Fidelity Introduces Retirement Income Solutions for Employees Who Keep Savings in Employer’s Workplace Plan During Retirement

- Employees Are Increasingly Viewing their Workplace Plan as a

Safe Place for Retirement Savings - Research1 Indicates 56%of Employers Now Prefer Employees to Leave Some or All of Their Savings in the Company’s Retirement Plan

- New Solutions Combines Online Tools, Mutual Funds and Cash Withdrawal Strategy

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20191031005264/en/

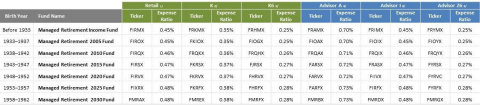

Current fund line-up (Graphic: Business Wire)

There are a variety of factors driving this increased focus on retirement income among employers, including a shift in traditional industry practices. First, employers1 are increasingly comfortable having workers keep their savings within the company’s savings plan when they retire, meaning more employers now feel a greater responsibility to provide tools and resources to help employees successfully transition into retirement. In addition, employers realize that offering a comprehensive in-plan retirement income solution can improve their overall benefits package as well as help meet fiduciary obligations. Lastly, employers are leveraging the larger asset sizes to more effectively manage the costs of their retirement plans. Typically, this also means lower expenses for workers.

“As an industry, we’ve been very good at helping individuals save for retirement, but more emphasis needs to be made on helping them understand how to draw down their savings once they enter retirement,” said

“People work hard every day to save enough to enjoy retirement and, as a result, transitioning into retirement can often be stressful. Fidelity’s new retirement income solution taps into a shift in the marketplace -- the growing trend of employees’ preference to leave savings in their former employer’s plan and employers feeling more comfortable having them leave it there,” continued Moorjani.

Complete Package of Digital Tools, Withdrawal Strategies and Investment Options

Fidelity’s new Retirement Income Solutions designed to help all employees, regardless of their level of savings, and includes three core components: a digital end-user experience, a customizable cash flow withdrawal strategy, and a suite of dedicated retirement income funds, all of which seamlessly integrate into a company’s workplace savings platform.

- Digital experience and tools provide individuals with a platform to evaluate and compare various withdrawal strategies and select the option that best suits their needs. The experience is part of Fidelity’s broader approach to engage employees throughout the entire savings and retirement journey, providing the data and information needed to help make the best decisions with their savings.

- Fidelity Managed Retirement Funds are a set of mutual funds designed to be part of an employer’s 401(k) or 403(b) plan fund line-up for retirees. The funds, which provide an age-appropriate asset allocation mix that becomes more conservative over time, are designed to complement a withdrawal and payment process that help to deliver a sustainable income stream in retirement.

- The Fidelity Managed Cash Flow withdrawal strategy is designed to complement the Fidelity Managed Retirement Funds, as well as model various systematic withdrawal payment options, and aims to provide a steady income payment strategy for individuals while maintaining a balance throughout their retirement. Payout rates increase over time and are updated annually.

The Fidelity Managed Retirement Funds are designed to be part of an employer’s retirement plan fund line-up and used by investors at or nearing retirement who plan on withdrawing money from their retirement savings. The funds, which leverage the expertise of Fidelity’s target date investment team, are designed to deliver an age-appropriate asset allocation that evolves over time which is comprised of a diversified mix of underlying equity, fixed income, and short-term strategies.

“We believe that our edge in constructing and managing retirement income portfolios comes from our experience in implementing our investment principles and process. We apply our unique insights and research on capital markets, our understanding of clients’ financial needs, and portfolio diversification to navigate the different types of uncertainty that investors may face over the course of their retirement” said

Fidelity currently offers seven Managed Retirement Funds allowing investors to select a fund that aligns with their birth year. Funds are designed for investors age 60 and older who turned (or will turn) age 70 in or within a few years of the applicable fund’s horizon date – for example, an investor born in 1945 would likely select Fidelity’s Managed Retirement 2015 Fund.

See the attached chart for an overview of the current fund line-up.3

The Fidelity Managed Retirement Funds are available now, while the digital experience (which includes the online planning tool) will be available in early 2020. Fidelity Managed Cash Flow and the digital experience are available at no extra cost to Fidelity 401(k) and 403(b) clients, while there are expenses associated with the Fidelity Managed Retirement Funds.

About

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of

The investment risk of each

Diversification does not ensure a profit or guarantee against a loss.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Before investing, consider the funds' investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

Information provided in this document is for informational and educational purposes only. To the extent any investment information in this material is deemed to be a recommendation, it is not meant to be impartial investment advice or advice in a fiduciary capacity and is not intended to be used as a primary basis for you or your client’s investment decisions. Fidelity and its representatives may have a conflict of interest in the products or services mentioned in this material because they have a financial interest in them, and receive compensation, directly or indirectly, in connection with the management, distribution, and/or servicing of these products or services, including Fidelity funds, certain third-party funds and products, and certain investment services.

905268.1.0

© 2019

1

2

3 Source:

View source version on businesswire.com: https://www.businesswire.com/news/home/20191031005264/en/

Corporate Communications

(617) 563-5800

[email protected]

[email protected]

Source:

The 6 Most Disruptive Tech Trends of the Year

Ace of Trades – Disabled Couple Advocates for Wellness Using Veteran-Owned Assuaged Health Technology

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Idaho is among the most expensive states to give birth in. Here are the rankings

- Some farmers take hard hit on health insurance costs

Farmers now owe a lot more for health insurance (copy)

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance News