Pandemic left lasting appreciation for mortality, life insurance in young people, LIMRA/Life Happens poll shows

The memory of the dark, scary days of the COVID-19 pandemic might be fading but the lessons are apparently imprinted on younger generations, especially single mothers, who have an appreciation for mortality and life insurance, according to the latest LIMRA/Life Happens Insurance Barometer.

Although a record-high percentage of consumers (39%) say they intend to buy life insurance in the next year, younger people are driving the demand with 50% of millennial and 44% of Gen Z respondents wanting coverage, according to the survey, which is being released on opening day of the Life Insurance & Annuity Conference in Salt Lake City.

Alison Salka, head of LIMRA research, said the 10th annual survey showed a growing pool of younger people wanting life insurance.

“Younger generations, the millennials and Gen Z, are really starting to see the need,” Salka said. “It really presents an opportunity for the industry. … The majority of Gen Z is interested in life insurance. Only 40% of Gen Z told us that they own life insurance and about half of them report a need gap.”

The pandemic is likely to have instilled that awareness of mortality and the need for life insurance in younger people because it was a defining moment in their development.

“You have these younger people who are coming of age after or during a pandemic, during a volatile, interesting labor market,” Salka said. “It's really heartening to see that so many of them recognize life insurance as a piece of their overall financial puzzle.”

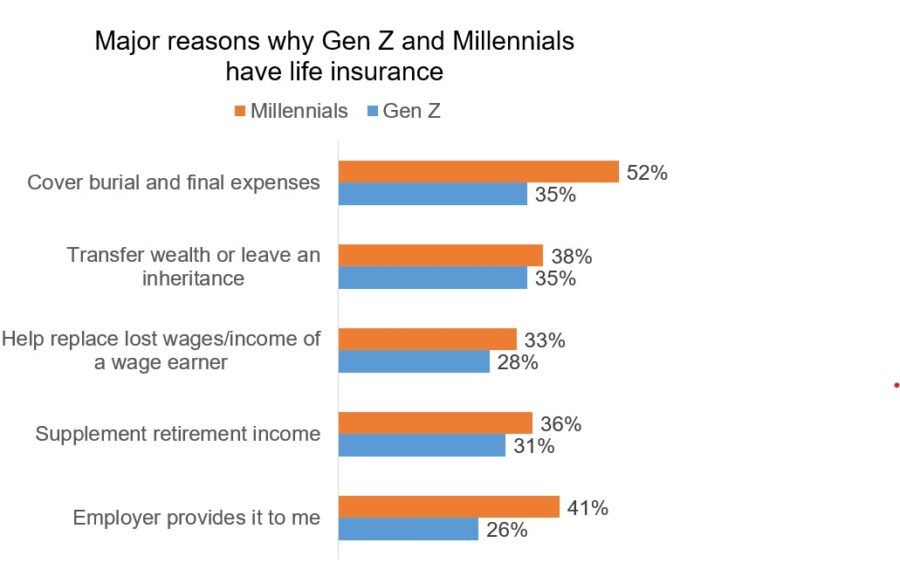

Millennials are most concerned about burial and final expenses, with that being cited as a major reason by 52% of millennials, while only 35% of Gen Z cited it. The second largest reason for millennials is that their employer gave it to them.

Millennials were the most likely to buy life insurance this year because of the pandemic, with 44% saying so; the younger Gen Zers lagged way behind at 24%; Gen X, 31%; and boomers, a mere 17%.

Considering that the younger generations want coverage, why aren’t they getting it? Largely because they don’t know a lot about it.

The main reason millennials didn’t have it yet was because 38% said they thought it was too expensive. Of course, being young, they could find inexpensive term coverage, but another reason they didn’t have insurance is that they had not gotten around to finding out about it – that was the leading reason for Gen Z, with 37% citing the reason while 27% of millennials selecting that.

The other reasons stemmed from not having the information they need, such as qualifying for coverage.

Anxious single moms

The need is acutely felt by single mothers, who are less likely to have coverage although they are more likely to want life insurance. Only 41% of single moms have life insurance while 59% say they want coverage or more of it. That’s even though parents of minor children were more likely to own life insurance, with 59% of parents having it compared to 52% of the general population.

Single mother household income is $50,000, half of what two-earner households bring in. Shouldering the burden for an array of financial challenges, often with little help, leaves moms vulnerable.

