Hybrid Is The Future For Advisors, Says LIMRA Researcher

See related stories from the LIMRA Distribution Conference for Financial Services, including Virtual Selling Might Be Here to Stay and Creative Lead Generation Tool ‘Like A Dating App’ For Advisors.

Robo-advisors appear to be the future, but perhaps not in the way most people define the term.

Rather than being replaced by a completely automated process, agents and advisors can look forward to working side-by-side with tech. So, it is more like robot colleagues instead of overlords.

That is one way to look at some of the findings that Todd Silverhart plans to speak about during the Customer Experience Transformed on Tuesday during LIMRA’s virtual Distribution Conference for Financial Services. Silverhart, LIMRA’s corporate vice president and director, research quality and performance, expects the data will help spur discussion on the issues in smaller groups during the session.

LIMRA conducted research with the Boston Consulting Group last year that compared the customer experience before and during the pandemic. Researchers found some surprises.

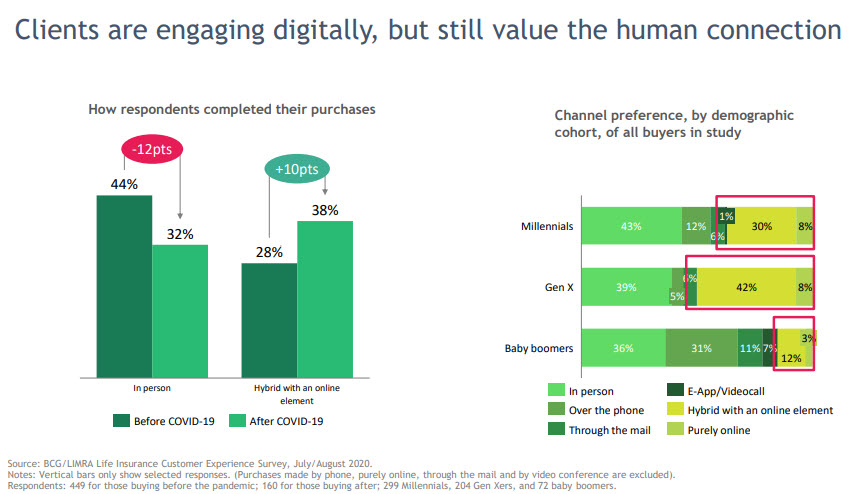

“We were expecting to see a decrease in face-to-face methodology for individuals that purchased during the pandemic,” Silverhart said. “We expected to see an increase in direct to consumer online purchases, and we didn't see that. We saw the increase in a combination of using the internet, but with the assistance of a financial professional, which we refer to as a hybrid model.”

