NICB’s Hot Wheels: America’s 10 Most Stolen Vehicles

DES PLAINES, Ill., Nov. 19, 2019 /PRNewswire/ -- The National Insurance Crime Bureau (NICB) today released its annual Hot Wheels report, which identifies the 10 most stolen vehicles in the United States. The report examines vehicle theft data submitted by law enforcement to the National Crime Information Center (NCIC) and determines the vehicle make, model, and model year most reported stolen in 2018.

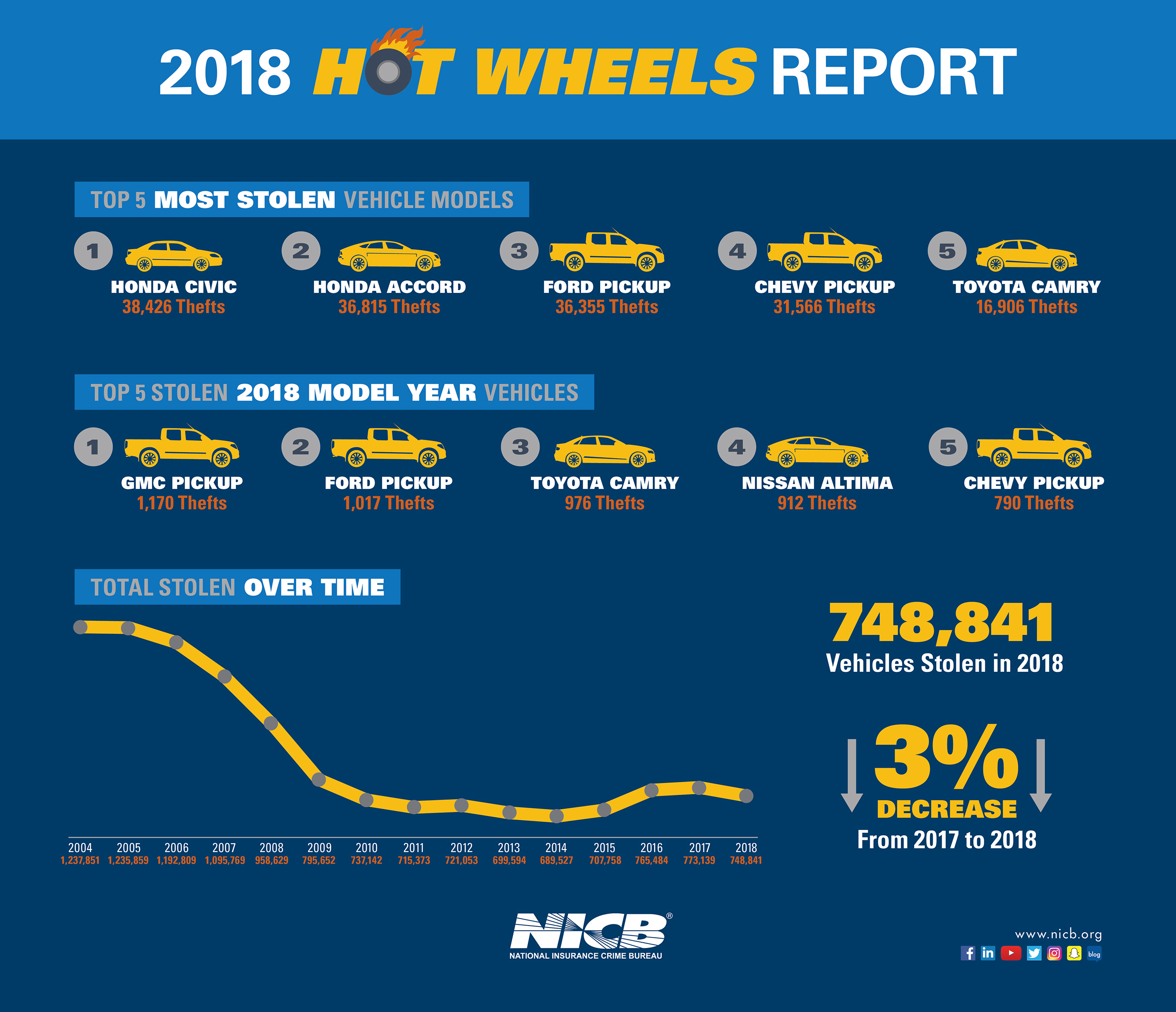

According to the FBI, in 2018, a total of 748,841 vehicles were stolen in the United States, a 3% decline, and a return to the dominant downward trend we've experienced since entering the 21st century.

Included with today's release is a list of the top 25, 2018 vehicle makes and models that were reported stolen in 2018.

