2018 Finra Fines Increase, Cases Down

Eversheds Sutherland has completed its annual study of the disciplinary actions reported by the Financial Industry Regulatory Authority (FINRA) in 2018.

By reviewing FINRA’s monthly disciplinary reports, press releases, and online database, Eversheds Sutherland partner Brian L. Rubin and counsel Adam C. Pollet found that in 2018 the amount of fines increased compared with 2017, although the number of cases and amount of restitution were down.

In addition, anti-money laundering cases continued to lead to the largest amount of fines.

Fines, Restitution, And Disciplinary Actions

The fines reported by FINRA in 2018 increased slightly to $68 million from $65 million in 2017, a five percent jump, yet down significantly (61 percent) from the record-setting fines of $176 million in 2016.[1] The fines in 2018 were also 28 percent lower than the $94 million in fines reported in 2015.

Despite this reduction, fines have increased by 143 percent in the ten years since 2008, when FINRA assessed fines of $28 million.

Although the amount of fines increased, the number of very large fines declined in 2018. FINRA assessed 13 fines of $1 million or more (what we call “supersized” fines). In contrast, in 2017, FINRA assessed 15 “supersized” fines. Similarly, in 2018, FINRA assessed five fines of $5 million or more. In contrast, in 2017, two cases resulted in these large fines.

In 2018, restitution ordered by FINRA was down significantly. FINRA reported restitution of approximately $31 million in 2018, a decrease of 54 percent from the $67 million in restitution reported in 2017 and well below the record of $96 million reported in 2015.

The decrease in restitution is less pronounced when FINRA’s overall monetary sanctions are analyzed. In 2018, the total monetary sanctions ordered by FINRA (fines, restitution, and disgorgement) were $124 million. The total sanctions ordered in prior years were as follows: $150 million in 2017; $207 million in 2016; and, $193 million in 2015.

The number of cases reported by FINRA also decreased last year. FINRA reported 638 disciplinary actions in 2018, a decrease of about 37 percent from the 1,007 cases FINRA reported in 2017.[2]

The number of individuals barred or suspended and firms expelled decreased in 2018 compared to 2017. FINRA barred 211 individuals in 2018, remaining fairly constant from the 214 individuals in 2017, a decrease of 1 percent.

The number of firms expelled by FINRA decreased from 7 in 2017 to 4 in 2018, a decrease of 43 percent. The number of individuals suspended decreased significantly from 413 in 2017 to 254 in 2018, a decrease of 38 percent.

“Last year, the amount of fines per case went up dramatically, while the number of cases decreased from the previous year, appearing to indicate that FINRA is coming down harder on firms when it decides to bring a case,” Rubin said. “FINRA addressed an array of topics in 2019, continuing its focus on anti-money laundering, while also pursuing more ‘nuts and bolts’ issues like suitability, variable annuities, and supervisory policies and procedures.”

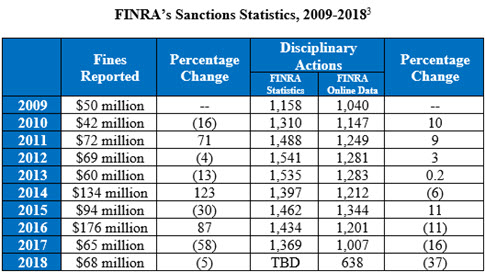

The chart below displays FINRA’s fines and the number of disciplinary actions during each of the past 10 years:

The chart below displays the restitution FINRA reported during each of the past 10 years:

Listed below are the top FINRA enforcement issues for 2018 measured by total fines assessed:[4]

1. Anti-money laundering (AML) cases resulted in the most fines assessed by FINRA in 2018. This is the third year in a row that AML has been at the top of the Eversheds Sutherland Top Enforcement Issues list and the fifth year in a row that AML has appeared on the list. FINRA reported 17 AML cases in 2018, which resulted in $27.3 million in fines. While the number of cases is almost the same as last year (16 in 2017), the fines reported increased by $12.7 million in 2018, an increase of 87%. AML maintained the top spot due in part to the largest single fine FINRA assessed in any case in 2018 ($10 million).[5] In that case, the firm’s AML surveillance system allegedly did not receive data from several systems, undermining its surveillance of wire and foreign currency transfers. The firm also allegedly failed to devote sufficient resources to the review of alerts generated by its AML surveillance system. Finally, FINRA claimed the firm did not reasonably monitor the deposit and subsequent sale of penny stocks for suspicious activity. Mr. Pollet noted, “AML’s presence at the top of this list for the third year in a row confirms that the financial services regulators—FINRA, the SEC, and FinCEN—are aggressively continuing to monitor how firms handle their AML compliance obligations.”

