$1.6 trillion in U.S. homes uninsured, mostly among Hispanic and African-American families

One in 13 American homeowners does not have home insurance coverage, being the equivalent of $1.6 trillion in uninsured home value, according to a new report by the Consumer Federation of America.

The most likely homeowners to go uninsured were Hispanic and African-American households, seniors, lower income-earners and those living in Miami and Houston — two cities extremely vulnerable to climate change.

“Storms and natural disasters are becoming all the more frequent. Homeowners insurance is essential for protecting consumers,” Michael DeLong, research and advocacy associate, CFA, told the National Association of Insurance Commissioners’ Consumer Liaison Committee at the Spring 2024 Meeting.

As such, the CFA has recommended ways the federal government can address this, including by introducing a public reinsurance mechanism that could help reduce premiums for American homeowners.

Key findings

The CFA assessed data from a 2021 American Housing Survey, weighting the 31,669 observations to be nationally representative.

DeLong presented findings to the NAIC, noting that this crucial information is not often rigorously studied.

“Our top finding was, in 2021, 6.1 million homeowners lacked homeowners insurance coverage. That's equivalent to 7.4% of homeowners or one in 13 homeowners across the United States,” he said.

Of the $1.6 trillion in home value that is without coverage, $339 billion is owned by Hispanic households and $206 billion is owned by Black households.

Additionally, homes built before 2000 were almost twice as likely to be uninsured than homes built in the last two decades, and “an astonishing 35%” of manufactured homes, which are gaining popularity, were uninsured.

“We expect rising insurance premiums and diminishing access to homeowners insurance,” DeLong said. “We think this is going to cause more people to go without homeowners insurance in the years to come.”

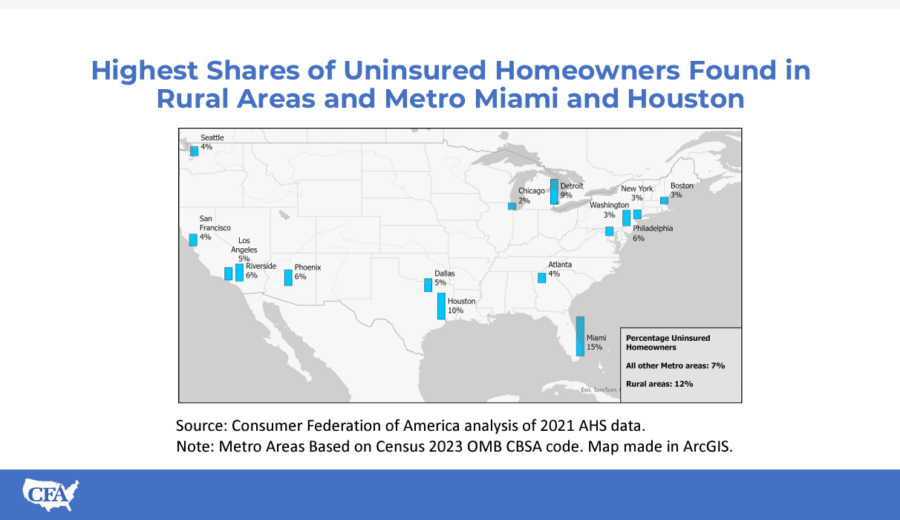

Demographic: Location

Rural homeowners were more likely to lack homeowners insurance, with 12% going without coverage.

In major cities, homeowners in Miami, FL, and Houston, TX, were found to be the most likely to lack coverage, where 15% and 10% respectively were uninsured.

The top 10 states with the highest percentages of uninsured homeowners were:

- Mississippi (13%)

- New Mexico (13%)

- Louisiana (12%)

- West Virginia (11%)

- Alaska (11%)

- North Dakota (11%)

- Alabama (11%)

- Oklahoma (11%)

- Florida (10%)

- Texas (10%)

However, DeLong underscored that uninsured homes are found across the country and the issue cannot be reduced to just a handful of states or regions.

