Bank of Japan Raises Interest Rate To Highest Since 1995; Flawed Inflation Data; Oracle-TikTok Deal

Impact On Carry Trade

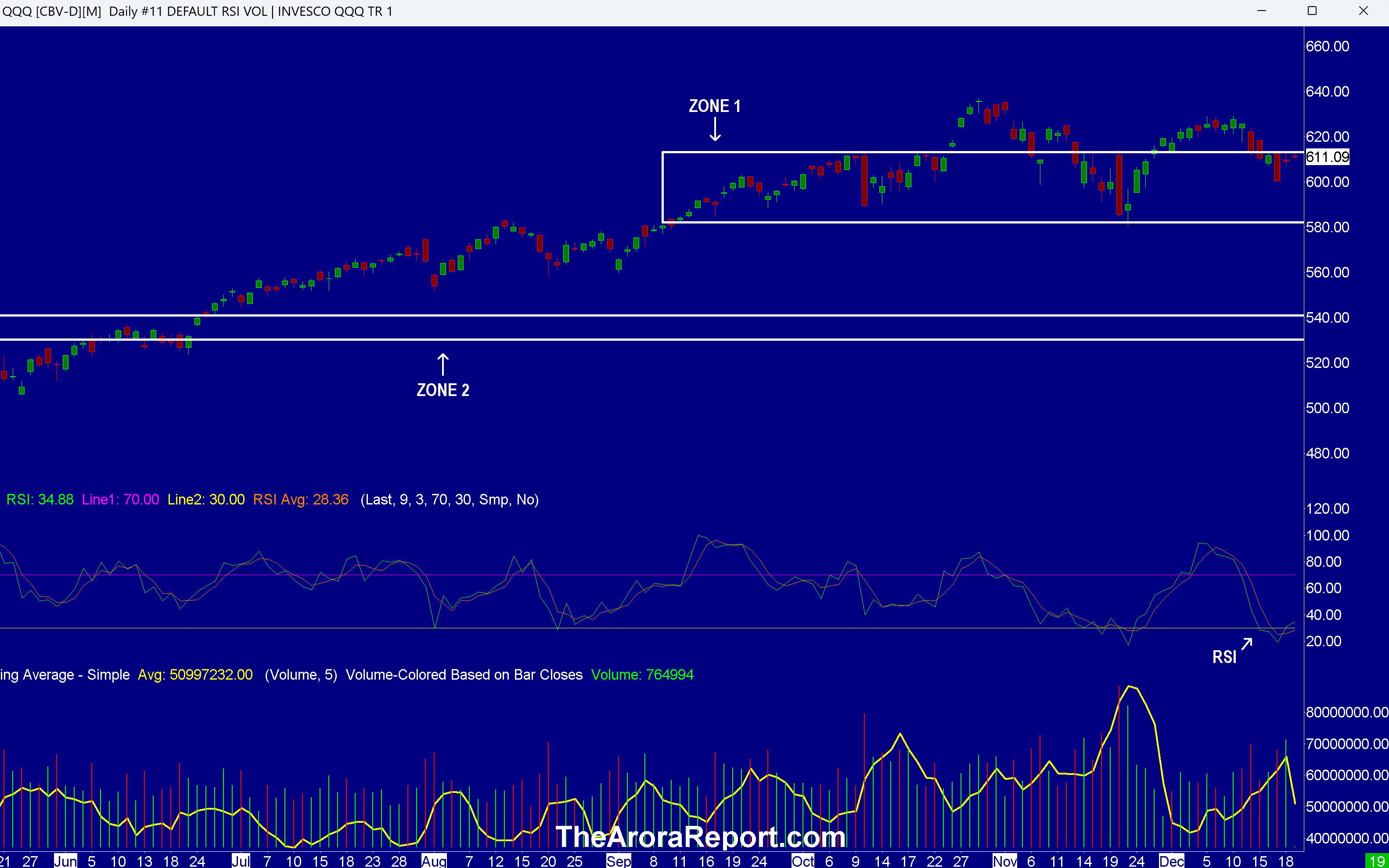

Please click here for an enlarged chart of

Note the following:

- The chart shows tech stocks are back to the top band of zone 1 (resistance).

- The chart shows QQQ did not dip to the lower half of zone one before bouncing. This is a positive.

