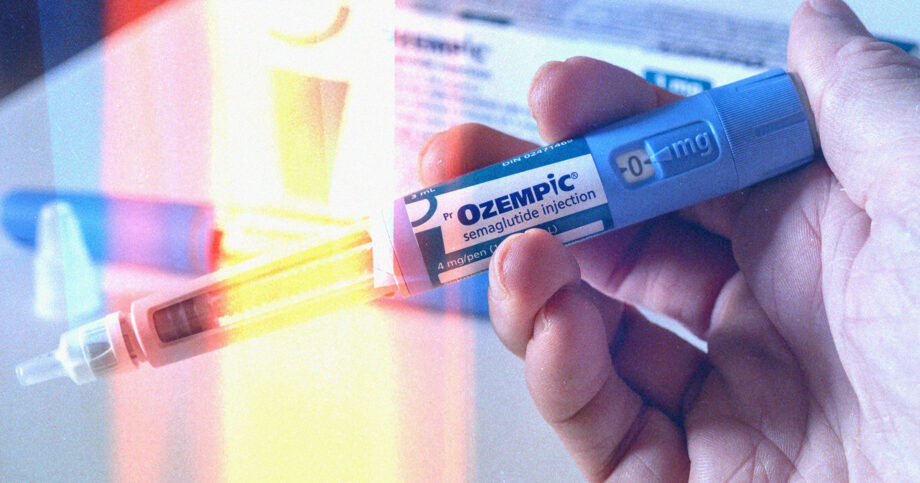

Insurers face tough risk call on weight loss drugs like Ozempic, says panel

WASHINGTON, D.C. – Whether insurers cover weight loss drugs like Ozempic is a unique risk proposition that needs more data.

According to research earlier this year from Morningstar DBRS, health and group insurers have begun paying out more claims related to the use of GLP-1 drugs like Ozempic and Mounjaro, which are generating record sales for the pharmaceutical industry.

A panel of experts debated the risk factors Monday at the beginning of NAILBA 43, the annual conference for the National Association of Independent Brokerage Agencies.

With a super-popular advertising jingle, Ozempic is leading the way in GLP-1 drugs that are amazingly effective and versatile, said Dr. David K. Lewis II, assistant vice president and medical and underwriting director for Nationwide.

GLP-1 is a protein found in the stomach and it plays a critical role in regulating blood sugar levels, appetite, and other metabolic processes. It inhibits the release of Glucagon, a hormone that increases blood sugar levels by stimulating glucose production in the liver. GLP-1 is even found in the brain and plays a role in promoting happy thoughts, Lewis explained.

"So, this individual drug can increase your insulin, decrease Glucagon, make you want to eat less because your belly is still full, and actually make your brain happy too," Lewis said. "So obviously this is an ideal drug for the treatment of diabetes."

The Food and Drug Administration approved Ozempic as an insulin-boosting treatment for Type 2 diabetes in 2017. In 2021, the agency added Wegovy, a version approved for weight loss treatment, without obliging insurance companies to cover it.

Both are made by Novo Nordisk, a Danish company. The drugmaker has exclusive rights to sell Ozempic in the U.S. through 2031 and has spent millions of dollars on advertising and lobbying to expand its market.

Patients pay a monthly premium of $300 to $1,300 out of pocket for the drug, which costs about $35 to manufacture.

Improved health outcomes?

The popularity of Ozempic and other GLP-1 drugs could have a positive impact for insurers in the long run if it proves to be a cost-effective solution for lowering obesity and mortality rates, Morningstar has noted.

Improved health outcomes could help keep premiums and claims for health insurance, life insurance and possibly even disability insurance and long-term care low. Nearly 42% of U.S. adults are obese and about 21% of children ages 6 to 11, Lewis said.

But there are risks associated with using the drugs for weight loss, some NAILBA panelists suggested.

"The downside with weight loss is ... of the weight that is lost, about 60% is fat. Unfortunately, 40% is muscle," Lewis explained. "In the setting of discontinuing these drugs, you gain back all your weight. You don't gain muscle back, you gain fat. And that's one of the biggest concerns about these medications, especially in the long run."

And studies show that patients do end up quitting the weight-loss drugs in high numbers.

John Jonassen is senior vice president, chief underwriter and head of claims at Security Mutual Life Insurance Company of New York. One study showed that after one year, half of the people quit taking the drug, he said. After two years, 70% of the people stopped.

"There's the [gastrointestinal] side effects," Jonassen said. "There are some unpleasant things that go along with it, such as cost. So, how sustainable is it? And we'll find out."

'Not terribly concerned'

Dr. Thomas Ashley also participated in the panel and parted with Lewis on the muscle loss. Ashley is senior vice president and chief medical director for Gen Re.

"It'll have good effects, and when those good effects become manifest, that's when I'm going to make a more favorable decision," Ashley said. "I expect to see good effects, but it's not going to happen in everybody for all kinds of reasons, like discontinuation.

"I'm not terribly concerned about the muscle loss either, because no matter how you lose weight, you're going to lose muscle mass."

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

More Annuity NewsHealth/Employee Benefits News

- NABIP asks Congress to stabilize ACA market, address affordability

- Expired federal subsidies leave fewer Walla Walla residents with health insurance

- Red and blue states alike want to limit AI in insurance. Trump wants to limit the states.

- CT hospital, health insurer battle over contract, with patients caught in middle. Where it stands.

- $2.67B settlement payout: Blue Cross Blue Shield customers to receive compensation

More Health/Employee Benefits NewsLife Insurance News