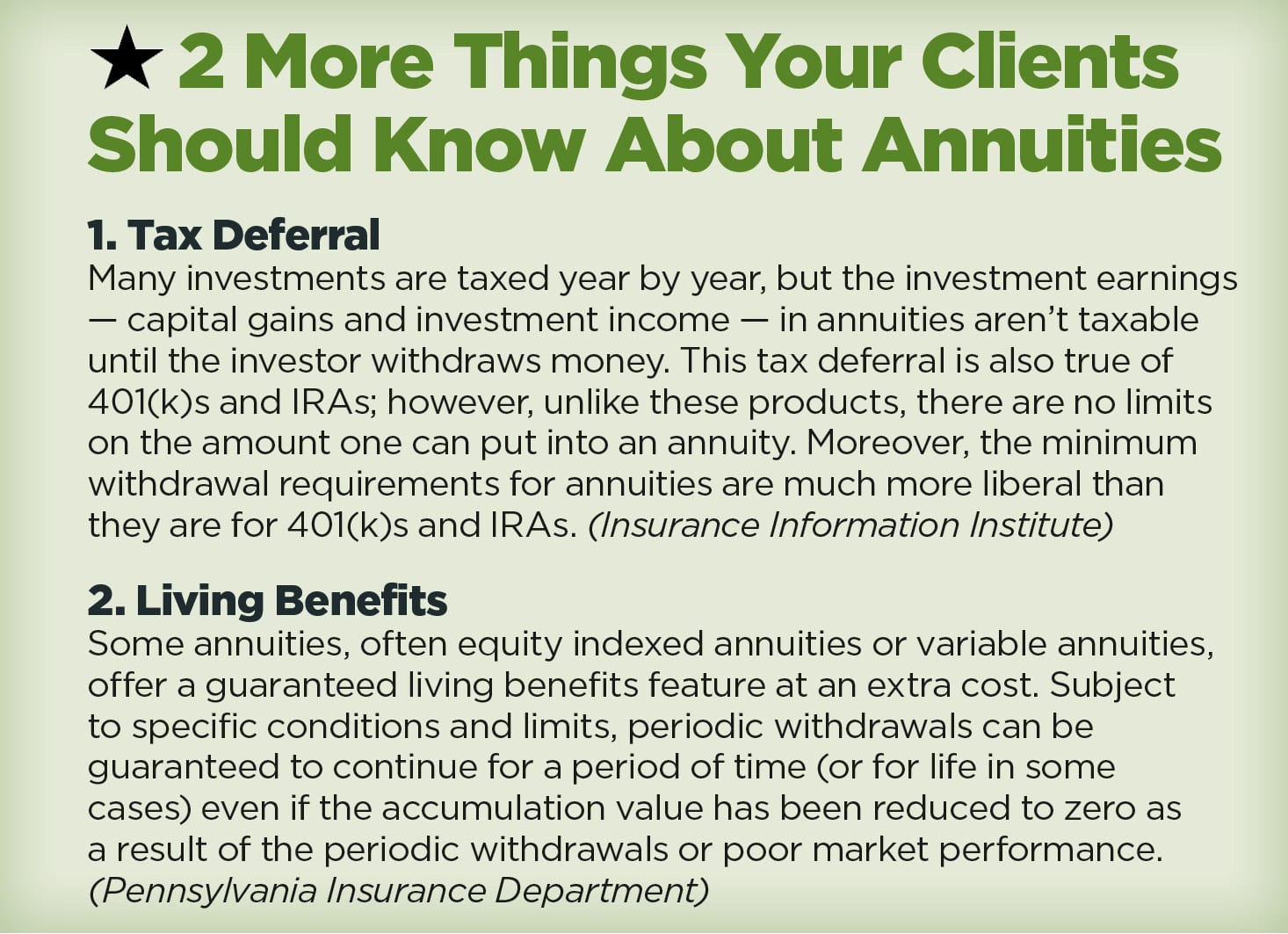

Although clients should always consult their tax professional about their personal tax liability, it’s important to talk about deferred taxation with annuities. The interest earnings on a nonqualified annuity or the contributions or earnings from a qualified annuity (a 401(k) plan or IRA) won’t be taxed every year. Instead, the owner will pay income tax on the withdrawals.

Annuities do have contract minimums and maximums, and clients should refer to the product specifics from each carrier. The IRS also sets annual cost-of-living adjustments for all types of qualified retirement plans and IRAs, which either remain unchanged or rise depending on Consumer Price Index thresholds.

And the higher the client’s tax rate, the bigger the tax deferral advantage of an annuity can be.

For example, suppose clients have a 32% tax rate, and they are looking at a 10-year deferred annuity that pays 3% interest. They may be eyeing other investments and wondering whether they should instead put the money somewhere that might provide a higher return. Walk them through the math to figure out how much of their investment they would lose to taxes if they put that sum in a vehicle without the benefit of deferred taxation. Once taxes are taken into account, the remaining difference might not be worth giving up the peace of mind that an annuity can provide.

4. What are your worries about the future?

Everyone has different concerns about retirement and their family. This is where the wide variety of available annuity products really comes into play.

One of the most prevalent worries today is losing everything you’ve worked for in a stock market meltdown. Sure, the pandemic rocked the stock market, but 2008 destroyed the stock market.

People who are making these financial decisions today lived through those events. One day, maybe they had a lot of money in the stock market, and the next thing they knew, they had half that amount.

People who were close to retirement in 2008 were affected big-time, and those who are getting closer to retirement now don’t want the same thing to happen to them. If clients are concerned about protecting their retirement funds, fixed annuities are excellent options for them to consider.

With prices rising and the Federal Reserve keen to be well positioned to act on inflation, cost-of-living increases are another topic that’s in the news now. Annuities can help in this area too. Talk with inflation-concerned clients about the possibility of adding a cost-of-living adjustment, which is an option available on some annuities.

Finally, a common concern is outliving your money. If this is your client’s biggest worry, they may want to purchase a guaranteed living benefit rider, which would make sure their payments continue to the end of their lives, even if the principal in the annuity is used up.

5. If you die first, what do you want for your spouse?

The truth is that it’s likely that one spouse will die before the other. In addition to dealing with the grief of losing a loved one, financial worries can be an added burden to the surviving spouse.

An annuity with a death benefit can be a boon for couples. If your client knows that their surviving spouse will have a monthly income that will allow them to cover expenses, stay in the same house, and pay for extras like vacations, they can get some peace of mind.

By asking these five questions, you will gather important information from your clients, but you’ll share important information with them as well. By letting them know that annuities are not a one-size-fits-all product, together you can pinpoint exactly the right annuity to address both their worries and their hopes for the future.

Mike Vietri is chief distribution officer at AmeriLife. He may be contacted at [email protected].

5 Things To Consider As The Midterm Elections Get Closer

College Funding: A Critical Part Of A Complete Financial Plan

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

- MetLife Completes $10 Billion Variable Annuity Risk Transfer Transaction

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News