Success for Insurers in the Emerging “Post-Digital” World Will Require Enhanced Customer Engagement Through Personalized, Real-Time Offerings, According to Accenture Report

Accenture Technology Vision for Insurance 2019 suggests insurers should master emerging technologies and shore up security with their ecosystem partners to meet consumers’ needs

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190410005101/en/

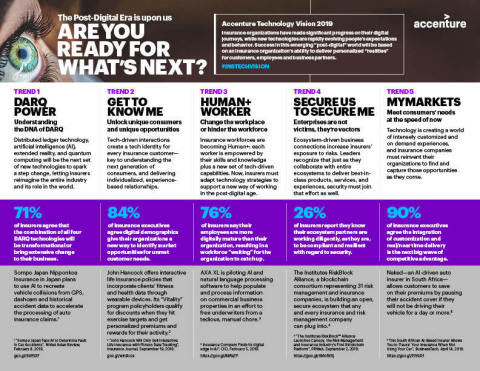

Five Key Trends from Accenture's Technology Vision for Insurance 2019 (Graphic: Business Wire)

The report, Technology Vision for Insurance 2019, notes that we’re entering a new “post-digital” era, where success is based on an organization’s ability to master artificial intelligence (AI) and other new technologies. The post-digital era doesn’t mean that digital is over, but rather, that it’s no longer a differentiating advantage — and now the price of admission.

As technology-driven interactions create an expanding technology identity for every consumer, insurers can tap into customers’ digital demographics to deliver hyper-personalized, on-demand services that meet customers’ specific needs, according to the report. More than four in five respondents (84%) who participated in the Technology Vision survey believe that digital demographics give their organizations a new way to identify market opportunities for unmet customer needs.

The report notes that while the average insurance customer engages with his or her insurer only once or twice a year, insurers are looking to increase engagement through real-time risk protection and mitigation services. Three in five insurers (60%) are already using technology to build products or services that boost the frequency and quality of customer engagement, with another 35% planning to so in the next year.

“There’s an opportunity for insurers to increase and improve their touchpoints with customers and forge a stronger, more personalized experience by harnessing customers’ digital footprints, but they’ll need to digitalize their core before they can reach these new heights,” said

Meanwhile, three in five insurers (59%) are forming distribution relationships with non-traditional partners to reach customers in new ways and create new value for them. While this is encouraging, only one-quarter (26%) of respondents know for sure that their ecosystem partners are working as diligently as they are to improve their security resilience. Leading insurers will recognize that as they collaborate with entire ecosystems to deliver new products, services and experiences, security must be a priority.

The report also suggests that failure to master social, mobile, analytics and cloud (SMAC) technologies will leave insurers unable to serve even the most basic demands of a post-digital world and prevent them from embracing the next wave of digital disruption — distributed ledger technology, AI, extended reality, and quantum computing (DARQ). This new set of technologies will let insurers reimagine the entire industry and its role in the world.

“For insurers to excel in the ‘post-digital’ environment, they’ve got to become more agile and implement SMAC as a core competency before they can rotate to newer technologies, including distributed ledger technology and AI,” said

A full copy of Accenture’s Technology Vision for Insurance 2019 can be accessed here: https://www.accenture.com/us-en/insights/insurance/technology-vision-insurance

About the Methodology

Technology Vision for Insurance 2019 is derived from the Accenture Technology Vision, developed annually by the

The insurance industry report is based on responses from 577 respondents at insurance companies in 27 countries across

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions — underpinned by the world’s largest delivery network — Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With 477,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190410005101/en/

+1 917 452 9458

[email protected]

Source: Accenture

House Infrastructure Subcommittee Issues Testimony From International Economic Development Council

New Plans for the PJC’s Access to Health and Public Benefits Project

Advisor News

- FPA announces passing of CEO, succession plan

- Study: Do most affluent investors prefer a single financial services provider?

- Why haven’t some friends asked to become clients?

- Is a Roth IRA conversion key to strategic tax planning?

- Regulator group aims for reinsurance asset testing guideline by June

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Findings from Harvard Medical School Broaden Understanding of Mental Health Diseases and Conditions (Association of Medicaid Accountable Care Organizations and Postpartum Mental Health Care Utilization): Mental Health Diseases and Conditions

- Health coverage redefined through innovative self-funded solutions

- CVS Health to cut another 22 jobs connected to its offices in Hartford

- Dozens Died In State Sober Living Homes As Officials Fumbled Medicaid Fraud Response

- Emerging workplace benefit trends for 2025

More Health/Employee Benefits NewsLife Insurance News

- Fourth Quarter 2024 Q4 2024 Statistical Supplement and Notes

- Symetra Enhances Workforce Benefits Offerings with Refreshed Group Accident Insurance

- Axcelus Financial Names Kimberly Gibson and Henry Komansky to Executive Roles in International Life and Annuity Insurance Companies

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Life insurance financial ratings: a system in need of an update?

More Life Insurance News