Insuring clients’ wealth with the world’s ‘favorite safe haven’

Gold and silver are vital for adding diversification to a client's portfolio. And most agents and advisors are well acquainted with the benefits of tangible assets such as gold and silver.

What’s surprising is how many are unaware of their ability to offer these precious metals — and the opportunity it holds to holistically serve their clients and grow their business.

Whether you are an investment advisor representative, a registered investment advisor, an insurance agent or a financial planner, offering gold and silver can help your clients save thousands of dollars that may be lost if they make an unfortunate mistake of working with a sham company.

Because many financial professionals aren’t aware they can offer gold and silver to their clients, it often inadvertently results in clients going out on their own and purchasing from companies with questionable ethics and practices.

Learn more about working with National Gold Consultants to help your clients buy gold safely.

In a situation familiar to many financial professionals, a client approached their advisor with concerns about a recent gold purchase they had made without their advisor’s knowledge. This client had already invested $30K in gold and was having second thoughts about the company they had dealt with.

On learning of the client’s predicament, the advisor reached out to National Gold Consultants, a licensed gold company recommended by her field marketing organization. NGC’s president, Ryan Long, joined a conference call with the advisor and the concerned client.

During the call, Long quickly identified the vendor responsible for the previous gold purchase. He also uncovered a slew of complaints against the vendor to the Better Business Bureau as well as hidden fees the client was unaware of. Without hesitation, Long initiated contact with the vendor directly while on the call and got the transaction reversed just in time to save the client from a costly mistake.

Despite this initial setback, the client remained interested in gold and decided to proceed with NGC for a more secure and trustworthy experience.

Situations like these underscore the fact that clients are interested in gold; therefore, insurance and financial advisors need a way to proactively offer it to their clients.

“Most financial advisors take courses that tell you to put clients’ money in hard assets. Your clients are buying it, and most agents are missing it or think they can’t help. I give a 5-star approval to National Gold and this incredible opportunity for annuity advisors to add to their portfolio.”

Tyrone Clark, president of Brokers Choice of America

An in-demand asset

In today’s economic environment, consumers are seeking refuge in “the world’s favorite safe haven.” Factors like the effects of BRICS on the dollar, the downturn of cryptocurrencies, inflation, the national deficit, rising taxes, an unpredictable stock market and geopolitical tensions as well as the upcoming election have consumers actively looking for reliable ways to protect and preserve their wealth.

“Gold and silver have helped me keep my clients calm and prepared through the storms.”