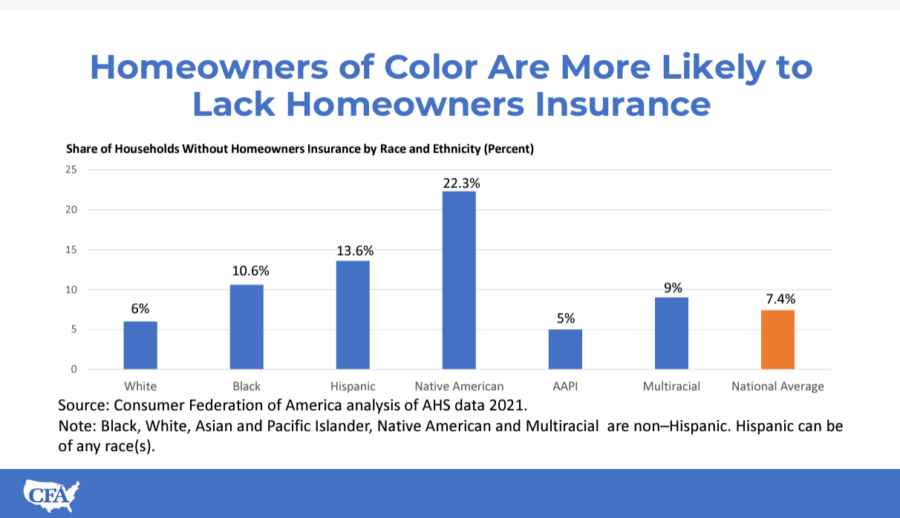

Demographic: Ethnicity

The CFA report found “some pretty substantial racial and ethnic inequalities.”

“Hispanic homeowners are more than twice as likely as white homeowners to not have homeowners insurance,” DeLong said. “This is especially worrisome because a lot of these communities tend to be disproportionately exposed and susceptible to natural disasters.”

More than 22% of Native American homeowners lacked homeowners insurance, compared to 14% of Hispanic homeowners, 11% of African American homeowners, 9% of multiracial homeowners, 6% of white homeowners and 5% of Asian American and Pacific Islander homeowners.

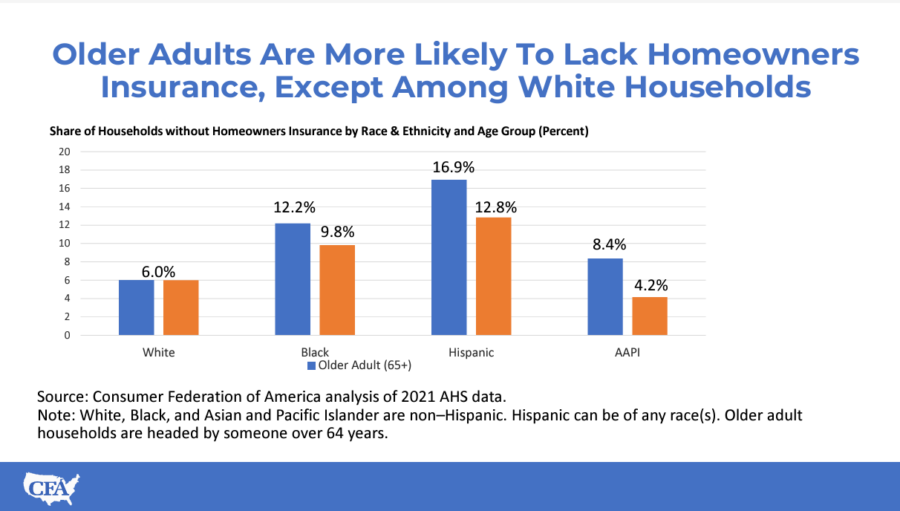

Demographic: Age

Results also found “striking” age disparities in coverage, which could potentially “deepen racial wealth and homeownership gaps.”