- After today, liquidity will dramatically drop. Expect momo gurus to take advantage of lower liquidity to push their followers to aggressively buy tech stocks. Expect momo gurus to try their best to push QQQ to a new high.

- Momo gurus already have very bullish projections for 2026. Prudent investors need to understand that momo gurus are like a one way street — they are perma bulls — always bullish.

- Tech stocks have a potential to be impacted negatively due to the

Bank of Japan (BOJ) raising its key rate. Often, there is a significant delay in the impact. BOJ raised its key rate to 0.75% from 0.5%. The rate has been at 0.5% sinceJanuary 2025 . 0.75% is the highest rate inJapan since 1995.- BOJ Governor Ueda is indicating that further rate hikes may be ahead.

- The 10-year Japanese Government Bond (JGB) has risen above 2%.

- In our analysis, after years of deflation, inflation is now taking hold at around 3% in Japan. Deflation kept interest rates near zero for a long time.

- Further in our analysis,

BOJ will also have to face the fact that the Japanese economy is losing momentum. This will make it harder to raise rates significantly. - Interest rates in

Japan have been important for the carry trade. Over the last couple of years, funds have been borrowing money inJapan and investing in the AI trade in the U.S. These funds are highly leveraged. As such, they will come under pressure and reduce their borrowings and sell some of their AI holdings ifBOJ continues to raise rates. - The inflation data released by the US government is flawed. Due to the government shutdown, the government was unable to gather some data. The government imputed some numbers. In our analysis, it is highly likely that actual inflation data was higher than the released data. At any other time of the year, the realization that the released data was flawed would have negatively impacted the stock market. However, today, the stock market is focused on positive seasonality ahead, ignoring that yesterday’s rally was on flawed CPI data.

New York Fed PresidentJohn Williams says that he does not see a "sense of urgency" to cut the Fed fund rate. Williams eventually sees rates lower than where they are now.- Lately,

Oracle Corp (NYSE:ORCL) stock has been under pressure due to its plan to heavily borrow to build data centers. This morning, ORCL stock is jumping on news TikTok ownerByteDance has formed a new joint venture for its newU.S. business. Oracle is a part owner of the joint venture. The joint venture will be responsible for data protection, algorithmic security, content moderation, and software assurance. - Positive seasonality is ahead. In anticipation of positive seasonality ahead, money flows into

U.S. stocks are becoming large. If history is a guide, smart money buying now will exit the positions they are buying now by the end of the year. The momo crowd will continue to hold. - Today is triple witching. In triple witching, stock futures, stock index options, and stock options expire. Triple witching often leads to volatility.

- In important earnings,

Nike Inc (NYSE:NKE) reported earnings better than consensus. Nike’s business is doing well in the U.S. NKE stock is tumbling because of headwinds inChina .FedEx Corp (NYSE:FDX) reported earnings better than consensus but worse than whisper numbers. Prudent investors pay attention to FedEx earnings because they are an important indication of the economy. - The release of PCE and personal income and spending data is delayed.

Magnificent Seven Money Flows

Most portfolios are now heavily concentrated in the Mag 7 stocks. For this reason, it is important to pay attention to early money flows in the Mag 7 stocks on a daily basis.

In the early trade, money flows are positive in

In the early trade, money flows are neutral in Alphabet Inc Class C (NASDAQ:GOOG) and

In the early trade, money flows are negative in

In the early trade, money flows are neutral in SPDR S&P 500

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is

Bitcoin

Bitcoin (CRYPTO: BTC) is range bound.

What To Do Now

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2020 Benzinga.com - Benzinga does not provide investment advice. All rights reserved.

Bank of Japan Raises Interest Rate To Highest Since 1995; Flawed Inflation Data; Oracle-TikTok Deal

Thousands of Idahoans cancel health insurance plans on exchange ahead of subsidies ending

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- $2.67B settlement payout: Blue Cross Blue Shield customers to receive compensation

- Sen. Bernie Moreno has claimed the ACA didn’t save money. But is that true?

- State AG improves access to care for EmblemHealth members

- Arizona ACA enrollment plummets by 66,000 as premium tax credits expire

- HOW A STRONG HEALTH PLAN CAN LEAD TO HIGHER EMPLOYEE RETENTION

More Health/Employee Benefits NewsLife Insurance News