— Kerry Morris, CFP®

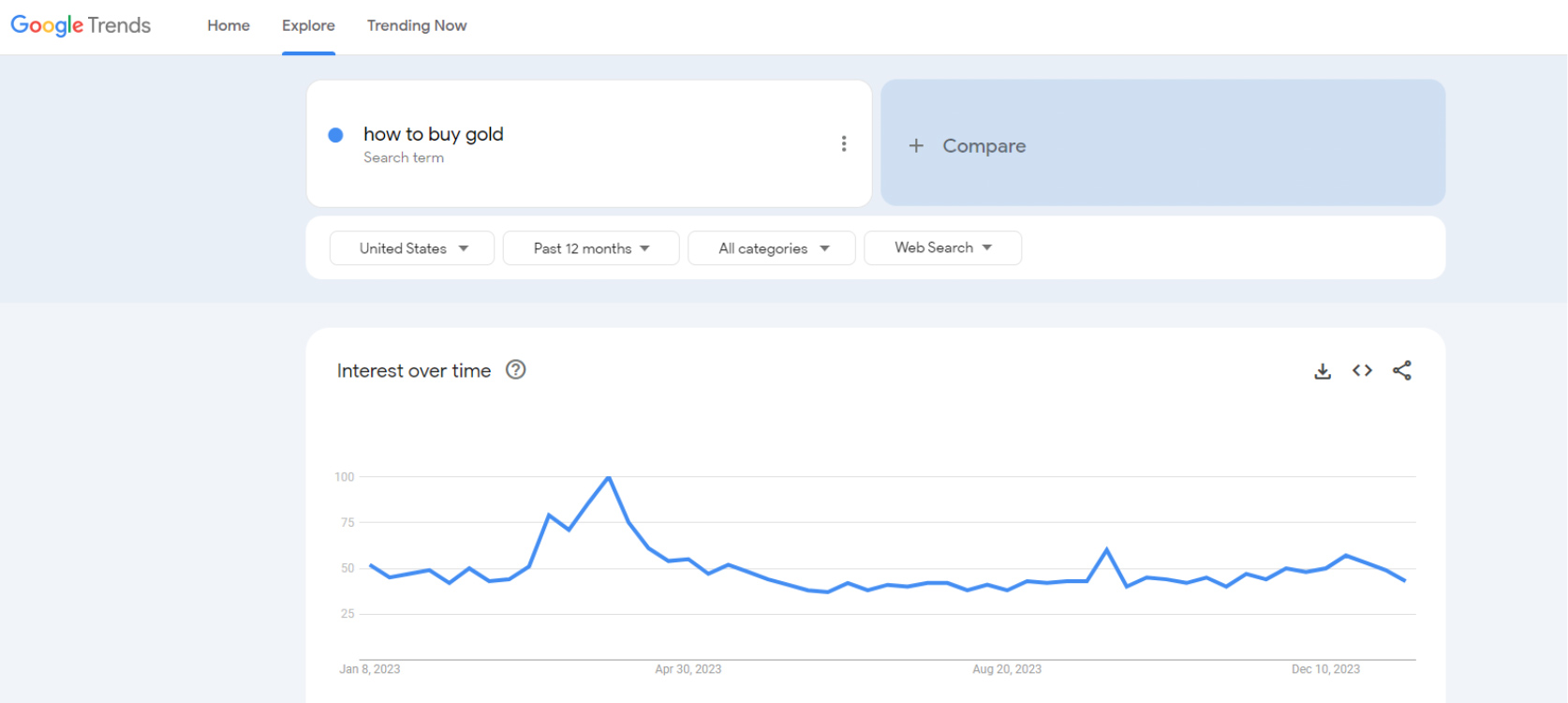

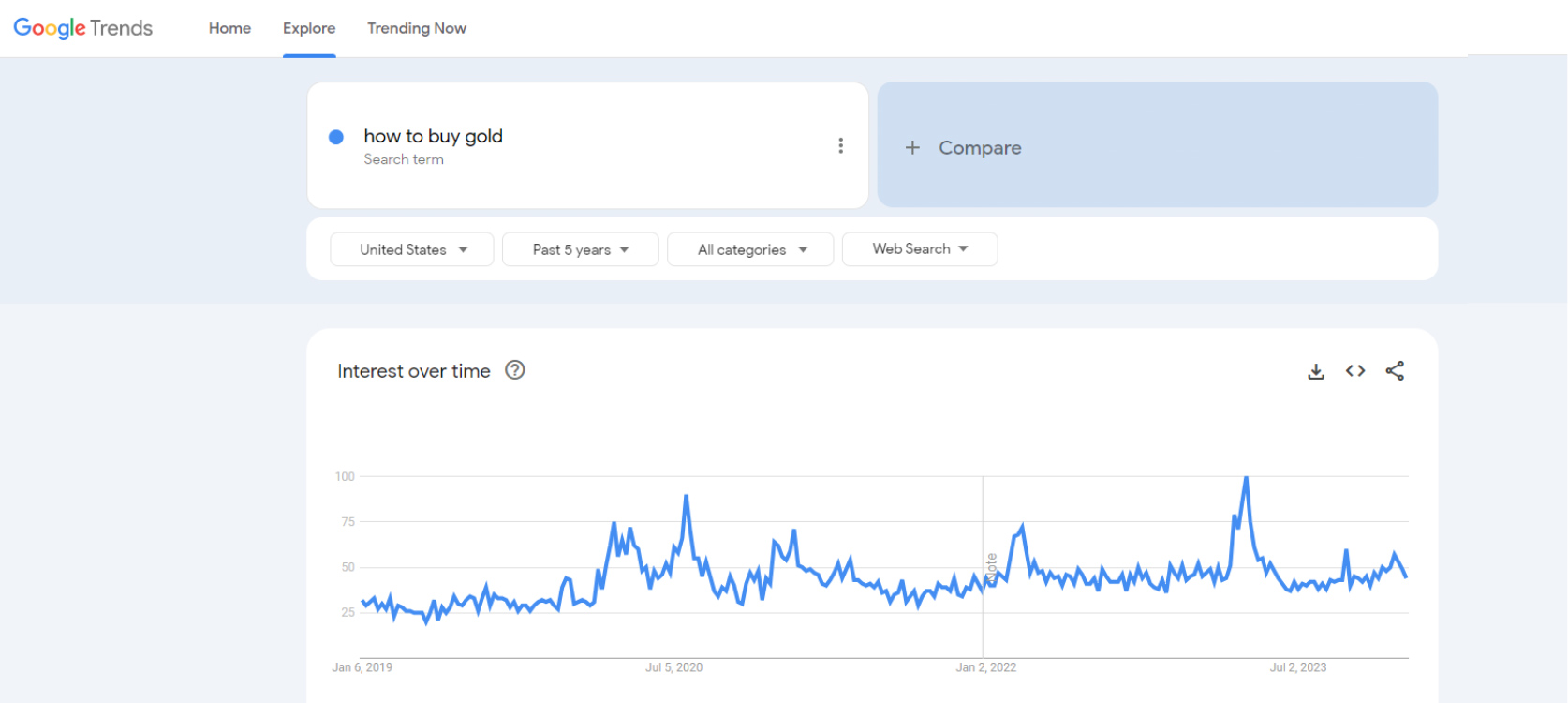

In April 2023, the Wall Street Journal reported that Google searches for the phrase “how to buy gold” had reached the highest recorded level according to Google Trends data. Still today, the number of searches for “how to buy gold” remains high.

