Updated Analysis from CoreLogic Shows 23,044 Homes at High or Extreme Risk Inside Wildfire Perimeters

—Reconstruction Cost Value totals more than

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181116005460/en/

Due to the increased containment of these two wildfires,

Understanding the Data:

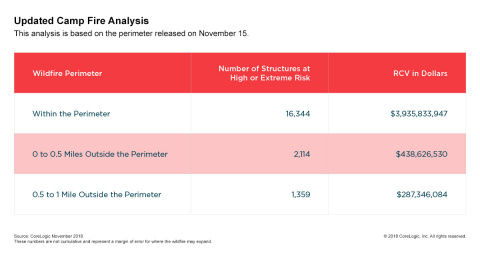

The tables calculate the number of homes at high or extreme risk from wildfire damage within the perimeter and quantify the risk of homes just outside of the perimeter for both the Camp and Woolsey Fires. However, due to the unpredictable nature of wildfires, it is important to note that even within the perimeter, not all homes will suffer damage; of those that do suffer damage, the damage will not all be equivalent.

Following the containment of the wildfires,

Methodology

The CoreLogic Wildfire Risk Score is a deterministic wildfire model which is as comprehensive as it is granular. It covers 15 states:

Source:

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from

About

View source version on businesswire.com: https://www.businesswire.com/news/home/20181116005460/en/

Media Contacts:

949-214-1414

[email protected]

512-906-9103

[email protected]

Source:

Investors Heritage Life Offers Single-Premium Deferred MYGA

First trial in 2017 fire suits against PG&E to focus on Napa County blaze

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Affordability vs. cost containment: What health plans will face in 2026

- Sick of fighting insurers, hospitals offer their own Medicare Advantage plans

- After loss of tax credits, WA sees a drop in insurance coverage

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

More Health/Employee Benefits NewsLife Insurance News