A Faster Glacier? Assessing Change In Life Insurance

BALTIMORE – Because quick change is not what life insurance is all about, the answers to the industry’s persistent challenges might sound familiar to the approximately 400 attendees at the 2019 Life Insurance Conference opening today.

But changes are not only coming, they are accelerating, said David Levenson, who is scheduled to open the conference’s general session Tuesday for the first time as LIMRA/LOMA’s CEO. The event is co-hosted with American Council of Life Insurers and the Society of Actuaries.

Speaking in advance of the conference, Levenson acknowledged that the speed of change depends on perspective.

“If you just look at something like technology, it's so different today than it was 10 years ago on our industry,” Levenson said. “And 10 years from now it's going to be much different than that.”

Artificial intelligence fueled by big data is accelerating change in a key area – underwriting. Despite the many announcements that underwriting is speeding up, larger face policies still seem to be stuck at a month or so.

Levenson said a few trends are meeting to push progress on underwriting.

“In the underwriting processes, the use of artificial intelligence and analytics is it a point where we're seeing less reliance on medical exams because there's such a rich history of medical records that could be accessed and are construed as sufficiently reliable for underwriters to make valid decisions,” said Levenson, whose actuarial background becomes apparent when he discusses data. “In another five years or 10 years, the ability to assess one's health and future mortality risk would be more advanced. That's part of the process that will endure to the benefit of the end consumer because it will be a quicker and a less invasive process.”

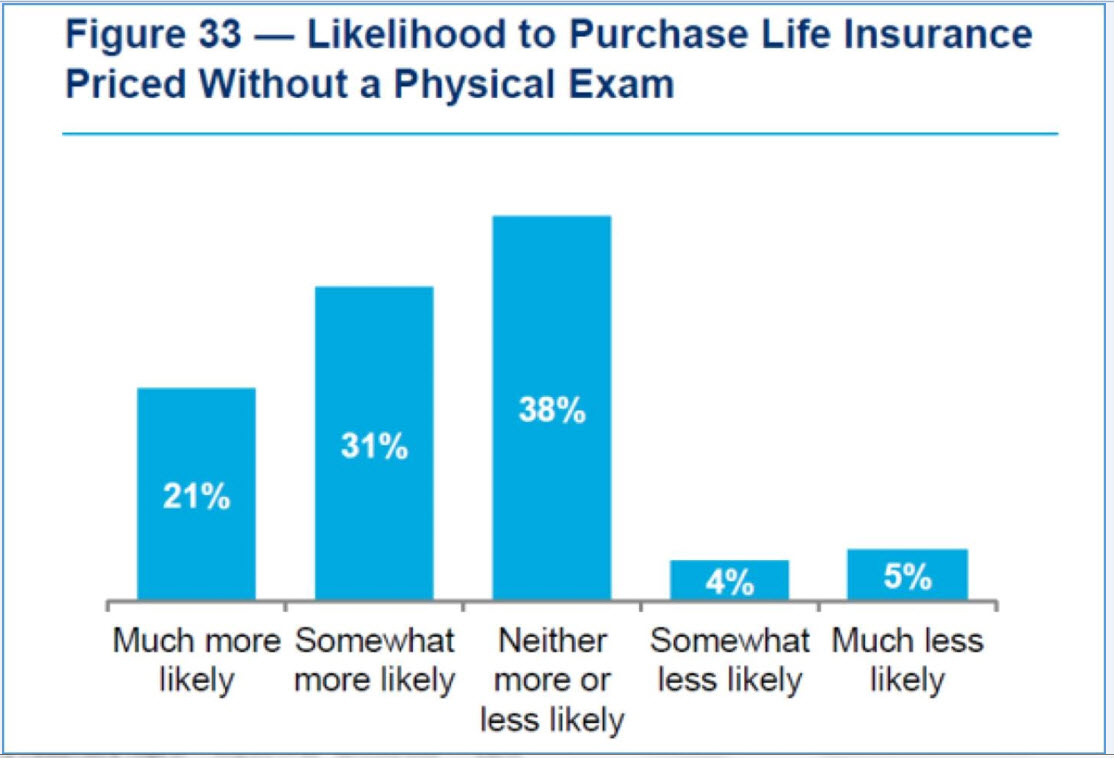

And a less invasive process means more sales. According to LIMRA data, 52 percent of consumers considering life insurance are more likely to buy without a physical exam.

