Door is open for life insurers to sell ‘risk prevention’ add-on services

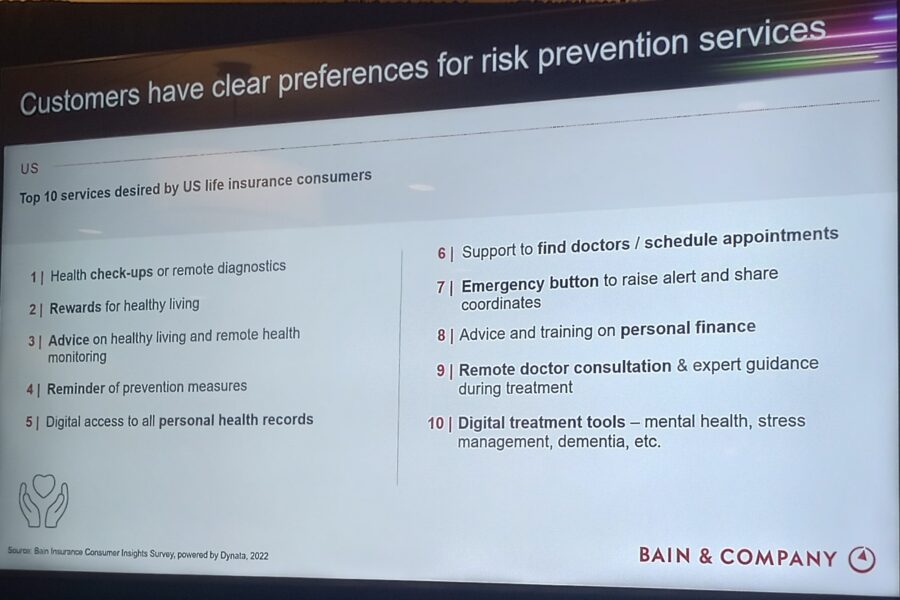

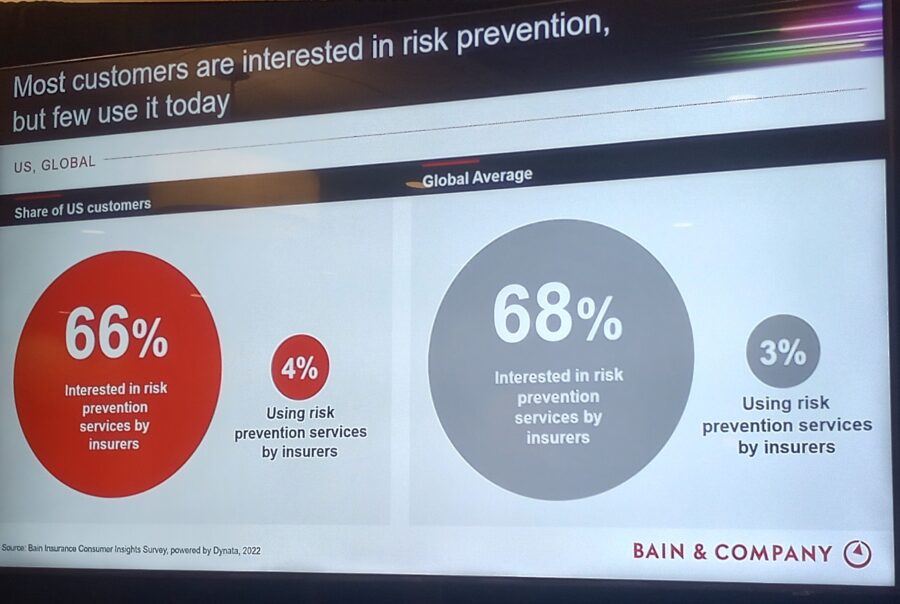

NASHVILLE – Offering “risk prevention” services is something life insurance customers overwhelmingly want, and a strategy that the few carriers who have tried it are having success with.

So why aren’t more life insurance companies jumping in the pool? Good question, agreed Andrew Schwedel, global partner, Bain and Co.

Schwedel led a session titled, “Building a Model That Works: From Loss Reimbursement to Loss Prevention” at the 2024 LIMRA Annual Conference.

“The carriers that are really going to succeed and win will be the ones who are kind of all in,” Schwedel said. “It's not something that you dabble with as one of five strategies that you're kind of throwing spaghetti against the wall and seeing what works. So, it starts with this ambition to say, ‘I'm going to make this a core part of how I do business.’”

John Hancock stands far and away the leader in investing in this concept among U.S.-based insurance companies. In 2015, the insurer partnered with Vitality, a tech-enabled wellness program providing education, support, incentives and rewards to customers for the everyday things they do to be healthy – from exercising to buying healthy groceries to getting a physical.

Vitality provides education, support, incentives, and rewards to encourage customers to adopt healthier lifestyles. In 2018, the company said that all John Hancock life insurance policies will come with Vitality.

Vitality clients can accumulate points for simple health related activities like walking, eating healthier, getting regular checkups, and getting a flu shot, to earn premium savings as well as rewards and benefits.