However, as illustrated by the real-life scenario above, interest with no guidance can lead consumers to make uninformed decisions. It’s why many end up purchasing the wrong type of gold or the wrong amount required to achieve their goals, or they break a rule by putting collector coins in an IRA account. That’s not allowed, but clients don’t know that. And Long says he sees this “all the time, unfortunately.”

“Ryan is thorough, sincere, and the most trustworthy source we have met in this part of the industry. Our personal experience with Ryan and NGC was especially helpful when we had a client that had purchased precious metals prior to meeting us. Once we were helping this client with his portfolio, we identified some concerns with his prior investment and along with the hard work of Ryan and NGC, we were able to work together to move that client to safety, and saving the client's $700K, with National Gold Consultants. Everyone we have worked with in the National Gold office has exercised complete integrity and commitment to excellence. We are so grateful to have this connection to help others have a safe place to acquire gold and silver.”

— Tony Hammock, National Retirement Consulting

Twenty years ago, National Gold Consultants saw an opportunity to provide information to financial professionals that would help them assist clients with making informed gold purchases.

“Clients need to look at gold for a percentage of their wealth, and it needs to be done correctly,” said Long.

“Whether I bring it up to my clients or not, they’re still buying. I don’t want them to be enamored by some slick brochure or late-night infomercial. So, we’re proactive in telling clients, ‘If this is something you’re considering, let’s talk about it.’”

— Victoria Larson, Investment Advisor and Retirement Income Certified Professional

Understanding the nuances of buying gold and silver is what makes the difference between you and your clients achieving your goals with gold and not. Agents and advisors can complete NGC's training within two hours and be able to offer gold and silver the same day. NGC also co-hosts educational workshops and webinars. Their objective is to empower advisors to help their clients, while also enabling them to add a potential 6-figure income stream to their practice.

Today, National Gold Consultants works exclusively with financial professionals and is the only company that offers E&O, even though agents are not required to have it, and is one of the only gold companies to be licensed and regulated.

“I first found out about National Gold Consultants from my FMO. When I heard National Gold was a fiduciary, that they are held to the same standard as I am, that was important to me.”

Victoria Larson, Investment Advisor and Retirement Income Certified Professional

“What’s the price of gold? How am I doing?”

Financial professionals and clients who work with NGC are encouraged to view gold and silver as protective measures against potential downturns in the stock or real estate markets or even fluctuations in the dollar’s value. The effectiveness of these tangible metals as a hedge stems from their often-inverse relationship with other asset classes, making them valuable tools for diversification.

This perspective on gold frames it as “wealth insurance” rather than primarily as an investment. This shifts the focus from fluctuating prices to its role as a safeguard. So you don’t get a call from your client every month asking, “What’s the price of gold, how am I doing?” because they understand that’s not why they have it.

How much gold and/or silver should clients buy?