2. Suitability cases resulted in the second most fines for FINRA in 2018, catapulting it into the Eversheds Sutherland Top Enforcement Issues list for the first time since 2015. FINRA reported 91 suitability cases, with $11.8 million in fines in 2018. The number of cases decreased 7% from the 98 cases brought in 2017, although the fines increased 228% from the $3.6 million in fines reported in 2017. FINRA also ordered $11.6 million in restitution in suitability cases, compared with $30.3 million in 2017. There were three large suitability cases this year related to variable annuities, described below, which resulted in fines of $6.7 million and $8 million in restitution. FINRA also fined a firm $713,000 and ordered $1.3 million in restitution for failing to supervise its representatives engaged in churning in customers’ accounts.[6] In another matter, FINRA fined a firm $800,000 for failing to adequately supervise the suitability of its representatives’ recommendations.[7]

3. Variable Annuity cases resulted in the third most fines for FINRA in 2018, pushing it back into the Eversheds Sutherland Top Enforcement Issues list for the first time since 2016. FINRA reported 28 variable annuity cases for a total of $8.1 million in fines. The number of cases increased 22% from the 23 cases brought in 2017, and the amount of fines increased 305% from the $2 million in fines reported in 2017. FINRA also ordered $8.7 million in restitution in variable annuity cases last year, compared with $428,000 in 2017. In one matter, FINRA fined a firm $4 million and ordered $2 million in restitution for failing to supervise the sale of variable annuity exchanges.[8] In another variable annuity matter, FINRA fined four affiliated firms a total of $1.69 million and ordered restitution of $6 million for failing to establish and implement adequate supervisory procedures regarding the sale of multi-share class variable annuities, especially L-shares.[9]

4. Short Selling cases resulted in the fourth most fines for FINRA in 2018. This is the first year that short selling has appeared on this list since 2013. In 2018, FINRA reported 7 short selling cases for a total of $7.8 million in fines. The number of cases decreased 70% from the 23 cases brought in 2017, but the amount of fines increased 387% from the $1.6 million in fines reported in 2017. Short selling’s appearance on this list was primarily the result of a single matter where a firm was fined $5.5 million for failing, despite numerous red flags and warnings, to establish supervisory procedures that were reasonably designed to achieve compliance with the requirements of Reg SHO which included failing to close-out fails-to-deliver, accepting short orders without first borrowing (or arranging to borrow) the security, and permitting the execution or display of short sales at prices less than or equal to the current national best bid.[10]

Enforcement Trends

* Cases Packing Harder Punch – In 2018, FINRA brought 638 disciplinary actions, down considerably from previous years and continuing a trend from 2017. Although the number of cases was down significantly, the amount of fines appears to be packing more of a punch. For example, in 2017, FINRA brought 1,007 cases[11] with fines totaling $65 million, for an average fine of approximately $65,000 per case. But in 2018, with 638 cases totaling $68 million fines, the average fine per case is approximately $107,000.

* FINRA Is a Second-Half Team – Many of FINRA’s big-ticket fines are brought in the second half of the year, often in year-end cases. In 2018, FINRA reported fines of $42 million in the second half of the year as compared to $26 million in the first half. Similarly, in 2017, FINRA levied $41 million in fines in the second half of the year and $24 million in the first half. In 2018, the large fines in the second half were in part the result of FINRA fining four firms $21 million in December 2018 alone, representing nearly one-third of the $68 million in total fines for the year.

* Share Class Cases – FINRA continues to pursue firms for failing to provide sales charge waivers for retirement plans and charitable organizations. In 2018, FINRA brought six enforcement actions against firms for failing to provide these sale charge waivers when applicable. FINRA levied fines in only two of the matters totaling $150,000, but ordered restitution of $3.1 million. This practice is consistent with a continuing trend of FINRA focusing on making harmed customers whole through restitution rather than fines.