For 2018, the most stolen vehicles in the nation were:

|

Rank |

Make/Model |

Model Year Most Stolen / (# Thefts)

|

Total Model Thefts |

|

1 |

Honda Civic |

2000 (5,290) |

38,426 |

|

2 |

Honda Accord |

1997 (5,029) |

36,815 |

|

3 |

Ford Pickup (Full Size) |

2006 (3,173) |

36,355 |

|

4 |

Chevrolet Pickup (Full Size) |

2004 (2,097) |

31,566 |

|

5 |

Toyota Camry |

2017 (1,144) |

16,906 |

|

6 |

Nissan Altima |

2017 (1,451) |

13,284 |

|

7 |

Toyota Corolla |

2017 (1,034) |

12,388 |

|

8 |

GMC Pickup (Full Size) |

2018 (1,170) |

11,708 |

|

9 |

Dodge/Ram Pickup (Full Size) |

2001 (1,155) |

11,226 |

|

10 |

Jeep Cherokee/Grand Cherokee |

2000 (646) |

9,818 |

The following are the top 10 2018 model year vehicles stolen during calendar year 2018:

|

Rank |

Theft Year |

Veh. Year |

Make/Model |

Total Thefts |

|

1 |

2018 |

2018 |

GMC Pickup (Full Size) |

1,170 |

|

2 |

2018 |

2018 |

Ford Pickup (Full Size) |

1,017 |

|

3 |

2018 |

2018 |

Toyota Camry |

976 |

|

4 |

2018 |

2018 |

Nissan Altima |

912 |

|

5 |

2018 |

2018 |

Chevrolet Pickup (Full Size) |

790 |

|

6 |

2018 |

2018 |

Hyundai Elantra |

775 |

|

7 |

2018 |

2018 |

Ford Transit |

723 |

|

8 |

2018 |

2018 |

Dodge Charger |

719 |

|

9 |

2018 |

2018 |

Toyota Corolla |

699 |

|

10 |

2018 |

2018 |

Chevrolet Malibu |

698 |

NICB recommends that drivers follow our four "layers of protection" to guard against vehicle theft:

Common Sense — the common sense approach to protection is the easiest and most cost-effective way to thwart would-be thieves. You should always:

- Remove your keys from the ignition

- Lock your doors/close your windows

- Park in a well-lit area

Warning Device — the second layer of protection is a visible or audible device which alerts thieves that your vehicle is protected. Popular devices include:

- Audible alarms

- Steering column collars

- Steering wheel/brake pedal lock

- Brake locks

- Wheel locks

- Theft deterrent decals

- Identification markers in or on vehicle

- VIN etching

- Micro dot marking

Immobilizing Device — the third layer of protection is a device which prevents thieves from bypassing your ignition and hot-wiring the vehicle. Some electronic devices have computer chips in ignition keys. Other devices inhibit the flow of electricity or fuel to the engine until a hidden switch or button is activated. Some examples are:

- Smart keys

- Fuse cut-offs

- Kill switches

- Starter, ignition, and fuel pump disablers

- Wireless ignition authentication

Tracking Device — the final layer of protection is a tracking device which emits a signal to police or a monitoring station when the vehicle is stolen. Tracking devices are very effective in helping authorities recover stolen vehicles. Some systems employ "telematics" which combine GPS and wireless technologies to allow remote monitoring of a vehicle. If the vehicle is moved, the system will alert the owner and the vehicle can be tracked via computer.

REPORT FRAUD: Anyone with information concerning insurance fraud or vehicle theft can report it anonymously by calling toll-free 800.TEL.NICB (800.835.6422)or submitting a form on our website.

ABOUT THE NATIONAL INSURANCE CRIME BUREAU: Headquartered in Des Plaines, Ill., the NICB is the nation's leading not-for-profit organization exclusively dedicated to preventing, detecting and defeating insurance fraud and vehicle theft through data analytics, investigations, learning and development, government affairs and public awareness. The NICB is supported by more than 1,300 property and casualty insurance companies and self-insured organizations. NICB member companies wrote over $496 billion in insurance premiums in 2018, or more than 81 percent of the nation's property/casualty insurance. That includes more than 92 percent ($254 billion) of the nation's personal auto insurance. To learn more visit www.nicb.org.

Car crashes into T-Mobile on Kempton Street, causes $50,000 in damage

Ametros Creates Industry-Leading Regulatory Advisory Council

Advisor News

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- ‘Absolutely ferocious’: Idaho introduces plan to repeal Medicaid expansion

- PEOPLE IN NEED OF DISABILITY BENEFITS ARE FACING NEW BARRIERS AND GOVERNMENT CUTS AND OVERHAULS ARE TO BLAME

- ANALYSES FIND HOSPITALS 'DRIVING UP HEALTH COSTS' WITH 'OPAQUE' BILLING PRACTICES, ANTI-COMPETITIVE CONSOLIDATION

- New Generation MyCare Program – What is it?

- Local lawmakers, advocates talk about BadgerCare expansion

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News