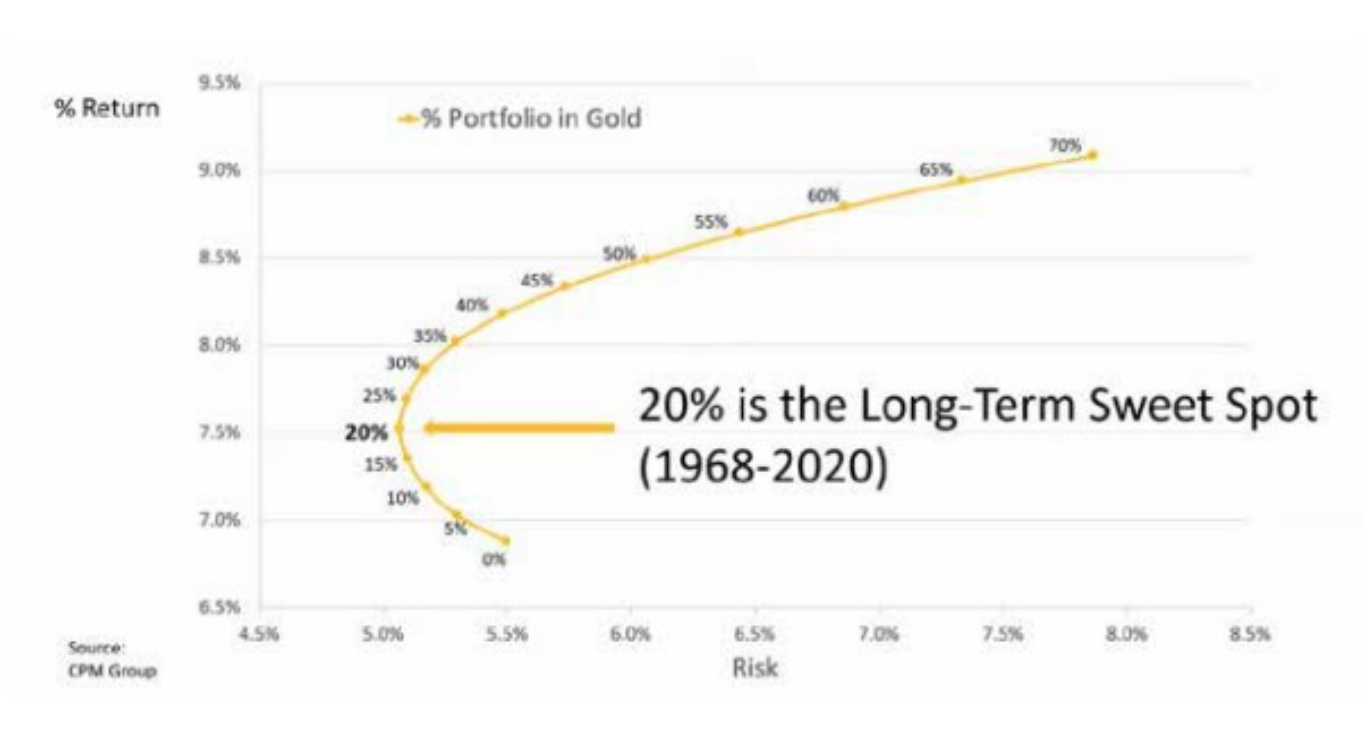

While gold and silver are essential for true diversification, they make up a relatively small portion of the overall portfolio. NGC suggests allocating “enough to make a difference.”

To that point, it would be impractical to insure a $500,000 house with only $25,000 in homeowners insurance, just like putting $10,000 of a $10 million portfolio into gold and silver wouldn’t make sense. NGC collaborates with advisors to seamlessly integrate gold and silver into a portfolio with an amount that accomplishes the client’s goals and complements the advisor’s existing strategy.

It's not about diverting all of a client's assets into gold and silver, but also, it isn't a hobby where clients buy a few collectors coins either. NGC suggests allocating 10% to 20% of the client’s portfolio, which is based on what they’ve seen in more than two decades in business as well as research from the CPM Group.

After making a sale, Long often remarks, “Now I hope the value of gold goes down!” This definitely grabs the attention of the client, after which he explains that a decrease in the value of the gold portion of their portfolio likely means an increase in the value of their other investments.

The benefits to clients, advisors and IMOs

The benefits of these tangible assets have also been realized by IMOs, like Brokers Choice of America, which differentiate themselves by offering gold and silver to their agents through National Gold Consultants.

When interest rates are high, everyone’s interested in talking about annuities, but what about when rates go back down? Gold can be a great conversation starter with both new and existing clients. It’s also an opportunity to recruit new agents with commission rates comparable to fixed indexed annuities and no additional licensure required.

Working through NGC, agents and advisors position gold to their clients as wealth protection, know how easy it is to sell back if the client needs to, and understand why pre-1933 gold coins are preferred over options like ETFs, gold bars or modern coins, for example. As a result, they feel confident bringing it up to clients and can make $100K, $200K, even as much as $500K per year.

Who’s telling your clients about gold?

The truth is that if you aren’t discussing gold and silver with your clients, someone else is. Embracing this opportunity can help you grow your practice or marketing organization and serve clients more holistically. And you could be making your first sale in as little as 24 hours.

However, gold, one of the oldest and most reliable forms of protection, is a limited resource. Once it’s gone, it’s gone. So go here to learn more about how you can offer gold and silver to your clients.

Sources:

‘How to Buy Gold’ Hits a Google Record as Crypto Investors Chase World’s Oldest Asset - WSJ

Why advisors are struggling to fill their events with ideal prospects and turn them into high-value clients (and how to fix it)

John Hancock’s Commitment to Life

Advisor News

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Idaho House approves Medicaid reform bill

- Trump makes it official: The American apology tour is over

- People, News & Notes: State treasurer advocates for increase in health plan premiums

- Accounts way to empower Americans with disabilities

- State employees denounce looming cost hikes as NC health plan tackles $1.4B shortfall

More Health/Employee Benefits NewsLife Insurance News