Insurance Industry Faces Average Annual Natural Catastrophe Losses of $133B, A New High According to Verisk Report

“The growth in exposure values, driven primarily by continued construction in high-hazard areas, and rising replacement costs - largely due to inflation - are the most significant factors responsible for increasing catastrophe losses,” said

No longer just hurricanes and earthquakes, thunderstorms responsible for 70 percent of insured losses

Losses from the hazards beyond the traditional peak perils of hurricanes and earthquakes, including flood, severe thunderstorm, and wildfire, now account for a much larger proportion of the overall annual losses, due to the combination of more frequent events and more valuable properties at risk.

Severe thunderstorms have been responsible for a growing proportion of the losses over the last five years and can no longer be considered a “secondary peril”. So far in 2023, severe thunderstorms have accounted for more than 70 percent of insured losses with eight multi-billion-dollar events and according to this year’s report, the contribution to the Global Average Annual Loss (AAL) insured from severe thunderstorms globally is nearly 40 percent.

Economic losses could exceed

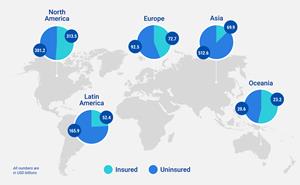

The sizable difference between insured and economic losses—the protection gap—represents the cost of catastrophes to society. On a regional basis, the percentage of economic loss from natural disasters that is insured varies considerably. In

The Verisk AAL is generally the sum of losses that can be expected, on average, every year. The global exceedance probability curve generated by Verisk’s suite of models provides probabilities on many different levels of loss, with significantly higher losses expected to occur with relatively high frequencies. According to the year’s report,

Churney continued, “Probabilistic catastrophe modeling remains the best approach for understanding risk and (re)insurers can use these models, with current exposure information, to put recent losses in perspective, while accounting for the impacts of continued exposure growth, climate change, and the increased role of perils beyond tropical cyclones and earthquakes.”

Download the 2023 Global Modeled Catastrophe Losses report here.

###

About

Attachment

Media Contact:Mary Keller 617-954-1754 [email protected]

Source:

Postpartum Medicaid Coverage Extended for Vermonters

New Insurance Product Targets Boda Boda Riders, Passengers

Advisor News

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

More Annuity NewsHealth/Employee Benefits News

- States try 'public option' Obamacare plans to reduce coverage costs

- Novocure Announces Optune Lua® Receives Reimbursement Approval in Japan for the Treatment of Non-Small Cell Lung Cancer

- Health care affordability pressures persist for privately insured Americans

- Minnesota teacher takes the fight to lower health insurance costs to the Legislature

- Predictable Benefits™ Launches White-Label ICHRA Platform For Benefit Providers To Offer ICHRA In A Matter Of Minutes, While Brokers Stay BOR

More Health/Employee Benefits NewsLife Insurance News

- Majority of Women Now Are the Chief Financial Officer of Their Household, Allianz Life Study Finds

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual Delivers Excellent 2025 Financial Results

- ACORE CAPITAL Named Alternative Lender of the Year ($15 Billion + AUM) by PERE Credit

- Baby on Board

More Life Insurance News