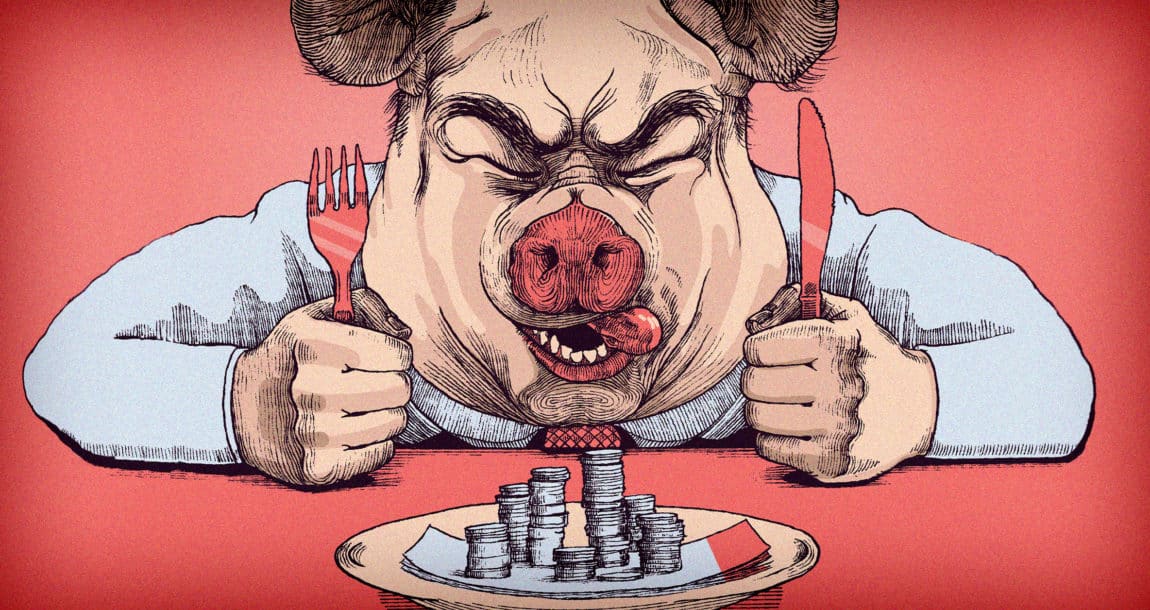

Ohio man sentenced to prison for $50 million Ponzi scheme

Jason E. Adkins, 46, solicited victims from all over the country and world.

"The victims in this case had their lives upended, their life savings taken, and their security ripped away, all while Adkins enriched himself and lived lavishly" said U.S. Attorney Kenneth L. Parker. "Adkins deserves the prison sentence he received today."

According to court documents, from 2012 through 2018, Adkins conspired to solicit millions of dollars from investors under false pretenses, failed to invest the funds as promised, and misappropriated investors' funds for his own benefit and the benefit of others.

Adkins and others claimed that they bought and sold over-sized tires commonly known as off-the-road tires, which are used on earth moving equipment and/or mining equipment. Investors were told their money would be used to buy the tires at a steep discount, and that the tires would then be re-sold to a buyer at a much higher rate.

Investors were promised a 15 to 20 percent rate of return on investment, generally within 180 days. Adkins would sometimes pay the return on investment for the first transaction with investor victims.

In addition, Adkins and his co-conspirators employed a sham escrow agent to falsely reassure investor-victims that their money was safe until the tire deals were consummated; more than $80 million flowed through the so-called escrow agent's accounts related to the scheme.

Adkins also laundered his ill-gotten proceeds for at least five years, including by investing in front businesses created by co-conspirators.

Adkins bought cars, vacations and property with the funds from the scheme. For example, he paid for the construction of a pool at his personal residence and more than $20,000 to lease a private jet.

Further, Adkins failed to file individual income tax returns reporting his income derived from the scheme. In 2013, specifically, Adkins earned at least $1.1 million, which caused a tax loss of nearly $237,000 to the IRS.

Niche Insurance Market May See a Big Move: Major Giants PICC Group, AIG, UnitedHealth Group

Accident and Illness Pet Insurance Market May See a Big Move: Major Giants PICC, Hartville Group, Embrace

Advisor News

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

- Gen X’s retirement readiness is threatened

More Advisor NewsAnnuity News

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

- MetLife Completes $10 Billion Variable Annuity Risk Transfer Transaction

- Gen X’s retirement readiness is threatened

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

- Prudential leads all life sellers as Q3 sales rise 3.2%, Wink reports

More Life Insurance News