$3.5T Budget Deal May Take Pressure Off Long-Term Care Insurance

The $400 billion home health care package was dropped from the infrastructure deal but it is appearing in some form in the $3.5 trillion Senate reconciliation bill.

The home health package was designed to allow seniors and people with disabilities remain independent in their homes as America’s aging population floods an already-overwhelmed long-term care system and LTC insurance market. In a statement from budget committee leader Sen. Bernie Sanders and Majority Leader Chuck Schumer, they refer to home health care goals in the bill, although details are still being worked out.

“We will ensure that people in an aging society can receive the health care they need in their own homes instead of expensive and inadequate nursing homes and that the workers who provide that care aren’t forced to live on starvation wages,” according to the statement.

That section is one of five health care initiatives in the bill, according to Kaiser Health News. They are:

• Creating dental, vision and hearing benefits in the Medicare program.

• Expanding long-term care benefits to help people getting home- and community-based services.

• Extending the ACA expansion under the already-passed $1.9 trillion covid-19 relief bill, the American Rescue Plan.

• Closing the Medicaid “coverage gap” in the states that refused to expand coverage under the ACA.

• Reducing the cost of prescription drugs.

Kaiser Health reported that the home- and community-based services expansion would likely be based on President Biden’s recent $400 billion proposal. The duration and scope of the spending are debatable, the report said, but it would likely look something like a bill offered late last month by Sens. Bob Casey (D-Pa.) and Ron Wyden (D-Ore.).

The long-term care package comes as LTC insurance market observers argue whether the industry has collapsed. During a National Association of Insurance Commissioners committee call in July, the American Council of Life Insurers countered the notion that the LTCi market has collapsed.

$12 Billion In Claims

ACLI said in a presentation that the market has not collapsed because millions of Americans are still covered by private LTCi, ACLI members paid out nearly $12 billion in LTCi claims in 2019, consumers find private LTC coverage to be invaluable, a hybrid long-term care market is expanding and interest is growing in state and federal long-term care initiatives and programs.

Consumer advocates, however, argued that the market is done and it is time to do something about it. Although Birny Birnbaum, director of the Center for Economic Justice, said the market has collapsed, he agreed with ACLI on a few points -- the promise of new hybrid products and government initiatives.

“Beyond the very few remaining companies selling few new policies, the new policies bear little resemblance to the earlier policies sold because of a variety of new limitations added,” Birnbaum said to InsuranceNewsNet. “What has grown are combination products like Life-LTC and Annuity-LTC. These products -- while too new to assess as useful vehicles for some consumers' long-term care needs -- hold far greater promise than a rebirth of the stand-alone product market.”

Federal resources should go into strengthening social insurance programs to support long-term care services, he said, instead of trying to prop up a private market that “at best, returns 60 cents on the premium dollar and is inevitably limited to more affluent consumers who can afford a private market premium.”

Bonnie Burns of California Health Advocates said not only are consumers having difficulty getting LTCi coverage, many of those who have it are struggling to keep it.

“Recent notices from Genworth to California policyholders has warned them of even more draconian premium increases than they are already getting,” Burns said, referring to a notice for an increase of 561% over the next three to six years. “In addition, CalPERS members who bought that long term care product are being hit with a 90% rate increase over two years on the heels of a previous 85% increase.”

'Expected Shortfall'

In its second quarter earnings call last week, Genworth Financial CEO Thomas McInerney said the company plans to break even eventually by increasing rates on in-force policies.

“Our current long-term cumulative improvement target on a net present value basis is roughly $22.5 billion in rate actions, which is the amount needed to address the current expected shortfall in our legacy LTC books of business,” McInerney said during the call. “Having achieved $15.5 billion against the current target of $22.5 billion means we are approximately two-thirds of the way towards achieving breakeven.”

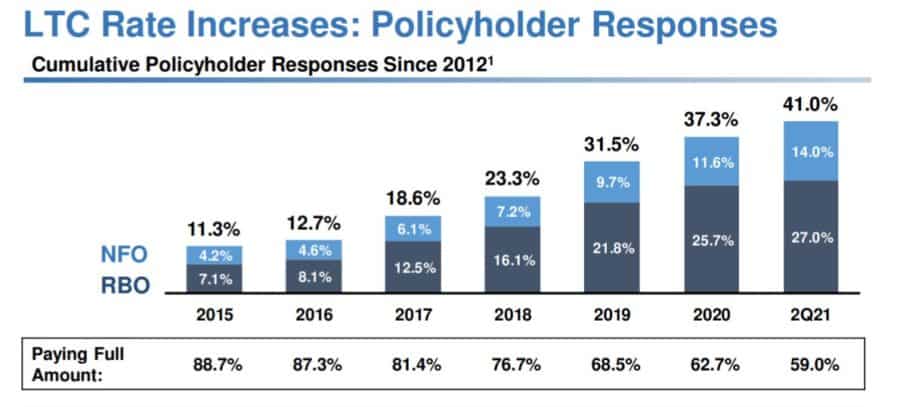

As of June 30, 59% of Genworth's LTC policyholders accepted all premium increases in full, 27% have taken a reduced benefit option and 14% have opted for a non-forfeiture lapse option.

RBO: % Of In Force Policies That Have Selected Reduced Benefit Option (RBO) At Least Once Since 2012.

Paying Full Amount: % Of In Force Policies That Have Always Elected to Pay The Full Rate Increase Premium.

The company does plan to start a new joint long-term joint venture next year, which the company focused on after deciding not to try the LTCi market in China, McInerney said.

“Our plan is to launch this new business sometime in 2022 in partnership with highly rated third parties,” McInerney said. “While Genworth's most significant contribution to any potential partnership would be our intellectual property and expertise, we may also invest a prudent level of capital.”

Meanwhile on the Senate budget deal, Schumer has said he wants to pass the reconciliation bill by the August recess, with Individual committees coming up with specific legislation in the fall.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

The Regulation of Annuities

Michigan Issues Fines In Alleged Title Company Insurance Fraud

Advisor News

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- As federal health tax credits end, Chicago-area leaders warn about costs to Cook County and Illinois hospitals

- Trademark Application for “MANAGED CHOICE NETWORK” Filed by Aetna Inc.: Aetna Inc.

- Study Results from University of California in the Area of Managed Care Reported (Minimally Invasive Overactive Bladder Therapy After Prolapse Surgery): Managed Care

- Reports from Guttmacher Institute Add New Data to Findings in Managed Care (Investing In Reproductive Health: Contraceptive Use and Preference Fulfillment Among Low-income Individuals Across State Policy Contexts): Managed Care

- Winona County approves 11% tax levy increase

More Health/Employee Benefits NewsLife Insurance News

- One Bellevue Place changes hands for $90.3M

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

More Life Insurance News