Sustainability Is Key In The Wake Of Changing Business Models

Sustainability is the name of the game when it comes to your benefits practice. Susan Rider, vice president of sales and operations at Preventia, walked through the steps of increasing practice sustainability by leveraging your practice’s human capital during a session held Monday at the National Association of Health Underwriters virtual convention.

Rider told participants that in the wake of the COVID-19 pandemic, some agencies adapted to changing businesses models more quickly than others. “Your main goal for you practice is to remain nimble. You want to be able to pivot, not just create a quick fix,” she said.

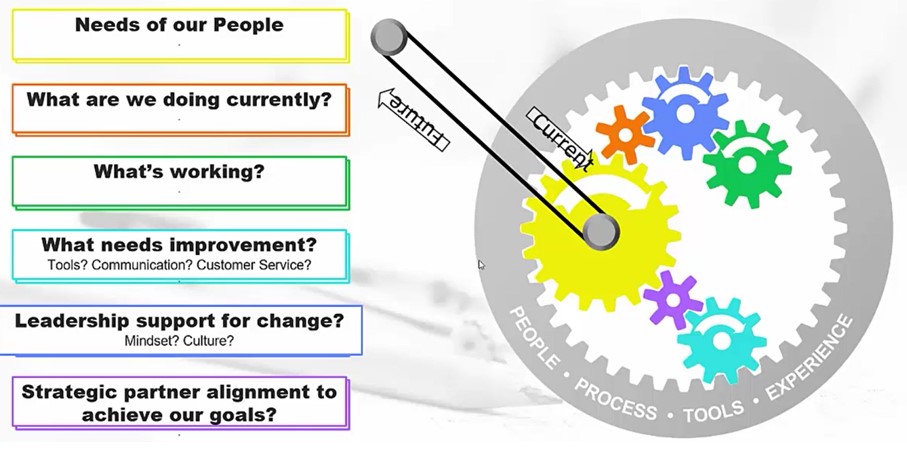

The first step is to begin with a gap analysis that looks at the following:

- The needs of our people.

- What are we doing currently?

- What’s working?

- What needs improvement? Tools? Communication? Customer service?

- Is there leadership support for change?

- Is there strategic partner alignment to achieve our goals?

“You need to look at things such as what’s working, what’s not, and what tools and resources can you leverage,” she said. “Do you need to align with strategic partners or do you have the resources you need in house?”

The end goal in the process is to create a blueprint with actionable steps.

“You need to look at things such as outsourcing versus in-home considerations,” she said. “Are you hitting the right targets?”

Agency owners need to ask, what new ideas are people seeing? “Our conversations are changing,” Rider said.

Other questions agency owners must ask include:

- Have we strengthened our agency consulting capability for our future buyer needs?

- Have we lost accounts because we don’t have human resources services?

- Will we need to add staff or outsource services?

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on Twitter @INNsusan.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- ‘They won’t help me’: Sickest patients face insurance denials despite policy fixes

- Thousands of Missouri construction workers with Anthem health insurance left scrambling

- Don't let death penalty turn Luigi Mangione into a martyr

- More than 5M could lose Medicaid coverage if feds impose work requirements

- Don't make Mangione a martyr

More Health/Employee Benefits NewsLife Insurance News

- Who's who in Lori Vallow Daybell's trial in Arizona?

- 2024 ModeSlavery Report (bpcc modeslavery report 2024 en final)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

More Life Insurance News