Medicare And Health Savings Accounts: Understanding The Rules

Medicare enrollees who are in the workforce may not be aware of the array of rules surrounding health savings accounts and Medicare, and they depend on their advisors to keep them from making a mistake.

Craig Ritter, president of Ritter Insurance Marketing in Harrisburg, Pa., gave health insurance advisors the latest information on “Health Savings Accounts And Medicare” during the National Association of Health Underwriters virtual annual convention.

Ritter planned to focus his presentation on two areas:

- Medicare and HSA rules.

- Medicare medical savings account plans.

“I want you to understand, from a group perspective, how HSA contributions work with employees who are over 65 years old,” he said. “And what some of the potential pitfalls are. And things to be aware of to ensure that the workers who are of Medicare age are not making contributions or the employer is not making contributions that are not qualified.” Medicare enrollees are not eligible for HSAs.

Enrollment in either Medicare Part A or Part B makes someone ineligible for an HSA, Ritter said. Deferring Part B is somewhat straightforward, but deferring Part A is more complex. Depending on the employee group size, the Medicare-age employee may be required to enroll in the health program. In addition, when an employee signs up for Social Security, even though they continue to be employed, Medicare Part A enrollment is automatic.

For an active employee who is past the age of 65 to continue HSA contributions, if Medicare Part A is deferred, two events will trigger retroactive Part A enrollment (up to six months, but not before initial entitlement).

- Signing up for Part A using the Special Election Period due to loss of active employment (or loss of coverage).

- Collecting Social Security benefits.

If an employee or spouse retires or begins collecting Social Security within six months of being entitled to Parts A or B, the employer or employee should stop HSA contributions in the month of their entitlement. If employee or spouse retires or begins collecting Social Security after six month of being entitled to Parts A or B, the employee or employee should stop HSA contributions six months prior.

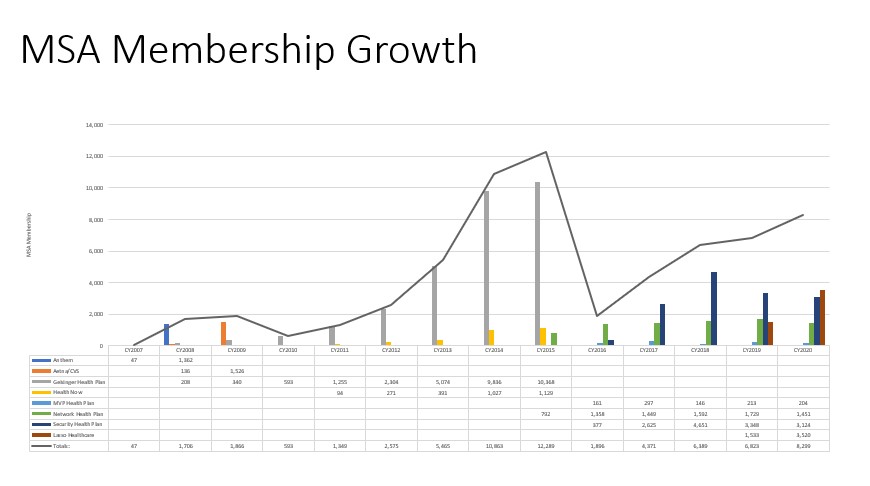

Although HSA enrollment has grown from 7 million to 24 million accounts since 2007, MSA membership has not seen widespread adoption, Ritter said. MSA have grown from two states to a projected 36 states in 2021.

In order to be eligible for a Medicare MSA Plan, an individual must have Medicare Parts A and B, and must list in an area served by an MSA Plan. They also cannot have health insurance that already covers the same services covered by Medicare Parts A and B – such as employer group health insurance.

“It's a zero premium plan, plus you get a deposit tax free in your account,” Ritter explained. “So if you're someone doesn’t have any health conditions – or fewer than two chronic conditions, but they’re managed – then I think it’s an interesting option.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- LTC: A critical component of retirement planning

- Pennsylvanians urged to prioritize health

- PLAINFIELD, VERMONT MAN SENTENCED TO 2 YEARS OF PROBATION FOR SOCIAL SECURITY DISABILITY FRAUD

- Broward schools cut coverage of weight-loss drugs to save $12 million

- WA small businesses struggle to keep up with health insurance hikes

More Health/Employee Benefits NewsLife Insurance News