Honda Accord Is America’s Most-Stolen Vehicle

| PR Newswire Association LLC |

Also in today's release is a list of the top 25 2013 vehicle makes and models that were reported stolen in calendar year 2013.

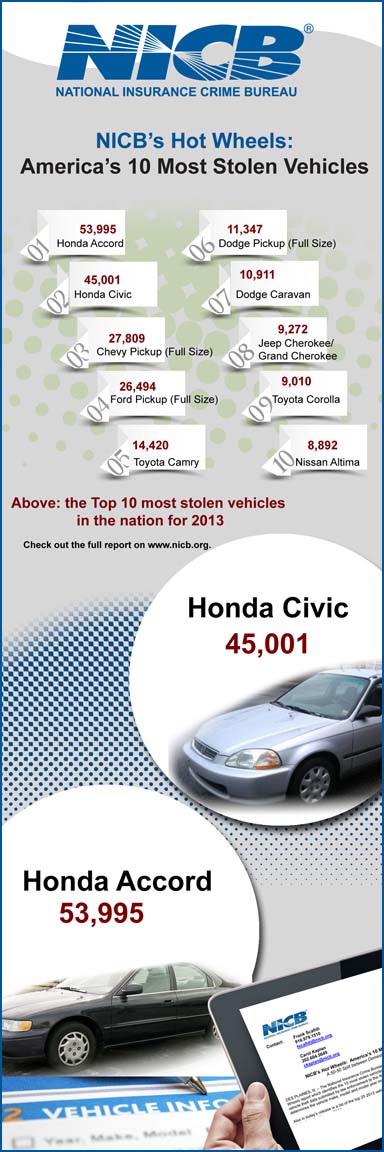

For 2013, the most stolen vehicles* in the nation were (total thefts in parentheses):

|

1. |

Honda Accord |

(53,995) |

|

2. |

Honda Civic |

(45,001) |

|

3. |

Chevrolet Pickup (Full Size) |

(27,809) |

|

4. |

Ford Pickup (Full Size) |

(26,494) |

|

5. |

Toyota Camry |

(14,420) |

|

6. |

Dodge Pickup (Full Size) |

(11,347) |

|

7. |

Dodge Caravan |

(10,911) |

|

8. |

Jeep Cherokee/Grand Cherokee |

(9,272) |

|

9. |

Toyota Corolla |

(9,010) |

|

10. |

Nissan Altima |

(8,892) |

See the complete report here. Download an infographic here. To watch a video on Hot Wheels, click here.

The following are the top 10 2013 model year vehicles stolen during calendar year 2013:

|

1. |

|

(810) |

|

2. |

Ford Fusion |

(793) |

|

3. |

Ford Pickup Full Size |

(775) |

|

4. |

Toyota Corolla |

(669) |

|

5. |

Chevrolet Impala |

(654) |

|

6. |

Hyundai Elantra |

(541) |

|

7. |

Dodge Charger |

(536) |

|

8. |

Chevrolet Malibu |

(529) |

|

9. |

Chevrolet Cruze |

(499) |

|

10. |

Ford Focus |

(483) |

Download 2013's complete top 25 most stolen list from this spreadsheet.

After a slight increase in 2012, the

"The drop in thefts is good news for all of us," said NICB President and CEO

Nonetheless, drivers must still be vigilant and protect their vehicles from theft. NICB recommends its four "layers of protection" against theft:

Common Sense: Lock your car and take your keys. It's simple enough, but many thefts occur because owners make it easy for thieves to steal their cars.

Warning Device: Having and using a visible or audible warning device is another item that can ensure that your car remains where you left it.

Immobilizing Device: Generally speaking, if your vehicle can't be started, it can't be stolen. "Kill" switches, fuel cut-offs and smart keys are among the devices that are extremely effective.

Tracking Device: A tracking device emits a signal to the police or to a monitoring station when the vehicle is stolen. Tracking devices are very effective in helping authorities recover stolen vehicles. Some systems employ "telematics," which combine GPS and wireless technologies to allow remote monitoring of a vehicle. If the vehicle is moved, the system will alert the owner and the vehicle can be tracked via computer.

Considering a used vehicle purchase? Check out VINCheck(SM), a free vehicle history service for consumers. Since 2005, NICB has offered this limited service made possible by its participating member companies. Check it out at: www.nicb.org/vincheck.

Anyone with information concerning insurance fraud or vehicle theft can report it anonymously by calling toll-free 800-TEL-NICB (800-835-6422), texting keyword "fraud" to TIP411 (847411) or submitting a form on our website. Or, download the NICB Fraud Tips app on your iPhone or Android device.

About the

*This report reflects stolen vehicle data contained in NCIC and present in the "NCIC mirror image" when accessed by NICB on

Facebook

Twitter

Blog

YouTube

LinkedIn

To view the multimedia assets associated with this release, please click http://www.multivu.com/players/English/70506512-national-insurance-crime-bureau-nicb-hot-wheels-10-most-stolen/

SOURCE

| Wordcount: | 813 |

Advisor News

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

More Advisor NewsAnnuity News

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

More Annuity NewsHealth/Employee Benefits News

- CVS Pharmacy, Inc. Trademark Application for “CVS FLEX BENEFITS” Filed: CVS Pharmacy Inc.

- Medicaid in Mississippi

- Policy Expert Offers Suggestions for Curbing US Health Care Costs

- Donahue & Horrow LLP Prevails in Federal ERISA Disability Case Published by the Court, Strengthening Protections for Long-Haul COVID Claimants

- Only 1/3 of US workers feel resilient

More Health/Employee Benefits NewsLife Insurance News