3 trends impacting employee benefits management

The impact of inflation is still being felt by almost every American business, employee or consumer — and it has had a ripple effect on the cost of health care (and health care coverage). How employers balance employee priorities and preferences with budgetary constraints becomes especially critical in a competitive environment touched by financial insecurity.

A recent survey by Optavise delved deeper into employer concerns about these rising costs as well as communication challenges and employee retention. The results provide insights into the challenges organizations face as they navigate their benefits package planning and execution. Here are three of the pivotal forces shaping the landscape of modern benefits management.

1. Economic uncertainty

Employer health insurance costs surged by an average of 6% in 2023 compared to 2022, KFF reported, and projections indicate a further uptick of 6.4%, 7% or even 8.5% in 2024. Those cost increases also trickled down to employees, who experienced an overall cost increase of 3.3% in 2023, encompassing premiums and out-of-pocket expenses — eating away at most of the average 4.4% pay increase that year.

With this context, employers are struggling to contain costs without sacrificing the quality of their benefits packages or passing even more of the burden down to their workforce. In fact, half (51%) of employers in the Optavise survey said that inflation affected what benefits they were able to offer in 2024.

Projecting ahead, employers cited several factors preventing them from adding to their benefits packages in the coming years. More than 60% said cost to the company was the biggest hurdle, followed by increased out-of-pocket costs for employees (46%) and broader economic uncertainty (46%). These concerns are limiting the scope of benefits employers can provide, potentially limiting their ability to attract and retain top employees.

2. Communication challenges

Financial pressures are also affecting employee decision-making with respect to their benefit choices. More than half (53%) of employers report that employees’ lack of understanding of the value of their benefits is a barrier to getting employees to enroll. Benefits are complex and can be confusing, and too many employees are unwilling to invest the time to research which options make the most sense for them or to understand how participation can ultimately save them money or provide additional financial security.

In addition, although most employees rely on their employers for benefits information, many organizations struggle to provide employees with these resources. As a result, some employees turn to friends or the internet to get their information, the Optavise survey found. This is in line with other survey findings, which show that more than a quarter of employers say that a lack of resources to effectively roll out and communicate offerings (27%) and a lack of one-on-one benefits counseling (25%) are barriers to getting employees to enroll in a benefits program.

Complicating matters, there are discrepancies between what resources employers say they provide and what employees say they provide. For example, 61% of employers report offering presentations and group sessions with human resources, while only 30% of employees say they were offered this. Similarly, 26% of employers report sending text messages about benefits, but only 7% of employees say they received texts from their employers.

Either employees are unaware that these resources are available, indicating a lapse in communication, or those resources aren’t resonating with employees, making them simply forgettable. Either way, it’s clear that finding the most effective and useful ways of reaching employees about benefits is essential for employers to drive engagement in their benefits program and boost employee satisfaction.

3. Employee retention

As the job market and broader economy continue to shift, retention remains a paramount focus for employers — 84% of employers said they had made changes to keep employees. By investing in comprehensive retention strategies, employers can nurture loyalty and commitment among their workforce, reducing turnover risks and ensuring employee loyalty. These strategies encompass not only additional benefits offerings but also flexible work arrangements to support work-life balance.

