UnitedHealth’s Commercial Unit: A Stabilizer Amid Healthcare Turmoil?

UNH is

currently navigating a challenging healthcare landscape,

with its Medicare Advantage business reportedly facing

regulatory scrutiny and rising care costs. However, amid all

the hurdles, its commercial insurance business is stepping up as a

vital source of stability.

As of

50.1 million people, representing a 1.9% year-over-year growth,

driven by its self-funded commercial benefits. With more than

30 million members, the company's commercial segment benefited from

favorable pricing and a healthier risk pool compared to government

plans. It showed consistent growth over time. Commercial plans are

available to both individuals and employers, have less volatile

cost structures and are less vulnerable to sudden changes in

regulations than Medicare Advantage.

After the return of former CEO

company is shifting its focus. As it works on tightening controls

and compliance in its Medicare operations, UNH is also putting a

strong emphasis on growing its commercial portfolio.

Even though UNH has pulled back on its full-year guidance due to

ongoing pressures, the commercial division continues to provide a

buffer against uncertainty. With the broader economy facing

challenges that affect both consumers and providers, the company's

approach, particularly the strong performance of its

commercial business, continues to anchor its financial

stability.

How Are Competitors Faring?

Some of UNH's major competitors in the healthcare plan provider

space are

MOH and

The

CI.

erratic utilization trends, which led it to cut its 2025 earnings

guidance. In contrast to its previous prediction of at least

entire year to be between

adjusted earnings of about

of 2025.

By strategically selling its Medicare Advantage, Cigna

Supplemental Benefits, Medicare Part D, and CareAllies businesses

to HCSC in

commercial-heavy model will provide clearer short-term visibility

and more consistent underwriting performance. Cigna reported

impressive results in the first quarter of 2025, driven by premium

rate increases and strengthened relationships with

existing clients.

UnitedHealth 's Price Performance, Valuation &

Estimates

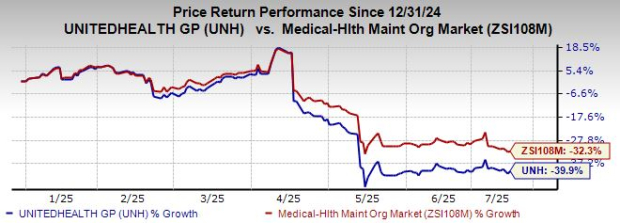

Shares of UNH have plunged 39.9% in the year-to-date period

compared with the

industry's decline of 32.3%.

Image

Source: Zacks Investment Research

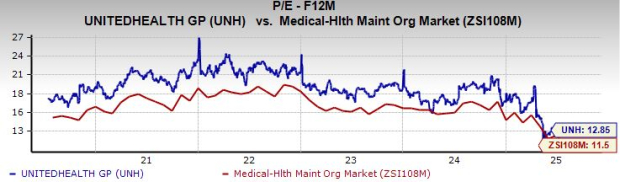

From a valuation standpoint,

price-to-earnings ratio of 12.85, above the industry average of

11.5. UNH carries a

Value Score of B.

Image

Source: Zacks Investment Research

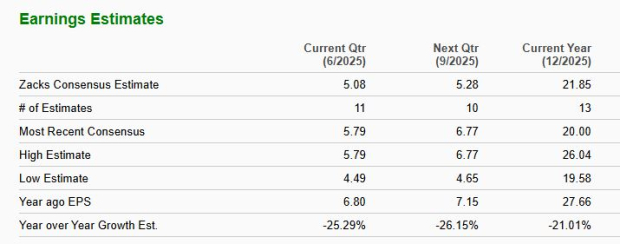

The Zacks Consensus Estimate for

pegged at

period.

Image

Source: Zacks Investment Research

The stock currently carries a Zacks Rank #5 (Strong Sell).

You can see

the complete list of today's

stocks here

.

5 Stocks Set to Double

Each was handpicked by a

gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and

Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the

Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under

radar, which provides a great opportunity to get in on the ground

floor. While not all picks can be winners, previous recommendations

have soared +171%, +209% and +232%.

Download

Atomic Opportunity: Nuclear Energy's Comeback free today.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report

Report

This article originally published on Zacks Investment Research

(zacks.com).

Wells Fargo Reports Second Quarter 2025 Financial Results

Insurance fraud: the beginning of the end of a mafia that harmed millions of Argentines

Advisor News

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

More Advisor NewsAnnuity News

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

More Annuity NewsHealth/Employee Benefits News

- Data from Stanford University Provide New Insights into Managed Care (The environmental chemical exposome and health insurance: Examining associations and effect modification of epigenetic aging in a representative sample of United States adults): Managed Care

- National Center for HIV Researcher Details Research in Health Insurance (Behavioral Readiness for Daily Oral PrEP in a Diverse Sample of Gay, Bisexual, and Other Men who have Sex with Men Who Have Not Been Offered PrEP by a Provider): Health Insurance

- When health insurance costs more than the mortgage

- Farmers Now Owe a Lot More for Health Insurance

- Health care outlook: Volatility and potential coverage gaps

More Health/Employee Benefits NewsLife Insurance News