Life Insurance Sales Move Online, Complexity Keeps Agents In Game

MINNEAPOLIS -- A recent survey of over 100 health/life insurance experts found that 59% of industry professionals believe that there is a major move online for consumers for the insurance purchase process for personal products like life, health, and property & casualty insurance. Only 27% said the move was major for businesses. The industry believes that consumers are in the midst of a digital-first move, while business owners/employers are slower in shifting.

The Society of Insurance Research (SIR), a private, nonpartisan, nonprofit group for insurance researchers to connect and collaborate worked with member organizations and independent research firm Greenwald Research (Greenwald) to develop a survey of insurance industry professionals to better understand trends in Digitalization of Insurance.

The study offers valuable findings on the key differences between Life and Health insurance sales trends and also provides a perspective on the differences between consumer versus employer uptake of digital services. In the age of COVID-19, digital sales have increased across the board.

Industry professionals believe that consumers are moderately comfortable with online purchase of life or health policies and are more comfortable with some of the online servicing options for both life and health products.

Seventy-three percent of industry professionals believe that consumers are comfortable with researching products online and 61% believe that consumers are comfortable meeting with agents or brokers online or selecting health or life coverage online. In comparison, when it comes to contacting service with questions or concerns, 82% believe that consumers are comfortable doing so online.

Industry professionals see key differences in how comfortable life and health consumers are with online options. While life insurance has evolved from being an agent-sold product to more consumers being accepting of online service options, consumers still see more of a need for agents with this product than with health insurance. This is especially clear when it comes to filing claims or submitting paperwork. Fifty-nine percent of industry professionals believe that health insurance consumers are likely to be comfortable doing this online compared to 47% who say the same of life insurance consumers.

Industry believes that businesses are more open to online broker meetings than consumers and are more able to understand detailed plan information digitally.

Eighty-four percent of industry professionals believe that businesses are open to online broker meetings versus only 61% saying the same for consumers. Professionals also believe that businesses are twice as likely to understand detailed information about life and health products online as consumers.

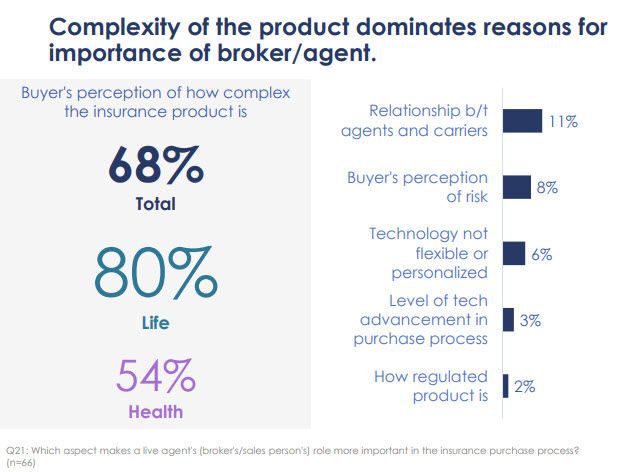

The general sentiment among professionals is that products are too complex & the online experience needs personalization and investment for it to be effective.

Industry professionals view the products in the life and health space as very complex and 65% believe that some of the reasons why it hasn't moved online more quickly is because of this complexity. Fifty-five percent believe that the online experience needs to be more personalized for it to be effective.

When it comes to a lack of investment in the online experience, 53% believe that complexity has impacted life insurance activities from moving online, whereas 29% see this as a problem for life. This may have something to do with the complexity of life products, which are require a needs analysis that is not simple to do. In fact, 27% of professionals believe that the life space is not ready for a full online experience yet.

The move online for life and health insurance products is progressing, but there are clear differences between the two in terms of what consumers and employers are ready for and how well the industries are prepared for this transition.

The industry sees many drivers for a move online, including easier to use technology (59%), increased trust in the experience (50%), increased online shopping behavior overall (47%), and demographic shifts (46%). Still, there are differences in how prepared the life and health industries are for this transition.

Life insurance has traditionally been a contact sport, where meetings in person or via phone are still preferred. The products are more complex and the technology is not yet ready to support a primarily online experience. In comparison, health insurance is more familiar, with consumers making a selection annually. As a result, while 70% of industry professionals believe that most touchpoints will be self-service in the next five years, the numbers vary considerably by industry: 67% see that as true for life insurance, compared to 85% for health insurance.

About the Digitalization of Insurance Survey

The 2020 survey of 117 insurance research, sales, and product professionals was conducted online using SIR's membership database between September and October of 2020. More information about the Digitalization of Insurance Survey, including a presentation deck with additional research findings can be found, at http://www.sirnet.org/digitalization.

About SIR

The Society of Insurance Research was created in 1950 as a non-profit, carrier led association to elevate fact-based insurance research and to support the professionals that create and drive these insights. For more information, visit http://www.sirnet.org email [email protected] or follow SIR on LinkedIn, Twitter and Facebook.

SIR leadership welcomes opportunities to assist journalists and industry news outlets with information and research about life, health, P&C and commercial insurance. Follow us on social for regular updates and please feel free to reach out to [email protected] with any inquiries.

SIR Spring Workshops--Social Distancing Silver Linings--New Techniques for the New World of Work

SIR invites research professionals, solutions providers, and media partners from across the insurance industry to join its annual Spring Research Workshops, virtually, on April 15, 22 and 29, 2021. For more info, visit http://www.sirnet.org.

Biden administration OKs Washington state counties for disaster-relief aid for wildfires

Center on Budget & Policy Priorities: 'States Should Decouple From New Federal Tax Break for PPP Loans'

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Legals for December, 12 2025

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Life Insurance News