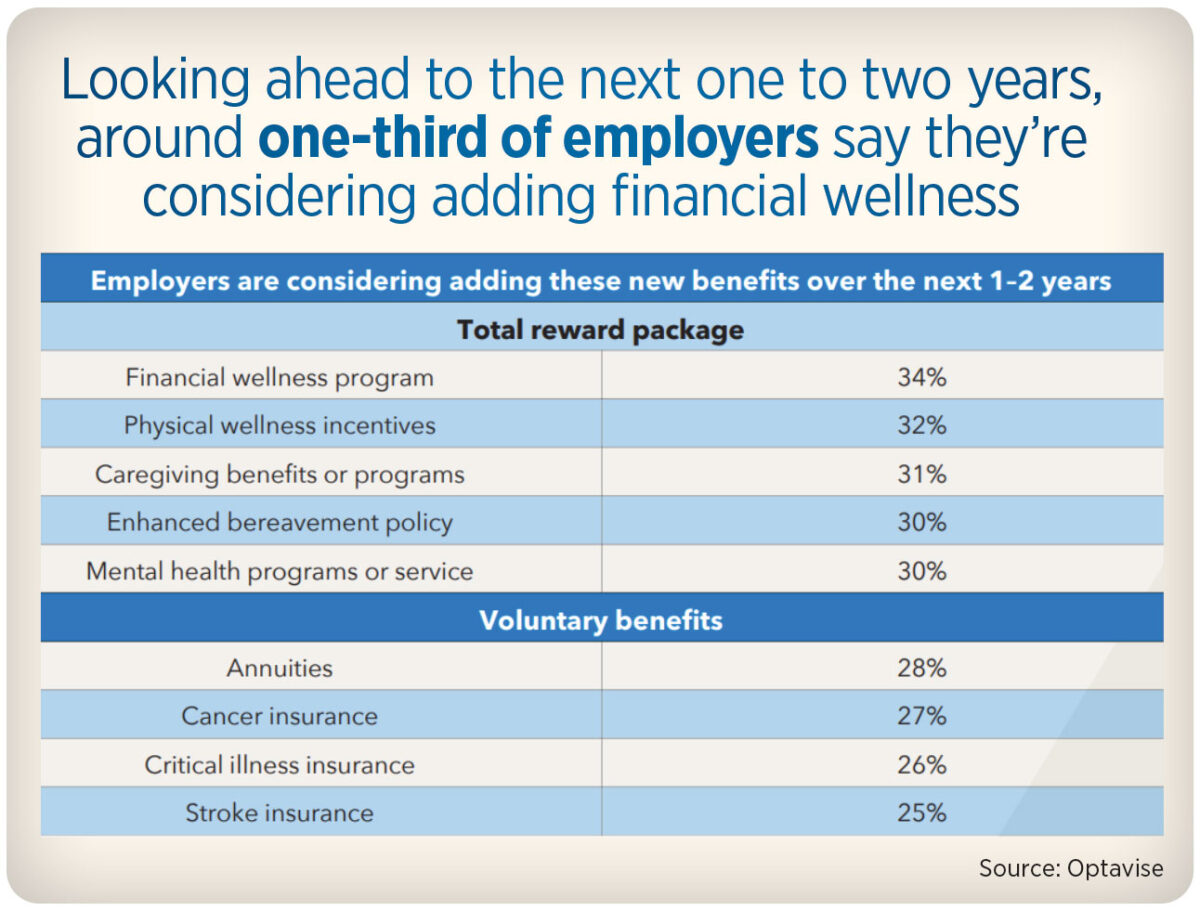

When asked how important add-on and voluntary benefits are to their workforces, 87% of all employers surveyed say that these benefits are at least moderately important to their employees. When asked which programs employers added in the past three years, respondents cited mental health programs or services (53%), physical wellness incentives (43%), and voluntary coverages such as buy-up life insurance (44%), accident insurance (43%) and short-term disability (42%). A third of respondents are considering adding financial wellness, caregiving benefits or programs and mental health support programs in the next one or two years, providing an added level of flexibility for employees to choose programs that meet their individual needs. Plus, such programs tend to be quite cost-effective, with affordable premiums that can be paid by the employer, employee or a combination of both, depending on the type of benefit.

Employee demand for flexibility has extended to job structure, with flexible work arrangements emerging as a key factor in enhancing employee well-being and satisfaction. Already, many companies are exploring innovative strategies to introduce greater flexibility to their workplace cultures, including implementing on-demand schedules, offering shortened work weeks, experimenting with new shift structures and times, and facilitating job-sharing arrangements. Although not all industries provide equal opportunities for flexible work, it’s important for employers to consider what they can do to provide flexibility to their workforce, given the long-term benefits.

As employers navigate changes related to rising costs, improving communication, and altering benefits packages, organizations must take a strategic approach that addresses both current and future needs. Identifying and implementing cost-effective benefit programs and work arrangements can be a challenge for budget- and resource-strapped employers. A good benefits partner — whether it’s a broker, consultant or other third-party vendor — can fill this need; in fact, 60% of survey respondents indicated that they’d like to use more third-party vendors to support their business over the next three years. With expertise and resources, employers can be confident that their benefits will be well received by employees while improving their ability to attract and retain top talent.

Richard Shaffer is senior vice president, Optavise. Contact him at [email protected].

Inherited annuities: Helping to stretch generational wealth

‘Magic number’ for a comfortable retirement surges upward

Advisor News

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Idaho is among the most expensive states to give birth in. Here are the rankings

- Some farmers take hard hit on health insurance costs

Farmers now owe a lot more for health insurance (copy)

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance News