The Path Is Greased For Annuity Sales Into Retirement Plans

While major legislation opened the door for annuities in retirement plans, a few more hurdles remain before annuities find a permanent home in 401(k)s.

A panel debated some of those hurdles Tuesday at the LIMRA Life & Retirement Virtual Conference. The issue is of major importance for both insurers as well as the people they insure, said Jana Steele, senior vice president and defined contribution consultant for Callan, an investment consulting firm.

"The change from the pension system to a shared responsibility savings program is partnered with increased longevity," she noted. "And in the midst of the global pandemic, participants may be forced into retirement earlier than planned."

That means figuring out how to spend down a large lump sum accumulated in a retirement plan at a time when many experts are distancing themselves from the traditional 4% annual drawdown theory.

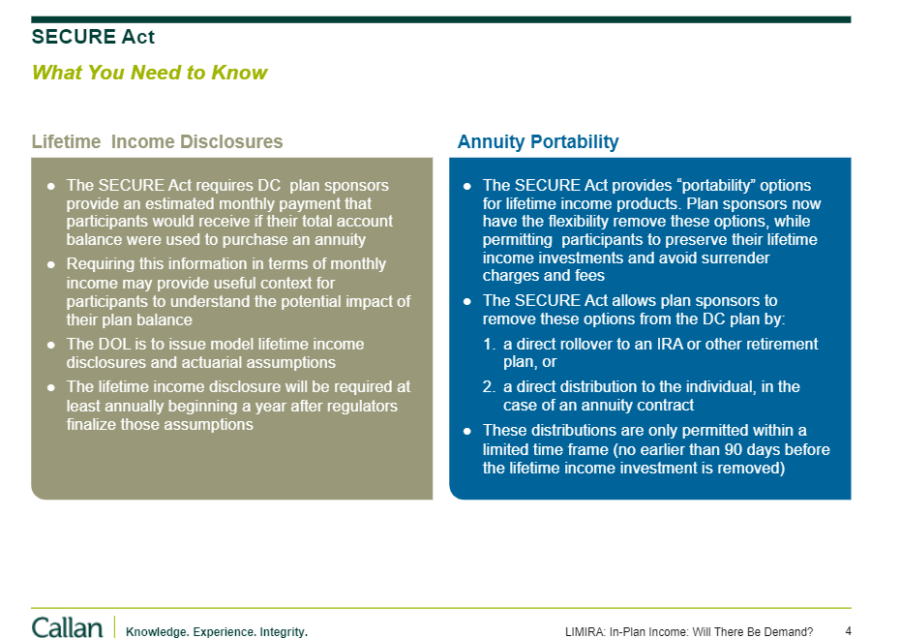

The Setting Every Community Up for Retirement Enhancement Act of 2019, signed in December, makes several changes to plan rules. First, it gives annuities an opening to be a big part of plans. Second, it makes it easier for small business owners to set up retirement plans. Thirdly, it changes the distribution rules around IRAs.

Specifically as it relates to annuities, the act created a Fiduciary Safe Harbor Provision for the Selection of Lifetime Income Providers inside of qualified retirement plans like 401(k) plans. This provision was intended to lessen the liability of a plan fiduciary when selecting an insurance company to provide annuities as investment options inside of the plan, Steele explained.

A few key changes:

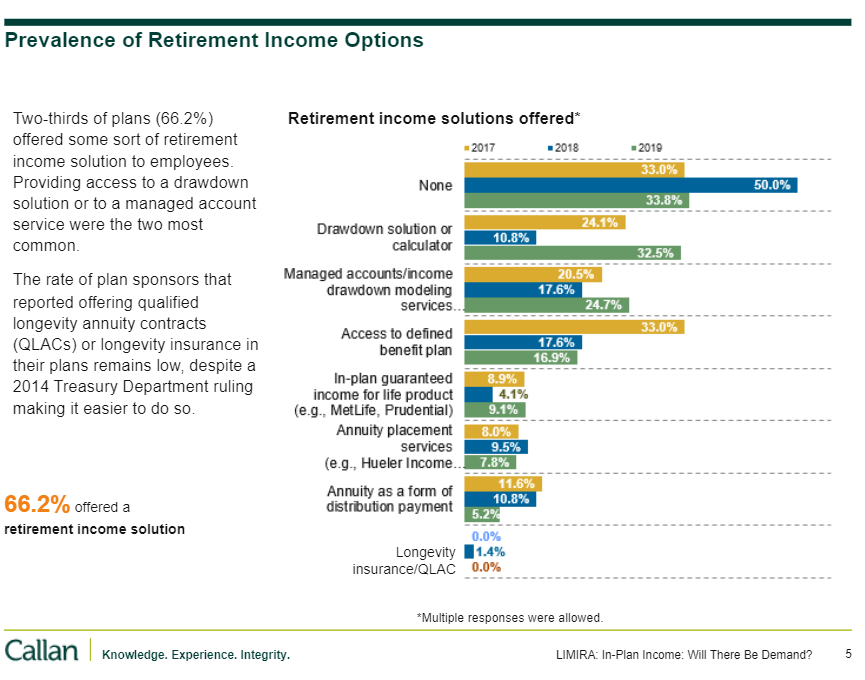

At this point, annuities in plans "hovers around 10%," Steele said, adding that legacy software programs are a major problem to growing that figure. Overall data on lifetime income options is mixed:

Employees Want Annuities

Not surprisingly, employees are big fans of lifetime income options in retirement plans, said Diane Smola, associate partner at Aon Hewitt, a consulting firm.

Most people spend their lives receiving regular money, be it an allowance as a teenager, or a paycheck all through adulthood, Smola noted.

But "at the end of our career, if we only have a defined contribution plan, we have a large sum of money and absent any employer guidance, or a plan option that helps us convert this large pile of money into an income stream, we're at risk for spending far too quickly," she said.

Another requirement under the SECURE Act is the disclosure of how much income from a life annuity a worker would get from the current account balance. This provision takes steps to help savers understand how accumulated savings translate into a regular guaranteed payment. For one thing, this addresses the psychological barrier clients face when handing over a very large sum of money in exchange for much smaller checks.

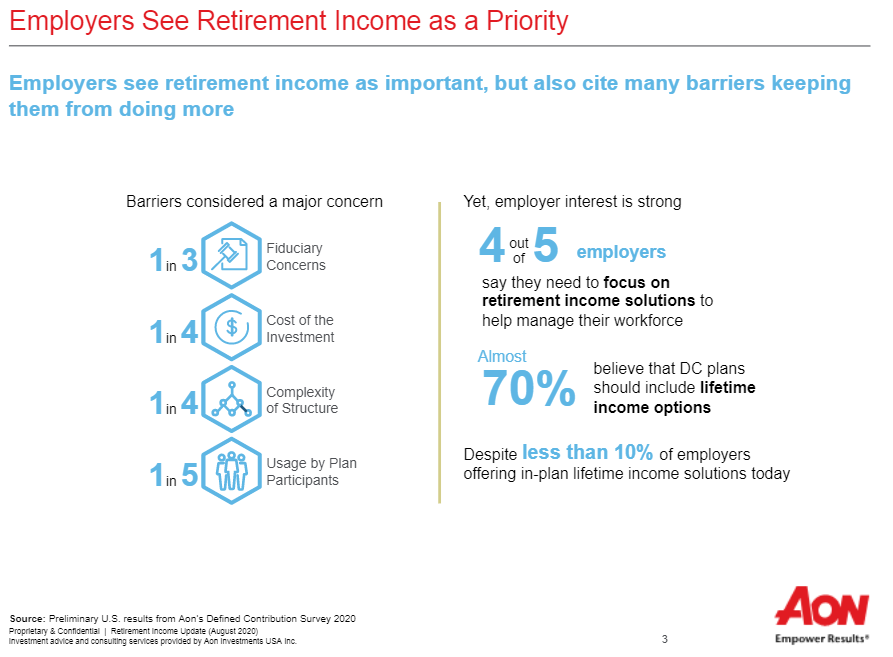

Nearly 70% of employers say providing lifetime income options within retirement plans is important and they want to accomplish that, Aon found. So what is the problem? It's complicated, Smola said.

Employers cite four reasons they are hesitant about adding lifetime income options to their plans:

The SECURE Act addresses some of employers' concerns, especially regarding liability, speakers said. Other hurdles will need time to work through.

The important aspects are in place, speakers agreed -- employees want lifetime income options in plans, and employers want to provide them.

"Once employees realize that the large pile of money that sounded so attractive to them previously doesn't provide the kind of income that they'd hoped for, or that they know they'll need, this may send them clamoring to plan sponsors for specific options in their DC plan," Smola said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- More Americans plan to focus on finances in 2025

- Americans’ saving, investment product savvy improves, study finds

- Bull or bear? What are financial advisors’ market expectations for 2025?

- Panel: Is the American retirement system ‘broken’?

- Goldman Sachs, others weigh in on what’s ahead for the market in 2025

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Tucson Speaks Out: Dec. 30

- Insurance is what makes U.S. health-care prices so high

- Florida was to expand children’s health insurance. Instead, it’s been kicking kids off its rolls

- Addiction Recovery Care has cut almost a quarter of its workforce

- OPINION: Colorado must be a trailblazer on youth mental health services and solve the commercial insurance problem

More Health/Employee Benefits NewsLife Insurance News