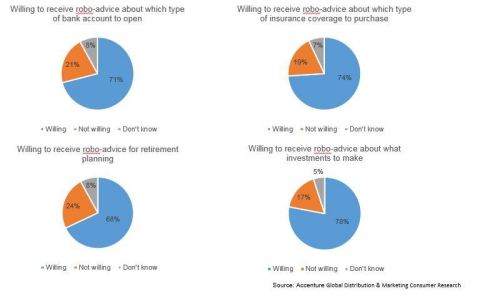

Seven out of 10 Consumers Globally Welcome Robo-Advice for Banking, Insurance and Retirement Services, According to Accenture

Rise in acceptance of robo services creates challenge for financial services industry: strike a balance between humans and robots

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170111005924/en/

The global Distribution & Marketing Consumer research by

Consumers also Expect First-Class Human Interaction

However, the study also found that nearly two-thirds of consumers still want human interaction in financial services, especially to deal with complaints (68 percent) and advice about complex products such as mortgages (61 percent).

Consumers indicated the main attractions for using robo-advice platforms is the prospect of faster (39 percent) and less expensive (31 percent) services, and because they think computers/artificial intelligence are more impartial and analytical than humans (26 percent).

The research found that the countries with the biggest appetite for robo-advice are in the emerging economies of

Non-traditional Providers Hold Strong Appeal

The survey also found that consumers are willing to switch to non-traditional providers for financial services. Nearly one-third would switch to Google, Amazon or Facebook for banking services (31 percent), insurance services (29 percent) and financial advisory services (38 percent). For consumers aged 18 to 21 years old, the number willing to switch banking services to one of these companies only rises to 41 percent, indicating that many younger consumers see value in traditional financial institutions. Tech giants are not the only ones putting pressure on financial service firms; nearly the same percentage of global consumers would also consider switching to a supermarket or retailer for their banking (31 percent) and insurance (30 percent) services.

Personalization

The survey found nearly two-thirds of consumers are interested in personalized insurance (64 percent) and banking (63 percent) advice based on their individual circumstances, and when asked about wealth management advice, that increases to 73 percent. Nearly half of consumers (48 percent) want banks to play a supporting role in the purchasing process for non-banking products, such as a house or new car or services related to those purchases (i.e. insurance products, assistance with the sale and/or closing process). Consumers indicated that banks could assist with these important decisions by sending helpful information based on consumer location data, price range and other personal preferences.

Data as Currency

The survey also found that consumers are willing to share their data with financial services providers in exchange for benefits like less expensive and faster services. Globally, 67 percent would grant their bank access to more personal data, but 63 percent want more tailored advice and demand a priority service – such as expedited loan approvals – or a monetary benefit, such as more competitive pricing, in return for the information they share. More than half (57 percent) of consumers would grant their insurance provider access to personal data, but 64 percent want more tailored advice in exchange.

Three consumer personas

Nomads: Highly digitally active group, ready for a new model of delivery, represents 39 percent of consumers surveyed, but significantly more in less developed economies, such as

Hunters: Searching for the best deal on price, represents 17 percent of consumers surveyed and tend to skew a little older

Quality Seekers: Looking for high quality, responsive service and data protection, represents 44 percent of consumers

The full report can be downloaded at www.accenture.com/FSConsumerStudy.

Methodology

About

View source version on businesswire.com: http://www.businesswire.com/news/home/20170111005924/en/

[email protected]

Source:

4sight Health Features Article on the Potential of NFL Leadership to Combat America’s Opioid Crisis

Health insurance by the numbers in Monroe County

Advisor News

- Tax filing season is a good time to open a Trump Account

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- 85,000 Pennie customers dropped health plans as tax credits shrank and costs spiked

- Lawsuit: About 1,000 Arizona kids have lost autism therapy

- Affordability vs. cost containment: What health plans will face in 2026

- Sick of fighting insurers, hospitals offer their own Medicare Advantage plans

- After loss of tax credits, WA sees a drop in insurance coverage

More Health/Employee Benefits NewsLife Insurance News