‘Gates have opened’ for in-plan annuities, LIMRA Research Director says

Legislative changes, product development and an enthusiastic industry are opening the gates to annuity products inside retirement plans.

Still, analysts are cautiously optimistic about the next steps. Challenges remain, said Alison Salka, senior vice president, director of research, for LIMRA and LOMA.

"The gates have opened, and you now have guidelines for portability, which was a question," Salka said. "So the gates have opened, but they haven't been floodgates, because I think the market is still nascent."

Salka will participate today in a session titled, "In-Plan Annuities: Are We at the Tipping Point for Adoption?" at the LIMRA 2023 Annual Conference at National Harbor outside Washington, D.C.

Momentum is definitely high, Salka said, fueled by the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 and the follow-up SECURE Act 2.0, signed into law in December. The bills removed barriers to offering annuities inside retirement plans, and the industry has responded.

"We're starting to see now are a lot of innovations and new products, especially since SECURE," Salka said. "We've been tracking sales and so far it's been a relatively staid market. But we are at a point where you're seeing more interest. You are seeing things change."

Americans want income

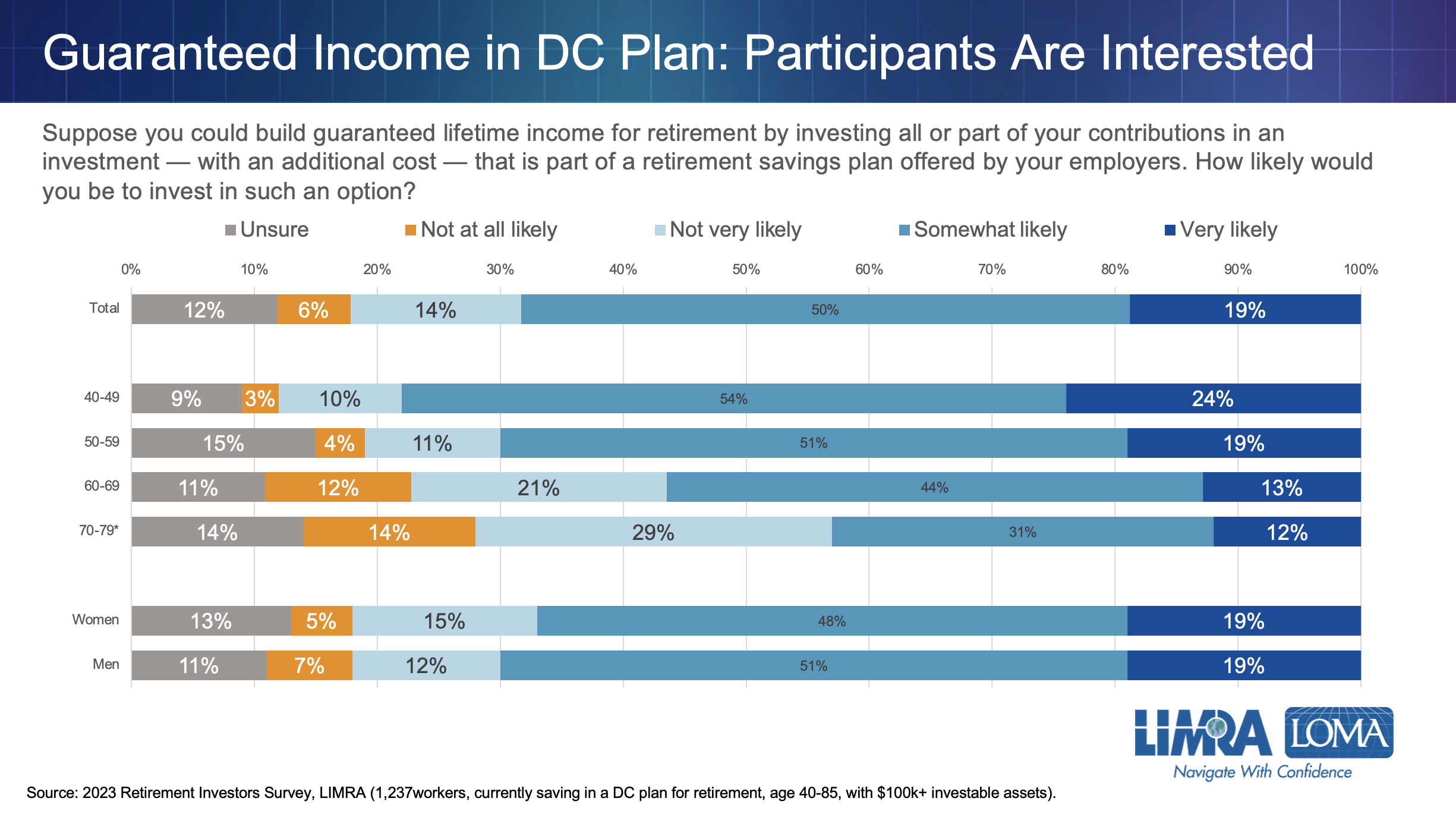

Supply naturally follows demand and in-plan annuities must have a market to thrive. The 2023 LIMRA Retirement Investors Survey of consumers shows a gathering market for guaranteed income.

"I think participants have always recognized that benefit," Salka said. "That is one hurdle, educating them about it, helping them take the steps, getting them into a plan that has [guaranteed income] available. Certainly we know that participants are interested and we know that defined contribution plans, retirement plans are where most of retirement assets are."

Complexity and availability remain the two biggest hurdles to in-plan annuities, a separate LIMRA/LOMA advisor survey revealed. Thirty percent of advisors said the products are "difficult for a sponsor to understand," while another 28% said "products are not available on all recordkeeping platforms."

Not surprisingly, better-educated advisors is a big key to connecting lifetime income products with eager plan participants.

"It seems like efforts to educate advisors and consultants has been working," Salka said. "So it seems like advisors and consultants are in a better position today to advise on these products and they're more comfortable recommending them."

Target-date products

One annuity in-plan product design that is gaining favor is the target-date fund with an annuity component. One popular design calls for gradual purchases of deferred life annuities beginning at age 50, instead of increasing the allocation to bond funds.

The National Bureau of Economic Research published a paper earlier this year finding that allocating a portion of target-date assets to deferred life annuities is financially beneficial compared with leaving all assets in a target-date fund and purchasing an immediate annuity at retirement.

"The target-date design has been one that we have found that advisors are more familiar with and makes sense, but I don't think it's the only option," Salka said. "What you're seeing right now is innovation and experimentation to see the different ways to meet this need. And I think that's a good thing."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Sick of fighting insurers, hospitals offer their own Medicare Advantage plans

- After loss of tax credits, WA sees a drop in insurance coverage

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

- Is cost of health care top election issue?

More Health/Employee Benefits NewsLife Insurance News