Your Clients Are Likely Underestimating Their Lifespan By 5 Years

If advisors and clients are looking at the average American lifespan as a yardstick for their retirement planning, they are most likely going to need a bigger stick.

That’s because Americans are underestimating their longevity by five years on average, according to a Capital Group blog post.

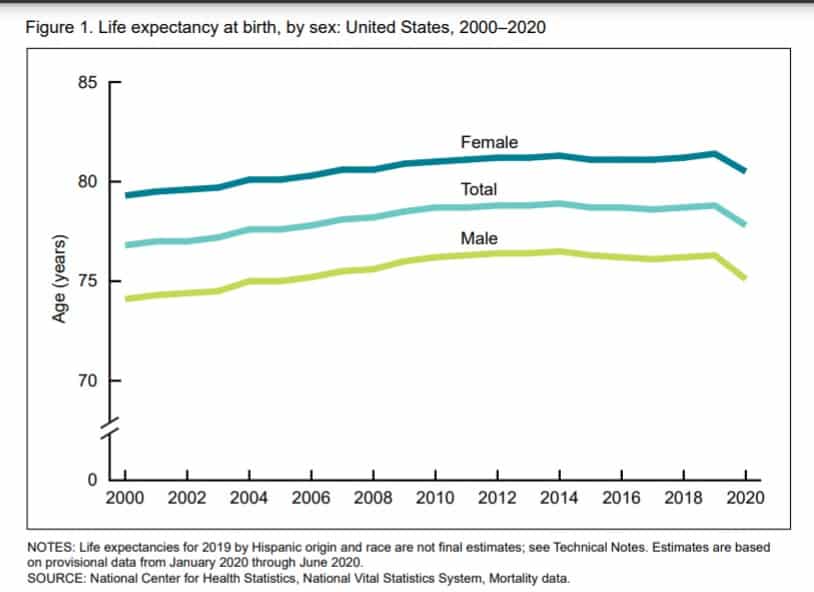

The underestimate owes much to the way people look at longevity statistics, which is to look at the aggregate. Overall, Americans are not doing great with longevity, falling behind many other advanced countries – and dropping.

The average in the first half of 2020, the latest available, was 77.8 years, which was a year younger than 2019, according to the Centers for Disease Control. Although the average has been stagnant or dropping for several years, the sharp decline early last year was attributed to COVID-19.

Although the Hispanic population has a longer life expectancy than whites and Blacks, COVID hit Hispanics and Blacks far harder than whites.

But even before the impact of COVID, American longevity was suffering from the impact of obesity, opioid addiction and poor lifestyle. But when Americans get to the milestone of 65, they can be reasonably sure that they will make it another 20 years or so. If they are building their retirement plan around 77.8 by the CDC’s overall estimate or 81 by the SOA’s, they are likely going to run out of money a lot sooner than their lifespan.

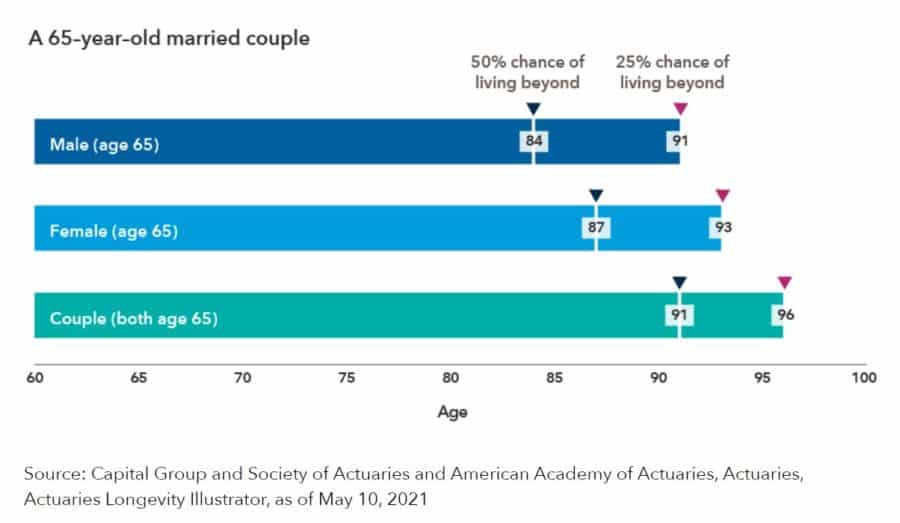

The Capital Group post based on Society of Actuaries data showed people underestimate their lifespan by five years. A couple that makes it to 65 can expect 20 additional years is the average, and one spouse will need to plan into their mid-90s, according to the Capital Group post.

“For the purposes of retirement income planning, a more relevant statistic is life expectancy at attained age,” according to the post by Capital Group’s Kate Beattie, senior retirement income specialist. “In fact, an 84-year-old non-smoking woman in excellent health has a life expectancy of about seven years and a 10% probability of living for another 14 years.”

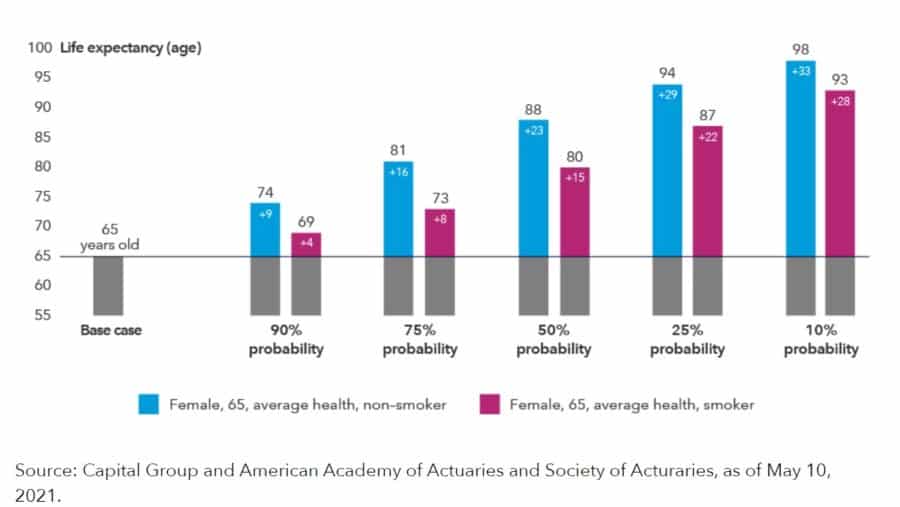

But just as lifestyle figures heavily in a person’s odds of making it to 65, those factors must also be taken into account in planning the longevity of 65-year-olds.

A 65-year-old woman who smokes and says she is in average health can expect to live another 15 years on average. If she is a nonsmoker, she can expect to live another 23 years on average.

Beattie cited the SOA for the statistics that 43% of retirees and 38% of pre-retirees underestimate life expectancy by at least five years. Advisors can use data to help their clients understand that they may be planning for too few years.

“While the uncertainty of how long someone may live cannot be eliminated,” Beattie wroted, “you can help investors better understand their own unique probabilities and develop plans to reduce the likelihood they will outlive their financial resources.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Fact Or Fiction: Dispelling Employer Myths About Institutional Income Annuities

NAIC Committee Passes Annuity Sales FAQs

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

- Grant Cardone, Gary Brecka, settle dueling state lawsuits

- 9 in 10 put off health screenings and checkups

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News