With the exception of white households, older Americans from all ethnicities were more likely to lack homeowners insurance. DeLong said this is concerning because of how vulnerable seniors can be without coverage.

“They tend to have less time to recover from disasters. A lot of them deal with mobility issues or health challenges, and a lot of them live on limited or fixed incomes, like Social Security. So, accidents or disasters may jeopardize their ability to stay in homes as they age in place,” he said.

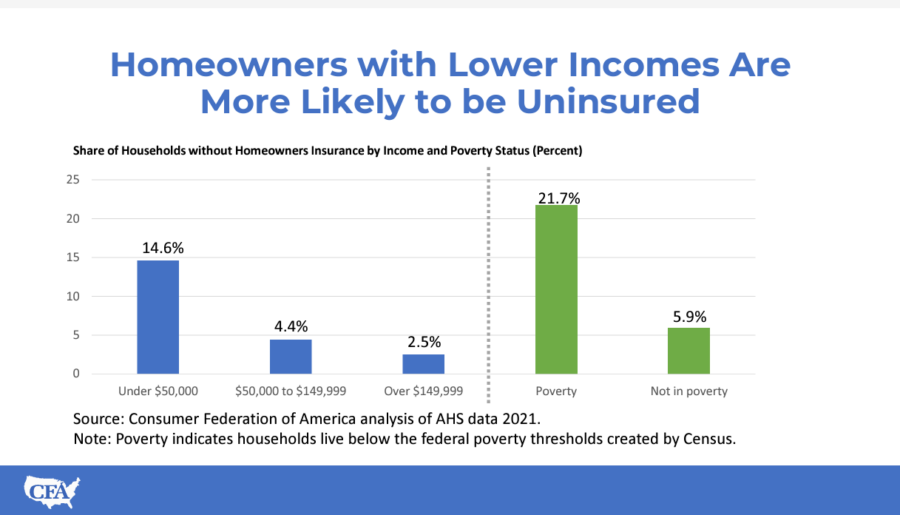

Demographic: Income

Homeowners who are least likely to have financial resources to pay for unexpected damage are most likely to go unprotected, DeLong said.

Nearly 15% of Americans who make under $50,000 per year and almost 22% of those living in poverty lack homeowners insurance. This is in contrast to 4.4% of those who make between $50,000 and $149,999 per year and 5.9% of those not living in poverty.

Additionally, 19% of the homes valued under $150,000 lacked coverage, compared to 5% of homes valued between $150,000 and $300,000 and 4% of homes worth more than $300,000.

CFA recommendations

To address the issue, the CFA suggests the government collect data on an ongoing basis, including research into homeownership gaps, and translate that data into forms the average American consumer can understand.

It also suggests the federal government invest more in risk reduction and create a public reinsurance mechanism to reduce overreliance on unregulated insurance and also lower premiums for homeowners.

“If premiums keep rising, many homeowners may be forced to go bare…and some homeowners already have been forced to go bare because of rising costs,” DeLong said.

“One major storm, fire or other event could turn an uninsured homeowner into an unhoused family.”

The CFA is an association of organizations that works to advance consumer interests through research, advocacy and education.

Rayne Morgan is a content marketing manager with PolicyAdvisor.com and a freelance journalist and copywriter.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Rayne Morgan is a journalist, copywriter, and editor with over 10 years' combined experience in digital content and print media. You can reach her at [email protected].

The ‘triple whammy’ keeping women from saving for retirement

Most HSA owners taking distributions but few are investing

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Congress takes up health care again − and impatient voters shouldn’t hold their breath for a cure

- On the hook for uninsured residents, counties now wonder how to pay

- Bipartisan Senate panel preparing ACA subsidies bill

- CT may extend health insurance sign-up amid uncertainty over future of ACA subsidies, Lamont says

- Recent Findings from University of Pittsburgh Advance Knowledge in Managed Care (Medicaid’s role in critical care after Medicaid expansion: evidence from Virginia): Managed Care

More Health/Employee Benefits NewsLife Insurance News