1 in 5 in study admit to considering insurance fraud

Insurance fraud is a pervasive issue in the U.S., with estimates suggesting it could cost the industry more $300 billion annually. But beyond the financial strain on insurers, it impacts consumers directly, leading to higher premiums and a sense of injustice among honest policyholders.

To delve deeper into this phenomenon, Customertimes conducted a survey of 2,000 Americans, shedding light on the prevalence of fraudulent claims and the underlying motivations driving them.

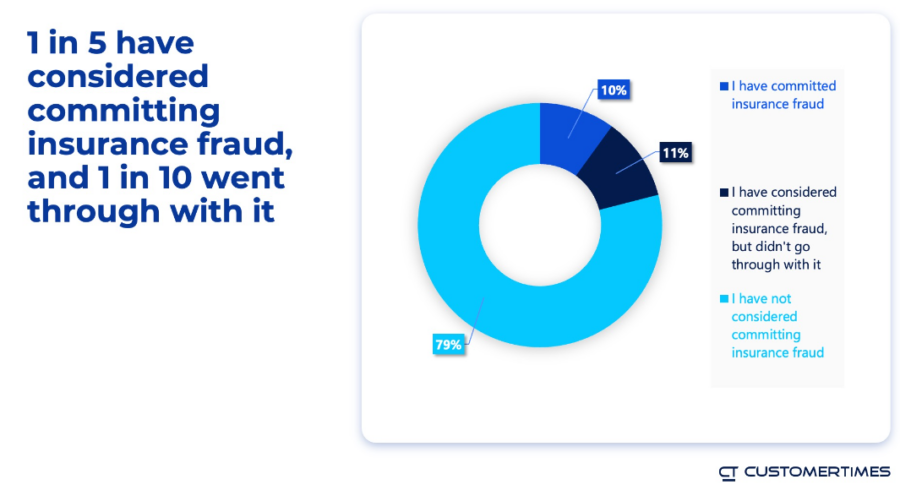

The findings reveal a concerning reality: one in five respondents admitted to at least considering committing insurance fraud, with 10% admitting to following through with their plans. Moreover, a significant portion of the surveyed population knew individuals who had either committed or contemplated insurance fraud.

The conclusions jibed with similar findings released last month by the Coalition Against Insurance Fraud, an organization of consumers, insurers, government agencies, prosecutors and others, all uniting to fight fraud.

“Consumer attitudes towards insurance fraud are concerning,” said Michelle Rafeld executive director of the coalition. “Studies show a significant portion of the population does not view it as a crime.”

Rafeld said that the same technology advancements that have made it easier for individuals to get their insurance, have also made it easier for sophisticated criminals to commit insurance fraud.

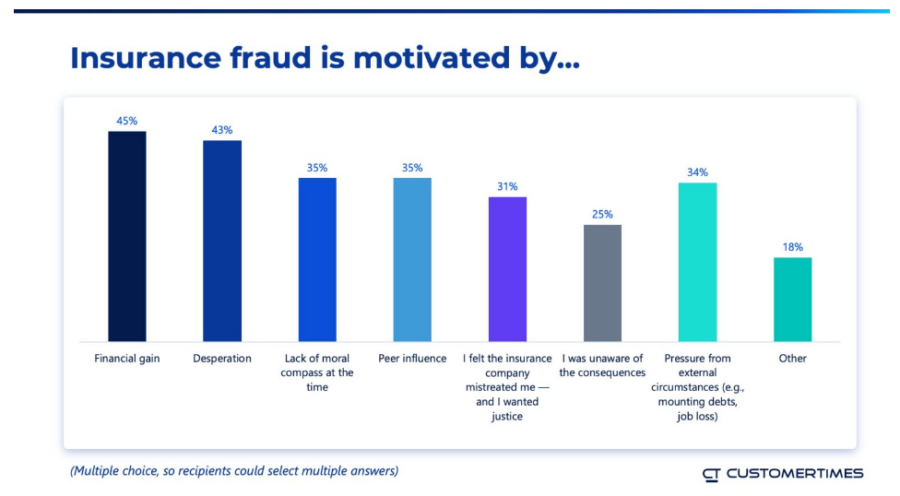

In the Customertimes survey, financial gain unsurprisingly emerged as the primary motivator for insurance fraud, cited by 45% of respondents. However, non-financial factors also played significant roles, including peer influence, a desire to address perceived injustices by insurers, ignorance of consequences, and desperation.

The study also highlighted consumers' perspectives on the role of policy loopholes and perceived unfairness in driving insurance fraud. Nearly half of Americans believed that loopholes in policies facilitated fraudulent activities, while a quarter considered insurance fraud justifiable when policies were deemed unfair. This subjective interpretation of fairness poses a challenge for insurers in crafting policies that are perceived as equitable by all parties involved.

Interestingly, consumers tended to view fraud committed by individuals as less serious than corporate fraud. While many expressed confidence in their ability to identify fraudulent cases, there was skepticism regarding insurers' capabilities in detecting and preventing fraud consistently.

Looking ahead, consumers expressed optimism about the potential of new technologies such as AI and data analytics to enhance fraud detection efforts. However, they also emphasized the need for insurers to prioritize consumer education and streamline communication processes. A majority felt that insurers were not doing enough to inform consumers about fraud prevention measures or adequately compensate fraud victims.

Moreover, consumers signaled a willingness to share more data if it contributed to fraud prevention efforts, underscoring the importance of transparency and collaboration between insurers and policyholders. Simplifying bureaucratic procedures and enhancing user experience emerged as key factors in building consumer trust and bolstering fraud prevention initiatives.

“If providers needed an additional incentive to improve the user experience, they should note that 80% of respondents said they would be more likely to trust insurance companies if they were less bureaucratic to deal with,” said Drew Sickler, VP salesforce for Customertimes. “If insurers can give consumers more confidence in their processes, then it could help provide valuable intelligence in preventing the scourge of insurance fraud.”

Addressing that scourge, he said, requires a multifaceted approach that encompasses consumer education, technological innovation, and a commitment to fairness and transparency within the industry.

“By heeding the insights gleaned from this study, insurers can take proactive steps to mitigate fraud risks and foster greater trust and accountability among all stakeholders involved in the insurance ecosystem,” he said.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

IRS again defers minimum distribution penalty for IRA beneficiaries

Revol One Financial retools with new annuity products, big goals

Advisor News

- Retirement moves to make before April 15

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

More Advisor NewsAnnuity News

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

More Annuity NewsHealth/Employee Benefits News

- Higher buprenorphine doses help patients stay in opioid use disorder treatment, new study finds

- Minnesota’s uninsured rate jumped last year — and it could be going higher

- Walz seeks to shake up Minnesota’s human services system amid fraud concerns

- Higher buprenorphine doses help patients stay in opioid use disorder treatment, new study finds

- Fee on health insurers to fund abortion services debated in WA Legislature

More Health/Employee Benefits NewsLife Insurance News

- Thrivent plans to add 600 advisors this year

- Third Federal Named a top Financial Services Company by USA TODAY

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

- Investors Heritage Promotes Andrew Moore to Executive Vice President; Names Him CEO of Via Management Solutions

- Kansas City Life: Q4 Earnings Snapshot

More Life Insurance News