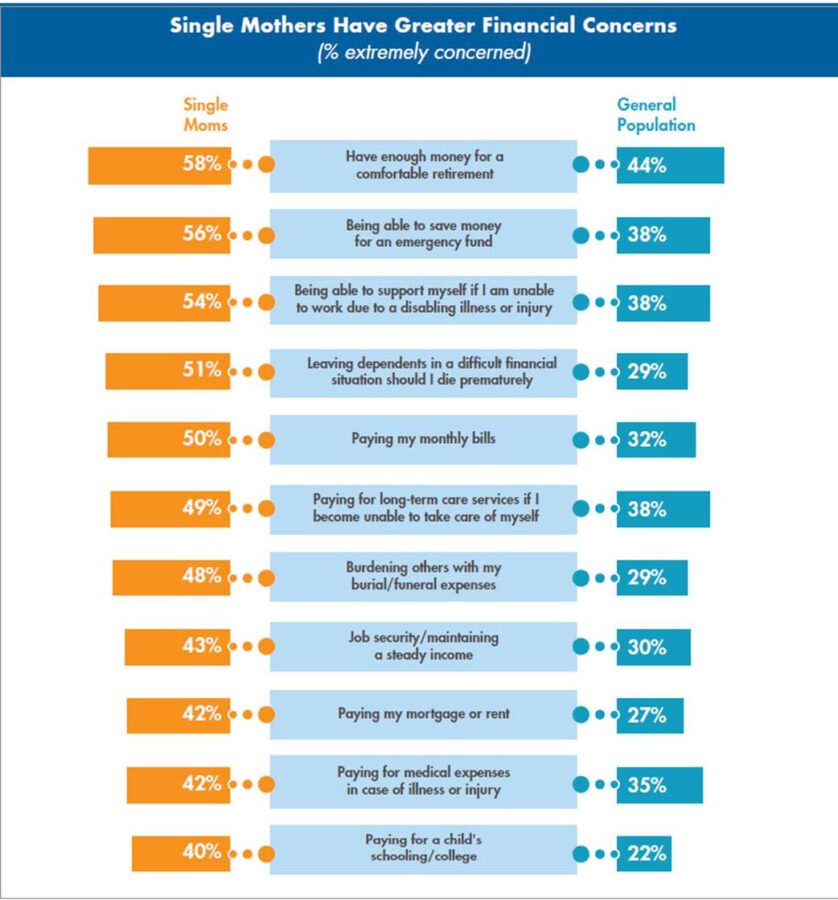

“We asked people if they were concerned about a number of common financial challenges -- are you concerned about being able to save for retirement? outliving your assets? Paying down debt? Are you worried about covering day-to-day expenses? And women, single mothers particularly, expressed greater concern about those issues.”

Far more single moms than other younger people cited cost as the main reason they did not have coverage, with 46% citing it while 38% of millennials and 42% of the general population cited it.

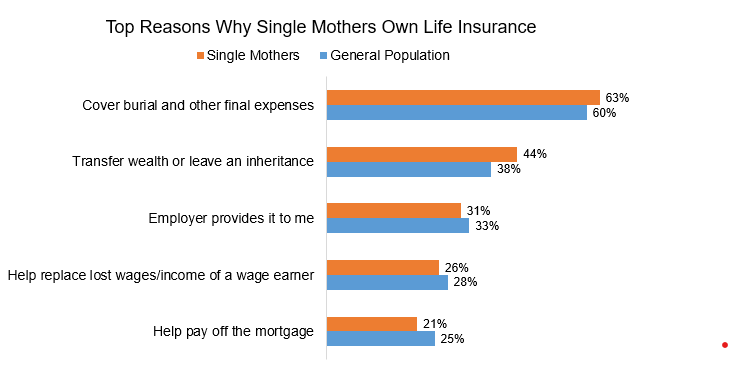

They were also slightly more likely than the general population to get coverage for final expenses. And being a single parent, they were also more interested in leaving an inheritance than the general population, 44% vs. 38%.

The survey showed that parents felt more secure when they had life insurance. Overall, 60% of parents said they would be financially stable if the family’s primary breadwinner died. But it’s clear that life insurance was the key to that security, because 69% of those with insurance felt that security while 47% of those without insurance felt it.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Advisor News

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Mercy Health, Cigna reach agreement to keep patients in network

- Register for 'Welcome to Medicare' seminar by April 15

- Prosecutors directed to seek death penalty against Luigi Mangione

- Maui fire settlement could shrink if health insurers take a bite

- Georgia House panel OKs bill denying state coverage of gender-affirming care

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- 5 steps to overcome mistrust in life insurance sales

- SC regulators ‘reviewing’ rehab strategy for Atlantic Coast

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Life Insurance News