Rate Increase Bodes Well For Fixed Annuity Sales

The fixed annuity industry could harvest some happiness in the months ahead. That’s because new sales of fixed annuity products will likely increase in the wake of the 0.25 percent jump in a key interest rate the Federal Reserve announced Wednesday.

The growth actually will be a continuation of the strong sales seen in third quarter, well before the Fed’s rate announcement. That’s according to Jeremy Alexander, president of Beacon Research.

Carriers have been making gradual increases in their crediting rates in traditional fixed annuities and in their cap rates in fixed index annuities for several months, Alexander explained.

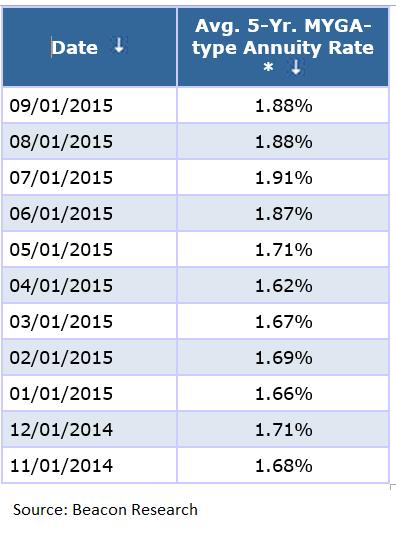

To illustrate, he provided InsuranceNewsNet with a chart showing the gradual rise in average crediting rates over the past several months. These were for five-year multi-year guaranteed annuities (MYGAs) sold by 94 percent of carriers in the market.

On Nov. 1, 2014, the average crediting rate for these products was 1.68 percent, the chart shows. The rates inched up and down after that and reached a high of 1.91 percent on July 1, 2015. On Sept. 1, the last date available, the average rate was down slightly, to 1.88 percent, but not back to the low.

The caps in fixed index annuities, the leading fixed product line by sales, also have risen since last August, he said.

Small increases have impact

The rate increases seem small, Alexander said. However, they can make a lot of difference to annuity buyers who, for instance, want to lock in a rate in MYGA as they dig out from the era of prolonged rock bottom interest rates.

He attributed the “strong growth” in third-quarter fixed sales in large part to those incremental increases. Total fixed sales rose by 15.9 percent to reach $26.5 billion for all types of fixed annuities, according to Beacon’s data.

The top selling line, indexed annuities, saw third quarter sales rise by 14.5 percent over second quarter to reach a new quarterly record of $14.4 billion. They also rose by 23.3 percent over third quarter last year.

MYGA sales volume, although substantially smaller at $3.4 billion in third quarter, shot up too. These sales rose 16 percent over second quarter, when they were up 26.4 percent from the previous quarter, he said.

This growth wasn’t all rate driven, Alexander said. This year’s volatility in the equity markets was a factor too. “We’ve always seen a flight to safety when equities markets are volatile and when fixed rates are rising.”

Now that the Federal Reserve has moved to increase its benchmark interest rate for the first time in nearly a decade, “we’re expecting continued gradual rate increases going forward,” Alexander said. He predicts that fixed sales will continue to be strong as a result.

In particular, he said he is expecting to see greater sales of MYGA products. “As rates rise, people typically prefer to ladder their annuities in MYGAs,” he said.

He also thinks index annuity sales will keep on growing. This growth will be thanks to the rising rate caps, dislike of volatility in the securities markets and the presence of lifetime income riders which many indexed annuities now offer.

“If consumers can get a high cap on the upside, living benefits for retirement income, and no downside all in one index annuity, that’s a deal-breaker for many who would otherwise purchase securities or variable annuities or just keep their money in cash,” Alexander said.

What to watch

Still, actual results may differ in surprising ways, he cautioned.

For instance, some clients might decide to put off buying a fixed annuity precisely because of the Fed’s action. “They may decide to delay buying a MYGA so they can lock in a higher rate later on,” he said.

Similarly, people who have been showing interest in purchasing immediate annuities may decide to delay the purchase for the same reason — “wait a little longer.”

On the carrier side, Alexander said, “Corporate profits typically decline when cost of capital goes up.” This could affect some company planning. However, he added, annuity carriers today tend to be well hedged for annuity rate increases - especially after all the downsizing and de-risking they did in the post-recession era - so producers can look to continued availability of products.

For those wanting to follow the rate trends of most significance to the industry, Alexander recommended keeping tabs on 10-year corporate bond rates. “These more closely represent insurance company portfolio holdings than do Treasury rates,” he said.

InsuranceNewsNet Editor-at-Large Linda Koco, MBA, specializes in life insurance, annuities and income planning. Linda can be reached at [email protected].

© Entire contents copyright 2015 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Linda Koco, MBA, is a contributing editor to InsuranceNewsNet, specializing in life insurance, annuities and income planning. Linda can be reached at [email protected].

SEC Bulletin Targets VA Charges, Expenses

Critical Illness Plans Become A Popular Voluntary Benefit

Advisor News

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Mystic resident attends State of Union to highlight healthcare cost increases

- Findings from University of Connecticut School of Medicine Provides New Data about Managed Care (Nursing Home Ratings and Characteristics Predict Hospice Use Among Decedents With Serious Illnesses): Managed Care

- Missouri, Kansas families pay nearly 10% of their income on employer-provided health insurance

- Researchers from California Polytechnic State University Report on Findings in COVID-19 (Exploring the Role of Race/Ethnicity, Metropolitan Status, and Health Insurance in Long COVID Among U.S. Adults): Coronavirus – COVID-19

- TrumpRx: Better prescription drug deals may already exist

More Health/Employee Benefits NewsLife Insurance News