NAILBA marks merger with Finseca by urging member growth

DALLAS – The National Association of Insurance and Life Brokerage Agencies and Finseca leaders finally shared a stage Monday months after the two organizations merged to create NAILBA: A Finseca Community.

Opening NAILBA41 Annual Meeting together, Dan LaBert, president of brokerage and executive vice president, and CEO Marc Cadin urged members to join the organization and help grow its lobbying power.

"Our ability to play offense, our ability to advocate for public policy that isn't some version of 'please don't hurt me,' our ability to advocate for this profession in the media is a function of one thing and one thing only," Cadin said. "How big is our membership."

He called LaBert back to the stage for a special announcement that LIBRA Insurance Partners is making 100% of its membership to Finseca.

"The reality is it requires 100% membership and LIBRA is taking the first step of what I hope will be many, many organizations having everybody be a part of this movement we're creating." Cadin said. "It doesn't happen without leadership."

Tough headwinds

On January 4, 2022, Finseca and NAILBA announced an intent to explore a merger after significant due diligence conducted by a joint task force that included NAILBA and Finseca members, staff, and leadership. After a protracted process, the merger became final in August.

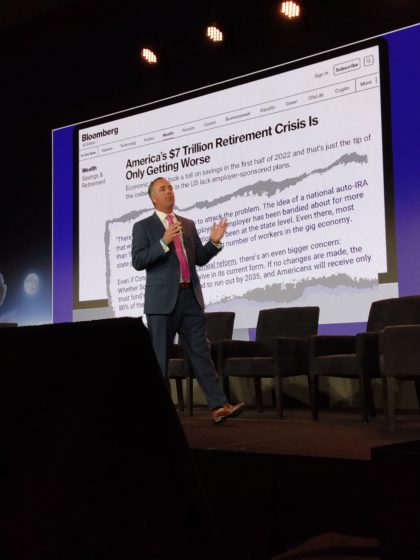

The resulting organization is well-positioned to help the financial services community reverse some bad trends, Cadin said:

Cadin cited a recent Ernst & Young study finding that permanent life insurance and deferred income annuities with increasing income potential outperform investment-only approaches conducted across three different starting ages: 25, 35 and 45.

For each strategy, EY performed a Monte Carlo analysis generating 1,000 scenarios based on randomized input from a range of factors, such as interest rates, inflation rates, equity returns and bond returns.

"Everybody in this profession should know about the study because it's what we do," Cadin said.

The EY study authors noted that the results depended on whether the investor is focused more on retirement income than legacy.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- Rural Hospitals Question Whether They Can Afford Medicare Advantage Contracts

- Brandeis University Reports Findings in Drugs Used In Alcohol Dependence (Alcohol Use Disorder Medication Coverage and Utilization Management In Medicaid Managed Care Plans): Drugs and Therapies – Drugs Used In Alcohol Dependence

- Minnesota couple accused of cheating Medicaid and Medicare of millions, buying mansion

- Health Insurance Shares Climb After Medicare Reimbursements are Boosted

- Medicaid expansion at risk: 'My life was saved by the citizens of Ohio'

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- AM Best Revises Issuer Credit Rating Outlook to Stable for Life Insurance Company of Alabama

More Life Insurance News