* Inadequate Resources – In a couple notable cases in 2018, FINRA cited firms for failing to commit sufficient resources to their regulatory obligations. These two matters resulted in sanctions of $10.8 million. In the first matter, FINRA alleged that the firm relied on three individuals to manually review suitability for over 600 representatives in over 250 branches.[12] As a result, FINRA found the firm failed to have a reasonable supervisory system for the suitability review of customer transactions. In the second matter, FINRA alleged that a firm failed to devote sufficient resources to review AML alerts, resulting in AML analysts carrying a large workload and failing to conduct sufficient investigations of potentially suspicious activity.[13] These cases are consistent with an approach outlined in a 2018 speech by FINRA’s Director of Enforcement Susan Schroeder.[14] She stated that in disciplinary actions FINRA would be identifying the root cause of regulatory deficiencies.

About Eversheds Sutherland

Eversheds Sutherland comprises two separate legal entities: Eversheds Sutherland (International) LLP (headquartered in the UK) and Eversheds Sutherland (US) LLP (headquartered in the US), and their respective controlled, managed, affiliated and member firms. The use of the name Eversheds Sutherland is for description purposes only and does not imply that the member firms or their controlled, managed or affiliated entities are in a partnership or are part of a global LLP. For more information, visit eversheds-sutherland.com.

[1] The 2018 data comes from FINRA’s monthly disciplinary reports, its Disciplinary Actions Online database, press releases, and other major news sources.

[2] The number of disciplinary actions has been identified by searching FINRA’s Disciplinary Actions Online database because FINRA has not yet published its annual report or updated its “Statistics” webpage.

[3] The 2009-2017 data contained in this chart and the next chart can be found in AnchorFINRA’s annual reports and FINRA’s “Statistics” webpage. See, e.g., FINRA 2015 Year in Review and Annual Financial Report, FINRA, available athttp://www.finra.org/sites/default/files/2015_YIR_AFR.pdf, and Statistics, FINRA,https://www.finra.org/newsroom/statistics.Under Disciplinary Actions, the “FINRA ‘Statistics’” are the number of disciplinary actions reported in FINRA’s Annual Reports or “Statistics” webpage, while the “FINRA online data” is the number of actions listed on FINRA’s Disciplinary Actions Online database. FINRA has not yet released its Annual Report or updated its “Statistics” webpage for 2018. “The Percentage Change” is calculated using the number of actions listed on FINRA’s Disciplinary Actions Online database.

[4] Because cases may involve more than one alleged violation (e.g., suitability and variable annuities), a case may be included in more than one category in this analysis.

[5] AWC No. 2014041196601 (Dec. 26, 2018).

[6] AWC No. 2012030564701 (Jun. 22, 2018).

[7] AWC No. 201403971101 (Sept. 11, 2018).

[8] AWC No. 2013035051401 (May 8, 2018).

[9] AWC No. 2015047177001 (Jul. 24, 2018).

[10] AWC No. 2014043143401 (Aug. 16, 2018).

[11] Since FINRA has not yet released its official 2018 figures, the number of cases cited in these examples are from FINRA’s Disciplinary Actions Online database for an “apples-to-apples” comparison.

[12] AWC No. 2014039071101 (Sept. 11, 2018).

[13] AWC No. 2014041196601 (Dec. 26, 2018).

[14] See Susan Schroeder, Remarks at SIFMA AML (Feb. 12, 2018), available athttps://www.finra.org/newsroom/speeches/021218-remarks-sifma-aml.

IRI To Push Aggressive Retirement Security Blueprint

Health Care Buy-In Proposals Address Costs Of Coverage

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Best’s Market Segment Report: AM Best Maintains Stable Outlook on Malaysia’s Non-Life Insurance Segment

- Report Summarizes Kinase Inhibitors Study Findings from Saga University Hospital (Simulation of Perioperative Ibrutinib Withdrawal Using a Population Pharmacokinetic Model and Sparse Clinical Concentration Data): Drugs and Therapies – Kinase Inhibitors

- Flawed Social Security death data puts life insurance benefits at risk

- EIOPA FLAGS FINANCIAL STABILITY RISKS RELATED TO PRIVATE CREDIT, A WEAKENING DOLLAR AND GLOBAL INTERCONNECTEDNESS

- Envela partnership expands agent toolkit with health screenings

More Life Insurance News