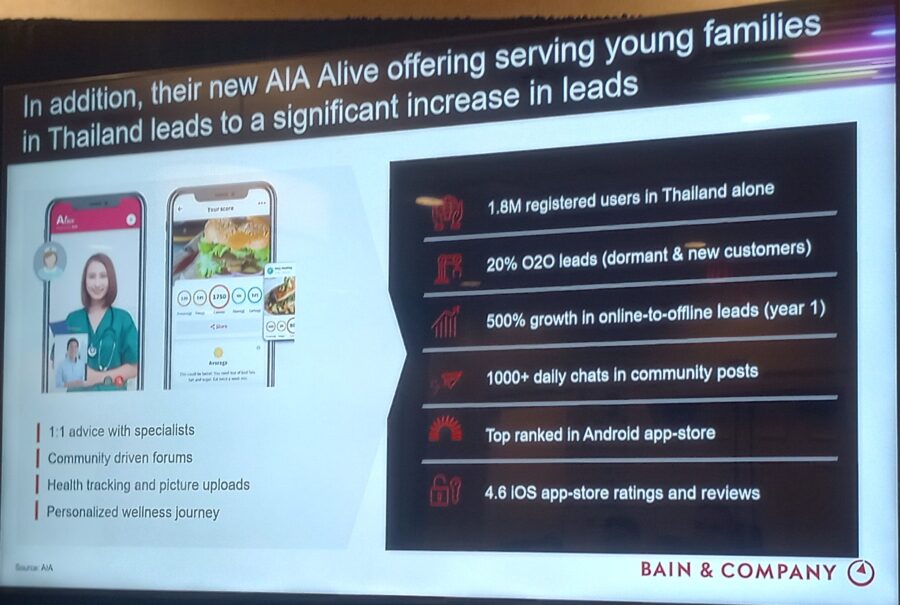

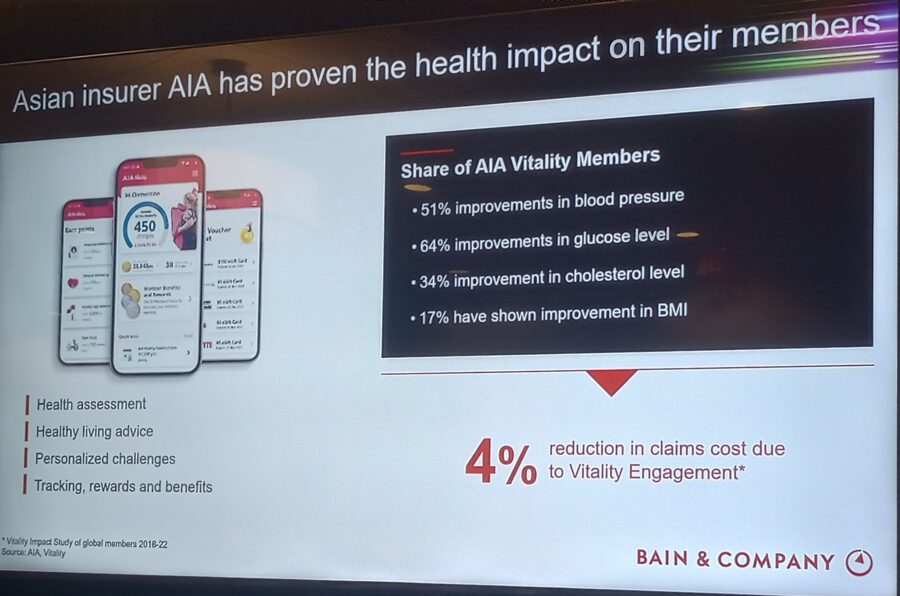

Likewise, AIA Vitality is a comprehensive wellness program offered by AIA Group, a Hong Kong-based insurance company. It aims to encourage and reward healthier lifestyles through a combination of personalized health assessments, goal-setting, and incentives.

Dating to the late-1990s, AIA Vitality has penetrated several countries, including Singapore, Malaysia, Thailand, and Australia. It leverages local partnerships and regional insights to tailor its health and wellness offerings to different markets.

“The programs have evolved quite a bit over time, from, very basic tracking through a Fitbit or something, of steps,” Schwedel said. “Starting from that to evolving and tracking more different types of metrics.”

The returns for John Hancock and AIA Vitality are significant, Schwedel said.

"There are hundreds of life insurers in the US; why are only a handful of them really doing this or doing this at scale and talking about it?" Schwedel asked rhetorically. "The big question every time I talk to companies about this is, 'Can the economics really work?'"

Investing in a program like the Vitality concept can come with a seven-, eight-, or nine-year wait for a good return on investment, Schwedel said.

"Am I really actually changing a client's behavior, or am I just attracting people who otherwise would have joined and been healthy anyway?" Schwedel said, echoing the questions life insurers are asking.

Schwedel said that a South Korean insurer presented an interesting case study. The insurer initiated a rewards program that proved immediately popular.

"They signed up a whole bunch of new customers," he explained. "And the rewards were expensive. At some point they said, 'We've got all these new customers. Maybe we should dial back on these rewards.' The initial program ended and usage dropped."

The example offers a lesson in how engaged customers are with their life insurance, as opposed to just trying to get a reward.

"The more you can make the rewards very relevant, so the more they really tie back to healthier lifestyle choices to give people more control over their health and well-being, the more people will actually engage with service," Schwedel said.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- HOW A STRONG HEALTH PLAN CAN LEAD TO HIGHER EMPLOYEE RETENTION

- KFF HEALTH NEWS: RED AND BLUE STATES ALIKE WANT TO LIMIT AI IN INSURANCE. TRUMP WANTS TO LIMIT THE STATES.

- THE DIFFERENCE INTEGRATION MAKES IN CARE FOR DUAL ELIGIBLES

- Arkansas now the only state in the country to withhold Medicaid from new moms

- Validation of the French Versions of the PHQ-4 Anxiety and Depression Scale and the PC-PTSD-5 Post-Traumatic Stress Disorder Screening Scale: Mental Health Diseases and Conditions – Anxiety Disorders

More Health/Employee Benefits NewsLife Insurance News