The Big Shift

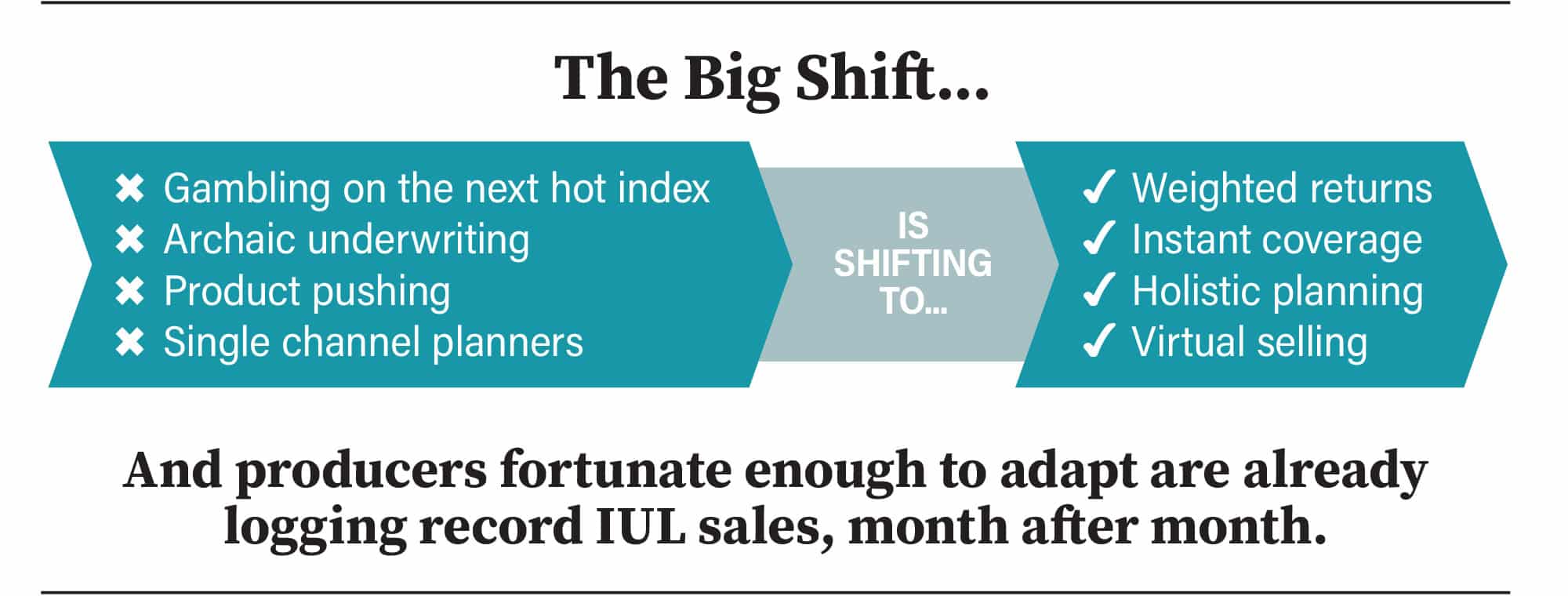

How the industry’s transformation to a digital landscape can help you place more business than ever before!

Big changes are underway in the industry. And they could soon elevate your production and your clients’ satisfaction. As you read this, paper apps, products taking months to issue, invasive underwriting and legacy systems are on their way out the door.

And it’s being replaced with modern products that are easy to understand and explain, equipped with automated underwriting, and are issued instantly.

It’s part of a big shift that producers and clients have wanted for years. It’s a shift that came by force, seemingly overnight. And it’s one that’s forced some unprepared or unwilling to adapt to close their doors. But not all suffered.

Companies remaining at the forefront of agent technology and consumer demands have continued to log month-over-month sales records. And for those like Simplicity Group, which has grown a reputation for creating amazing virtual sales strategies, sales records are growing even faster, thanks to the influx of producers eager to thrive in today’s digital environment.

It’s a smart move, considering where the industry is rapidly headed.

