Voya Financial Survey Results Highlight the Power of Financial Advice

Financial professionals offer guidance on various aspects of retirement planning

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181126005571/en/

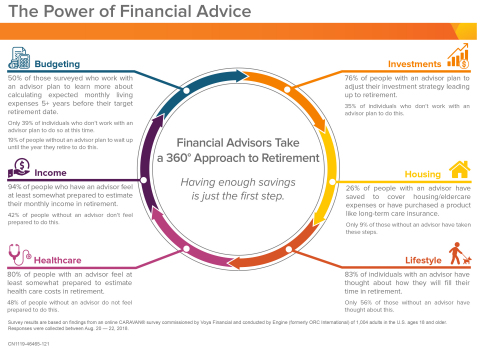

Financial advisors offer holistic advice in regard to various aspects of retirement. (Graphic: Business Wire)

“Americans are all very focused on that magic number — the amount you need to save to maintain your lifestyle in retirement — but there are many important aspects of retirement planning beyond the financial,” said

Not surprisingly, Voya’s research showed that people who work with a professional are significantly more prepared for a range of financial decisions in retirement compared to those who go it alone. Several key findings, outlined below, signal a need for Americans to seek out professional advice, particularly as they approach retirement.

Calculating Income and Expenses

Working with a financial advisor can lead to better budgeting and, therefore, potentially better outcomes in retirement. Many pre-retirees don’t realize that budgeting can begin approximately 10 years before retirement, or around age 55. Voya’s research showed that individuals without an advisor are postponing the budgeting process, sometimes until the same year they retire. Financial advisors can provide guidance so that people are prepared for daily spending decisions, health care costs and other living expenses in advance of retirement.

- 94 percent of individuals surveyed who work with an advisor feel at least somewhat prepared when it comes to making decisions about estimating their monthly income in retirement. On the other hand, 42 percent of individuals surveyed without an advisor don’t feel prepared at all to make these decisions.

- 80 percent of individuals with an advisor feel at least somewhat prepared when it comes to estimating health care costs in retirement, while almost half (48 percent) of individuals without an advisor do not feel prepared at all when it comes to this.

- Half (50 percent) of individuals who work with an advisor plan to learn more about calculating their expected monthly living expenses at least five years before their target retirement date. Only 39 percent of individuals who don’t work with an advisor plan to do so at this time. Furthermore, 19 percent of individuals who don’t work with an advisor plan to wait up until the year they retire to calculate these expenses.

“When asked what aspects of retirement they wish they had spent more time considering, the majority of retirees said calculating monthly expenses and estimating their retirement income,” Nichols added. “These are two areas where individuals working with an advisor feel far more prepared than those who had not, according to our research.”

Recalibrating Investments

As individuals prepare for retirement, they may want to take steps to make sure their assets are protected against potential economic downturns. They also may want strategies to eventually draw down money from retirement accounts, in a way that avoids financial penalties from withdrawing too early or too late. Voya’s research identified a significant gap between those who do and do not work with a financial advisor, in relation to knowledge of investment and retirement income strategies.

- 76 percent of individuals with an advisor plan to make adjustments to their investments leading up to retirement, compared to 35 percent of individuals who don’t work with an advisor.

- 40 percent of individuals who work with an advisor plan to adjust their investments with a focus on protecting their assets, compared to 18 percent of those who do not work with one.

- 57 percent of people who work with an advisor feel very prepared when it comes to making decisions about withdrawing money from a retirement plan in a way that avoids financial penalties from withdrawing too early or too late, compared to only one-quarter (22 percent) of those who do not have an advisor.

- Nearly half (46 percent) of individuals surveyed who work with an advisor feel very prepared when it comes to making decisions about catch-up contributions. On the other hand, 53 percent of individuals who don’t have an advisor say they don’t feel prepared at all to make this decision.

Managing Lifestyle Changes

Financial advisors are preparing their clients — not just for financial aspects of the transition into retirement but also for the social and emotional aspects. Voya’s survey research suggests that individuals who are not receiving advice from a professional are not adequately preparing for the impact retirement will have on many aspects of their lifestyle.

- 83 percent of individuals with an advisor have thought about how they will fill their time in retirement, compared to 56 percent of those without an advisor.

- Nearly all (92 percent) of those surveyed who work with an advisor believe they should be thinking about housing in retirement, compared to 78 percent of their peers without an advisor.

- 26 percent of individuals with an advisor have saved money to cover the cost of housing/eldercare expenses or have purchased a product like long-term care insurance. Only 9 percent of individuals who do not work with an advisor have taken these steps.

For more information about saving for retirement and working with a financial advisor, visit Voya’s website at voya.com/contact-us/find-a-pro.

Survey results are based on findings from an online CARAVAN® survey commissioned by

* Investment adviser representative and registered representative of, and securities and investment advisory services offered through,

About

View source version on businesswire.com: https://www.businesswire.com/news/home/20181126005571/en/

Media:

Mobile: (860) 839-1589

[email protected]

Source:

Life Insurance in Saudi Arabia: Key Trends and Opportunities to 2022

InsureMyTrip Wins International Travel & Health Insurance Journal Award For Innovation

Advisor News

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Universal health care: The moral cause

- IOWA REPUBLICANS GET WHAT THEY VOTED FOR: HIGHER HEALTH INSURANCE PRICES, FEWER PEOPLE ENROLLED IN THE ACA

- XAVIER RECEIVES $3 MILLION FOR OCHSNER MEDICAL SCHOOL SCHOLARSHIPS

- Gov. Phil Scott, officials detail health reform measures

- Idaho is among the most expensive states to give birth in. Here are the rankings

More Health/Employee Benefits NewsLife Insurance News

- AllianzIM Buffered ETF Suite Expands with Launch of International Fund

- Author Sherida Stevens's New Audiobook, “INDEXED UNIVERSAL LIFE INSURANCE IN ACTION: FROM PROTECTION TO PROSPERITY – YOUR PATH TO FINANCIAL SECURITY,” is Released

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

More Life Insurance News