Advanced Analytics Techniques Helped an Insurance Company to Minimize Customer Acquisition Costs and Optimize Conversion Rates| Quantzig

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180920005475/en/

Advanced Analytics Solutions for an

According to the insurance industry experts at Quantzig, “Advanced analytics represents a collection of techniques and methods used to model internal and external data to produce valuable insights that can drive business-refining actions.”

With the advancement in technology, disruptive novices, and higher customer expectations marketplace has been redefined and insurance industry players remain focused on improving top line sales, bottom-line profitability, tackling challenges, and competing in this dynamic industry. Also, insurance industry players have a lot on their plates. Regulatory and political disturbances globally are changing some of the ground rules about how organizations may operate. Additionally, customer expectations and innovations are driving the rapid evolution in the conduction of business. The newcomers in the market are looking to snatch the market share from reigning insurance industry players.

Book a Solution Demo to see how Quantzig’s analytics solutions can help you.

The advanced analytics solution helped the insurance firm to gain valuable insights into the unique buying behaviors of their target customers, including the type of media they consume, the time of day they are most likely to conduct research and comparison shop and the length of time within which they typically make a buying decision.

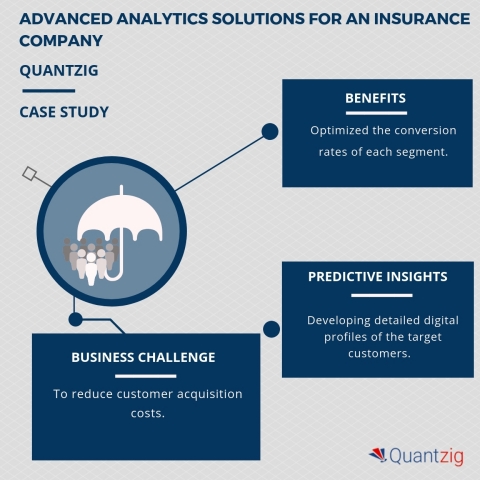

This advanced analytics solution provided benefits that helped the client to:

- Gain valuable insights into the unique buying behaviors and interests of their customers

- Optimize the conversion rates of each segment

- To know more about the benefits of our advanced analytics solution, speak to an expert

This advanced analytics solution offered predictive insights on:

- Developing detailed digital profiles of the target customers

- Categorizing those profiles with the highest propensity to convert

- To gain detailed insights and understand the scope of our solution, request a proposal

View the complete advanced analytics solution here:

https://www.quantzig.com/content/advanced-analytics-insurance-industry

About Quantzig

Quantzig is a global analytics and advisory firm with offices in the US,

View source version on businesswire.com: https://www.businesswire.com/news/home/20180920005475/en/

Quantzig

US: +1 630 538 7144

https://www.quantzig.com/contact-us

Source: Quantzig

Liberty Mutual And Safeco Insurance Catastrophe Teams Blanket Region To Handle Hurricane Florence Home And Auto Claims

Candidates talk economy, Medicaid expansion

Advisor News

- Understanding IRA Required Minimum Distributions

- American women report economic stress, worry about future health care costs and retirement

- Trade groups express concern about regulatory process on DOL fiduciary rule

- 7 in 10 preretirees say ‘no way’ they can retire at age 65

- Women share their challenges in the financial services industry

More Advisor NewsAnnuity News

- Strategic philanthropy: A look at charitable lead annuity trusts

- How much of the $1.33 billion Powerball jackpot is left after taxes?

- Industry fears impending DOL action will target pension transfer market

- New product: Guardian Life moves to crack the RILA market

- Cash vs. annuity: Which payout should you pick if you win Mega Millions, Powerball jackpots?

More Annuity NewsHealth/Employee Benefits News

- Catherine Rampell: The Great Medicaid Purge was even worse than expected

- More people in Oregon buy private health insurance plans as thousands lose Medicaid coverage

- Prudential introduces workforce benefits that support mental health and growing families

- False offers of cash subsidies used to ‘capture’ health insurance customers, lawsuit alleges

- Juno introduces first-ever child disability insurance in the U.S.

More Health/Employee Benefits NewsLife Insurance News

- MassMutual partnership with Insurify enables advisors to help clients comparison shop for P/C

- $80M verdict for 3 workers fired for taking ‘off the record’ time off in California

- NY lawsuit over premium financing tests oversight promised by Reg 187

- Fitch monitoring Globe Life following short seller’s allegations

- Woman’s Life Insurance Society to merge with Trusted Fraternal Life

More Life Insurance News