States prepare for impact of Medicaid policy changes

By KFF, Nov. 13, 2025, https://www.kff.org/medicaid/state-medicaid-officials-project-flat-enrollment-post-unwinding-but-increased-spending-and-budget-pressures-as-states-prepare-for-impact-of-federal-medicaid-policy-changes/

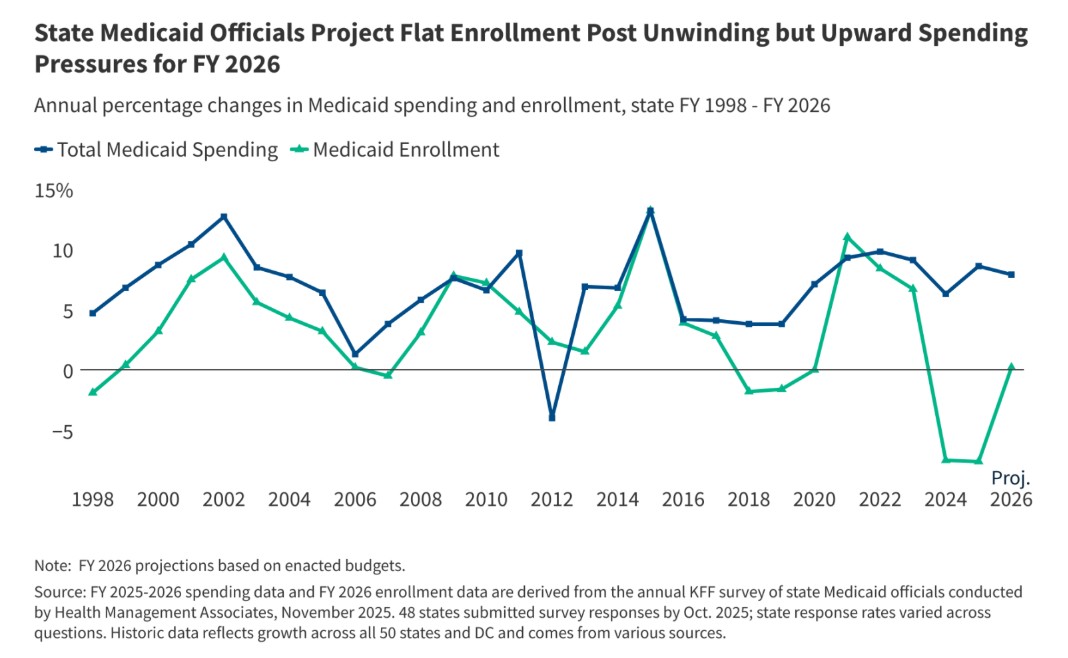

As states completed the “unwinding” of pandemic-era continuous coverage, Medicaid enrollment fell 7.6% in FY 2025 and is expected to be largely flat in FY 2026, according to KFF’s 25th annual Medicaid Budget Survey. At the same time, total Medicaid spending grew by 8.6% in FY 2025 and is expected to grow by 7.9% in FY 2026. States report that provider rate increases, greater enrollee health care needs, and increasing costs for long-term care, pharmacy benefits, and behavioral health services are the most significant drivers of increased costs.

In addition to increasing spending demands, slower revenue growth and heightened fiscal uncertainty have created a more tenuous fiscal climate for states in FY 2026. States are also preparing for $911 billion in federal Medicaid spending cuts enacted in the budget reconciliation law earlier this year, including new financing restrictions and work requirements, which will exacerbate existing budget challenges. The challenging fiscal climate and the magnitude of federal Medicaid cuts will make it difficult for states to absorb or offset the reductions.

Almost two-thirds of states say they face at least a “50-50” chance of a Medicaid budget shortfall in FY 2026 as states anticipate state Medicaid spending growth of 8.5% in FY 2026 and tight fiscal conditions. The reconciliation law prohibits all states from establishing new provider taxes or from increasing existing taxes, which could increase state budget pressures. Future requirements to reduce existing provider taxes for states that have adopted the ACA expansion could result in additional budget pressures.

Even though many provisions in the reconciliation law do not take effect until FY 2027 or later, states are already anticipating changes and related fiscal pressures. According to KFF’s companion report, which highlights key policy priorities and issues state Medicaid programs focused on in FY 2025 and are prioritizing in FY 2026, the number of states making reimbursement rate increases for specific provider types is slowing while there is an uptick in rate restrictions. Provider rate changes generally reflect broader economic conditions, and states have typically turned to provider rate restrictions to contain costs.

Most states also report new or expanded initiatives to contain prescription drug costs. In particular, interest in expanding Medicaid coverage to include GLP-1s for obesity treatment is waning, and some states are planning to restrict existing coverage in the future. Sixteen state Medicaid programs reported covering GLP-1s for obesity as of October 1, 2025. Coverage of GLP-1 drugs for obesity is optional for states, while coverage is required for conditions like diabetes and cardiovascular disease.

The survey was conducted in mid-summer of 2025 by KFF and Health Management Associates (HMA) in collaboration with the National Association of Medicaid Directors (NAMD). This year’s estimates of Medicaid spending and enrollment reflect what is assumed in states budgets in most cases, though projections always include some uncertainty.

KFF is a nonprofit health policy research, polling, and news organization.

NJ has a huge health care gap for people with disabilities. Dig into our series

Loews Corp. (NYSE: L) Sets New 52-Week High in Thursday Session

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsLife Insurance News

Property and Casualty News

- GOVERNOR HOCHUL UNVEILS GRASSROOTS SUPPORT BEHIND HER PROPOSALS TO LOWER THE COST OF AUTO INSURANCE

- SNEED ADVANCES FOUR INSURANCE BILLS IN COMMITTEE

- Bills to rein in home insurance costs fail to advance in Oklahoma Legislature

- Louisiana’s fortified roof grant program can’t keep up with demand from homeowners

- Insurance Premium Pressure: 57% Have Made Financial Sacrifices to Afford Home Insurance | Insurify

More Property and Casualty News