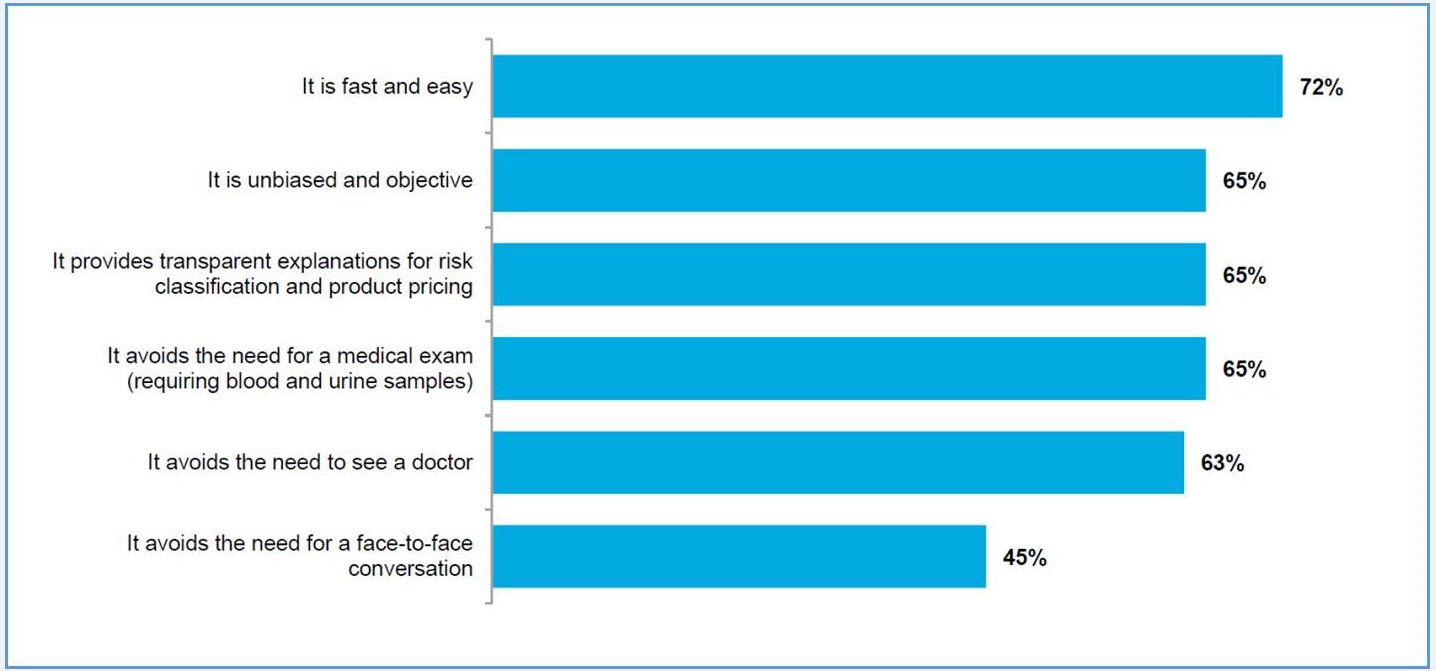

Of consumers who wanted to buy life insurance through a simplified underwriting, 65 percent said one of the main reasons was that it “avoids the need for a medical exam (requiring blood and urine samples).”

“Fast and easy” was the most common top reason that simplified underwriting would prompt buying, with 72 percent choosing it. Other top reasons were ones that might not come right to mind, with 65 percent choosing as top reasons “it is unbiased and objective” and “it provides transparent explanations for risk classifications and product pricing.”

It might please agents to hear that less than half (45 percent) leaned toward online buying because “it avoids the need for a face-to-face conversation.” So, the ease of the online process seems to benefit agents rather than cut them out. ONLINE FACTORS CHART

The need for the industry to improve processes may help a persistent problem of America’s underinsurance, according to LIMRA data. Only 54 percent of Americans have life insurance and those households that have it are typically underinsured by $200,000.

Quick and accurate analysis of big data can help the industry be there at the moments when consumers want life insurance.

“One of our statistics is that 41 percent of Americans considered a life insurance purchase at a time in their lives that something significant is happening,” Levenson said. “Family change, birth of the child, whatever the case may be.”

This is where the actuarial meets the actual. Pulling all these factors together, not only data analytics, but also other segments such as blockchain, is vital to enhancing the industry’s relevance.

“There is where technology tools, artificial intelligence and social media will allow our member companies to reach out to those individuals, often through a third party, at the time that they are most in need,” Levenson said. “The distribution part of the chain, the underwriting part of the chain, the financial reconciliation part of the chain, all of that is evolving for the good of the customer ultimately.”

Steven A. Morelli is editor-in-chief for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2019 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

More Annuity NewsHealth/Employee Benefits News

- Tom Campbell: Is the cost of healthcare top election issue?

- 6 AOA ADVOCACY WINS IN 2025 THAT SET THE STAGE FOR 2026

- BIPARTISAN FORMER HHS SECRETARIES URGE STABILITY FOR MEDICARE ADVANTAGE

- Former South Salisbury firefighter charged for insurance fraud

- Studies from University of Washington Medical Center Provide New Data on Managed Care (The Impact of Payment Reform on Medicaid Access and Quality: A National Survey of Physicians): Managed Care

More Health/Employee Benefits NewsLife Insurance News