Majority of Americans Believe They are Likely to Be Impacted by a Natural Disaster, Few are Financially Prepared: AICPA Survey

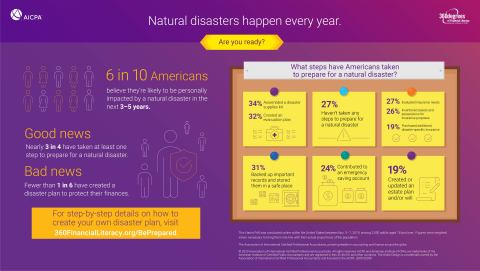

- 6 in 10 Americans believe it is likely they’ll be personally impacted by a natural disaster in the next 3 to 5 years

- Only 15 percent have created a disaster plan to protect their finances

- COVID-19 impacts disaster planning preparations and potential recovery

- For members of the media, the AICPA has disaster preparedness experts available to assist with stories

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200527005084/en/

Six in ten Americans (61 percent) believe they are likely to be personally impacted by a natural disaster in the next three to five years, including one in five (19 percent) saying they are very likely to be personally impacted. That’s according to an

“In the face of a natural disaster, protecting your family from harm should be your primary concern,” said

Understanding Financial Impacts of Natural Disasters

Nearly four in ten Americans (37 percent) admit they do not have a good sense of how much recovering from a natural disaster would cost their family financially. And seven in ten (71 percent) say that such an event would have a major or moderate impact on their financial situation, including a third (33 percent) who said there would be a major impact.

“It is a good idea to run through the calculations for potential damage, finding temporary housing and other recovery costs, so you can check to see if you would have enough cash on hand to cover it,” added Anton. “Review your insurance to be sure you have the right amount of coverage and that you're not overpaying. Make sure you know what is covered and don’t be afraid to comparison shop periodically to see if switching makes sense.”

Emergency Preparedness

The good news is nearly three-quarters of Americans (73 percent) have taken at least one step to prepare for a natural disaster, most commonly assembling a disaster supplies kit (34 percent), creating an evacuation plan (32 percent), or backing up and storing personal medical and financial records in a safe place (31 percent). The bad news is only 15 percent have created a disaster plan to protect their finances. And concerningly, a little more than a quarter of Americans (27 percent) have not taken any steps at all to prepare for a natural disaster.

|

Steps Americans Have Taken to Prepare for Natural Disaster |

||||

|

34% |

Assembled a disaster supplies kit (first-aid kit, food, water, tools, etc.) |

|||

|

32% |

Created an evacuation plan |

|||

|

31% |

Backed up & stored personal, medical & financial records in a safe, accessible place |

|||

|

27% |

Evaluated insurance needs to assure adequate coverage |

|||

|

26% |

Taken an inventory of assets & possessions for insurance purposes |

|||

|

24% |

Contributed to an emergency saving account |

|||

|

19% |

Created or updated an estate plan and/or will |

|||

|

19% |

Purchased additional insurance (e.g., flood insurance, hurricane insurance, etc.) |

|||

|

15% |

Created a disaster plan to protect finances |

|||

|

2% |

Other |

|||

|

27% |

I have not taken any steps to prepare for a natural disaster |

|||

Take Steps Now to Protect Your Financial House

“If you haven’t filed your taxes yet this year, you have the opportunity to cross two ‘to-dos’ off your list at the same time,” said

Every situation is unique, but there are some general natural disaster emergency preparedness steps that all households should take to prepare for unexpected challenges. For Americans looking for help getting started on their own disaster plan today, visit www.360FinancialLiteracy.org/BePrepared. There you will find guidance that covers the five key components of a disaster plan to protect both your family and your finances.

COVID-19 Impact on Disaster Planning Preparations

Many people are living in an unsettled financial state right now— either from sudden unemployment, or perhaps just being displaced from their place of work or local area. Disruptions caused by the COVID-19 pandemic can complicate the process of preparing a plan to protect your financial wellness from the next natural disaster. Government and institutional responses may be slower than usual at this time. With that in mind, here are a few areas where Americans may want to get a head start.

Banking Without the Bank -- If your bank branch is closed due to the pandemic, you may need some new options for accessing cash, depositing funds, and checking your account activity. Now is a good time to investigate alternative locations where you can use your ATM card to obtain cash without additional fees, and perhaps mobile banking which can allow most banking activities including check deposits and transfers between accounts.

Insurance Coverage -- If you haven’t recently reviewed your coverage with your insurance agent, you’ll want to be sure your homeowner’s or renters insurance is up to date for changes in value, valuable items you’ve added like jewelry or watches, and special risks you may face like flooding. As a first step, be sure you know how to contact your agent, who may be working remotely or with a reduced staff under current conditions.

Safe Deposit Box -- If you have documents in a safe deposit box that you may need after a disaster, you may find that your local bank branch is closed or operating under restrictions. You can check with the bank’s main office to learn how to access the box if local restrictions apply and may continue.

Wills, Powers of Attorney, and Health Care Proxies -- If disaster results in incapacity, loss of a loved one, or serious injury, you’ll want to be sure that your legal paperwork is up to date. Your attorney may be working remotely under pandemic- related conditions. If your papers need an update, it pays to get a head start in contacting the professionals you will look to for help and advice.

Employment-Based Programs -- Visiting your human resources department to check on items that may help you manage through financial survival in a disaster, like your disability coverage or ability to borrow from a 401(k) or similar retirement plan, is likely not an option if your workplace is closed due to the pandemic. You can take steps now to learn how to get the information you need, and request any needed updates, by phone or online.

Methodology

This survey was conducted online within

About the AICPA’s 360 Degrees of Financial Literacy Program

The AICPA’s 360 Degrees of Financial Literacy Program is a nation-wide, volunteer grass-roots effort to help Americans develop a better understanding of money management and take control of their financial lives. Since 2005, the AICPA has been empowering people to make better decisions with the tools and resources on the 360 Degrees of Financial Literacy website. Financial Literacy is the cause of the CPA profession and the 360 Degrees of Financial Literacy program is the AICPA’s flagship corporate social responsibility effort. These efforts are focused on financial education as a public service and are completely free from all advertising, sales, and promotions. In addition to financial calculators, articles and videos, the 360 website features an ‘Ask the Money Doctors’ section where consumers can submit their specific questions to be answered by a CPA financial planner. Connect with 360 Degrees of Financial Literacy on Facebook for tips, insights and motivation to keep your finances on track.

About the

View source version on businesswire.com: https://www.businesswire.com/news/home/20200527005084/en/

212-596-6033

[email protected]

212-596-6119

[email protected]

Source:

Even in a Pandemic, Save for Child’s Future With Wealth Secure+

Patra and Assurex Global Announce Multi-Year Strategic Partnership

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

More Annuity NewsHealth/Employee Benefits News

- PALLONE REMARKS AT HEALTH AFFORDABILITY HEARING

- The Health Care Cost Curve Is Bending up Again

- Republicans can make healthcare affordable by focusing on insurance reforms

- Governor Stitt strengthens regulations for Medicare Advantage Plans

- Health insurance CEO can't commit to safe AI practices in Congressional hearing

More Health/Employee Benefits NewsLife Insurance News