Coming Shift 1: We’re Going Digital

“I see three major changes that are coursing through the industry as we know it. One is to make every aspect of a sale — from the product and underwriting to delivery — 100% digital,” Schneier explained. “You need to offer the products people want, the way people want them, in order to thrive today,” he added.

“When we launched our first all-digital IUL product, ExecuDex, in partnership with F&G, we knew it had to check a lot of boxes,” Schneier began. “This was going to be a revolutionary product. Something that consumers wanted — an IUL that performs well, is easy to explain and apply for, 100% digital, with automated underwriting and instant issue. And it couldn’t have come out at a better time,” he finished.

While the ExecuDex FIUL was released during the pandemic, its roots began long before COVID-19 was an everyday word. ExecuDex and all Simplicity Group’s proprietary initiatives have been designed to help producers excel in a modernized, digital landscape. A landscape where products will be designed to prioritize a customer’s experience, without complicated formulas.

Coming Shift 2: Products Focused on Customer Experience

As digital continues to become the new normal, tools for digital sales will be enhanced.

Customer servicing technologies 24/7 and instant-issue insurance products are prime for industrywide adoption.

“Insurers must evolve to compete and deliver tailored digital products that align with distribution partners. At Simplicity Group, we have the needs of multiple channels with very different customers that need specific products that fit the advisor’s holistic planning process,” Schneier explained. “The future has never been brighter for today’s life insurance consumer — instant issue and simplified digital products are here to stay.”

Coming Shift 3: Reprioritized Training and Industry Events

While the thought of simpler digital products can be enough to stir panic and make some producers feel obsolete, those attending any of Simplicity Group’s virtual sales training, where attendees are paid for their time to learn how to thrive in a digitally-focused world, are finding their books of business stronger than ever, many logging record sales month over month, even during the pandemic. The events, open to any contracted producer, have become so popular that Schneier himself can hardly believe it.

“We’re always trying to offer insurance agents the most cutting-edge and relevant material, whether it’s sales strategies or product training. But the content and easy-to-follow advice producers are given at these virtual sales training events has been so valuable our attendance has increased tenfold,” Schneier exclaimed. “Even better is that people are applying these methods we’re sharing and having phenomenal success with them,” he happily added.

With speakers such as bestselling author Patrick Kelly sharing the latest virtual selling tax-free retirement strategies and Shark Tank’s Kevin O’Leary, a.k.a Mr. Wonderful, detailing the secrets to online selling for producers, it’s not hard for anyone to find success, especially with a growing assortment of 100% digital products available and a powerful turnkey system for leads.

It’s an earned feather in the cap for any premier distribution group. The secret, according to Schneier, has been the structure of the content presented to producers. It’s a structure that he believes will spread throughout the entire industry.

“In the past, industry and training events have spent a majority of their time focusing on products and product features and less time adapting to and teaching producers how to use technology to work for them to help them see more clients and place more business,” Schneier said. “Those priorities are going to definitely change because what many producers want today are answers. Actionable answers and strategies to help them through this,” he added.

The answers Simplicity Group offers allow agents to go far beyond how to just use technology or digital products. In addition to sharing easy-to-follow lead gen and virtual sales ideas, the firm also dives into the most effective social media strategies of the day and provides volumes of bespoke, original content for producers to pull from and share with their audience, keeping themselves top of mind.

It’s a holistic approach that’s handing producers almost everything they need to be successful in today’s market. And the results speak for themselves. “It’s an absolutely incredible feeling to see these ideas put into practice one day and paying off the next, especially when it comes from a producer who shows up with a skeptical mind,” Schneier stated.

While the big shift may have had an impact for many producers, carriers and IMOs, it also has forced the insurance and financial industry into a new, modern era. For companies such as Simplicity Group, that means more satisfied customers and thriving producers.

Introducing John Hancock’s All-New Protection VUL

“We’re not in Kansas anymore!”

Advisor News

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

- How OBBBA is a once-in-a-career window

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

- How the life insurance industry can reach the social media generations

More Life Insurance News