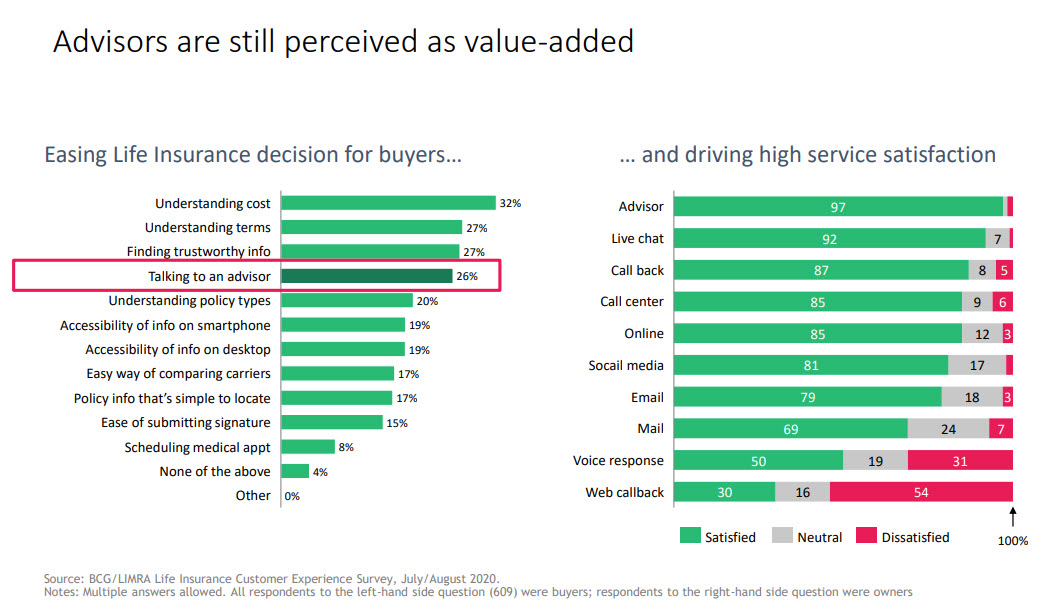

That means rumors of the death of insurance agents and advisors might be premature. In fact, Silverhart said the findings prompted the carrier research association to reassess its thinking on the direction in distribution and its guidance for its members.

“The results were compelling,” Silverhart said. “There were lots of other indicators in the data suggesting that there will continue to be a valued role of the advisor. And the recommendation to companies is as they're investing in technology to really look to double down on technology that's going to assist advisors in being more productive.”

Other research showed that hybrid model will be firmly in place by the end of the pandemic. A study that compared the attitudes of Canadian consumers before and during the pandemic showed that their preferred method of buying decreased for in-person and increased for online.

But they also asked the hypothetical question of how they would prefer to purchase after the pandemic, and consumers’ preference for online decreased and in-person increased, Silverhart said, “but certainly not back anywhere near the levels that they were prior to the pandemic.”

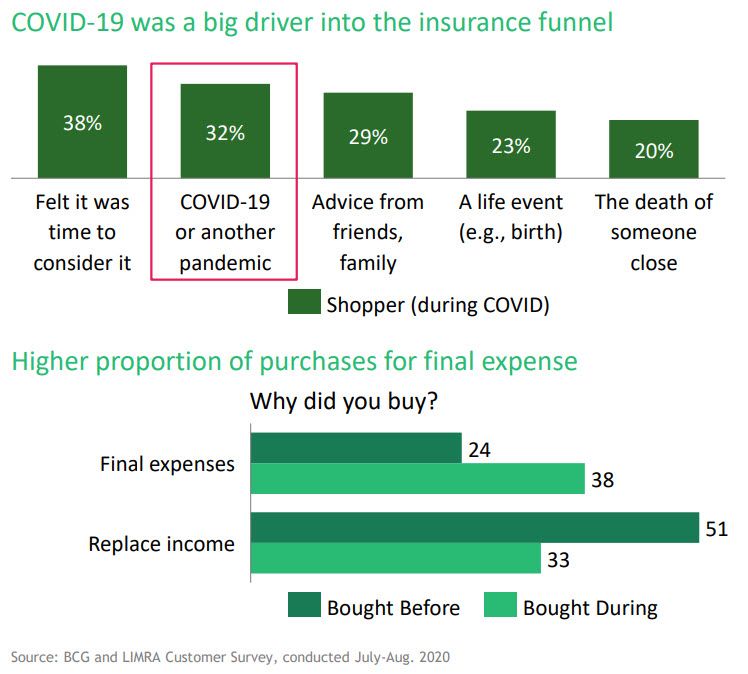

The pandemic prompted many consumers to buy life insurance, but their motives changed significantly.

"When we ask this question, final expense and replacing income are always highly endorsed," Silverhart said. "But the change that we saw between those that bought before and during was pretty notable. Final expenses, 24 to 38%. And replacing income going from 51% down to 33%."

Steven A. Morelli is editor-in-chief for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- PID finds violations by Aetna Insurance

- Iowa insurance firms warn bill would make health costs rise

- ELLMAN BILL PROTECTS ACCESS TO HEALTH COVERAGE, PREVENTS DENIALS OVER PAST-DUE PREMIUMS

- Blue Cross Blue Shield of Wyoming CEO Gore announces retirement; Urbanek to take lead

- Wellpoint taps Rachel Chinetti as president

More Health/Employee Benefits NewsLife Insurance News

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

More Life Insurance News