Why A Down Market Is The Perfect Time To Recommend An FIA

By Sean A. Ruggiero

In 2018, the stock market suffered the worst December since the Great Depression. We see the headlines on the internet, we hear about it on the news, even our President is talking about it. So what does this drop in the stock market mean to your clients, and what might you do about it?

Since November 2009, the stock market has generally gone up, but 2018 marked the first year that we recorded a loss in nearly a decade. For most investors, this recent downturn in the market is expected. The severity, though, is catching many investors, especially those close to or in retirement, off guard.

Having such a strong bull run is bound to have some corrections, but when it starts to look like a bear market (i.e. losses of 20 percent or more), we often act out of emotion or desperation and commit the cardinal sin of “selling low.”

We are also witnessing very unusual levels of volatility in the market, with erratic swings going up and down 1 to 3 percent in a single day of trading. This volatility only adds to our fears of losing money and not getting out of the market in time. So what can your clients do in the midst of all this volatility and market loss? Consider buying a fixed indexed annuity.

Clients might hear the word “annuity” and believe some of the bad press about the product. I believe Moshe Milevsky, professor of finance at the Schulich School of Business at York University, put it best in his recent article, “Annuity Fables: Some Observations From An Ivory Tower,” when he wrote, “Saying you don’t like annuities is like you saying you don’t like funds. What type of funds? Hedge funds? Venture capital and private equity funds? Exchange-traded funds? Mutual funds? The word annuity without a descriptor isn’t informative. There are life annuities and term-certain annuities, fixed annuities and variable annuities, immediate annuities and deferred (or delayed) annuities.”

Milvesky’s point is valid; there are many types of annuities built for various purposes. So I urge you to help your clients understand how an FIA could make sense for them right now.

An FIA isn’t right for everyone. But the latest breed of FIAs are excellent options for investors who are in the midst of a bear market and need to create stability and safety but don’t want to miss out on the potential of future gains in the market when it rebounds. Furthermore, many accumulation FIAs can immediately help clients gain back some of the losses they may have suffered in December with something called a premium bonus when transferred. Let me explain.

An FIA uses indexing to gain indirect exposure to the market. Indexing is accomplished through the purchase of something known as “call options.” This purchase of call options comes from the interest gained from the general investment pool of the insurance or annuity carrier offering the FIA. If the index rises, the options pay out (and can be a significant gain). If the index drops (the market continues to go down), then the options are worthless, but the investor has lost nothing.

To illustrate this best, let’s examine one of the simplest annuities, the fixed annuity. A fixed annuity, also called a multiyear guaranteed annuity, simply gives the purchaser fixed annual interest crediting during the contract period. This interest is generated by the general investment pool of the annuity carrier and is guaranteed by its strength and financial standing as a legal reserve company in the state in which they do business in.

For example, if a client has $200,000 to purchase a fixed annuity, they could purchase a 5-year MYGA that yield a guaranteed 3.25 percent annual compounding return. Because it is an annuity, it would grow tax deferred and also be subject to limited liquidity with a surrender charge. So each year, the client would get a 3.25 percent compounding interest credit to their $200,000. Straightforward and not confusing.

An FIA works in a similar fashion, but rather than taking the “safe money” and keeping the 3.25 percent, the annuity carrier purchases call options on an index with the 3.25 percent. Their goal is to get the best price for the options to maximize return. So if a client purchased an FIA with $200,000 of premium, instead of having a guaranteed 3.25 percent, they would have a guarantee of zero percent, but would have that 3.25 percent dedicated toward the purchase of call options on an index such as the S&P 500. These options would generally have a term of one or two years. When the maturity date for those options comes up, the options would either pay out or expire and be worthless. However, the client’s principal is never in danger, thus the zero percent guarantee.

So if the S&P 500 (which closed at 2,448 on Jan. 3, 2019) rose to 2,750 by Jan. 3, 2020, then the index would have gone up 302 points, or 12.3 percent. At that point, the options would pay out. If we use a hypothetical 60 percent participation rate, then the $200,000 would be credited 60 percent of the 12.3 percent, or 7.38 percent. This means that $14,760 would be credited to the account as a realized gain.

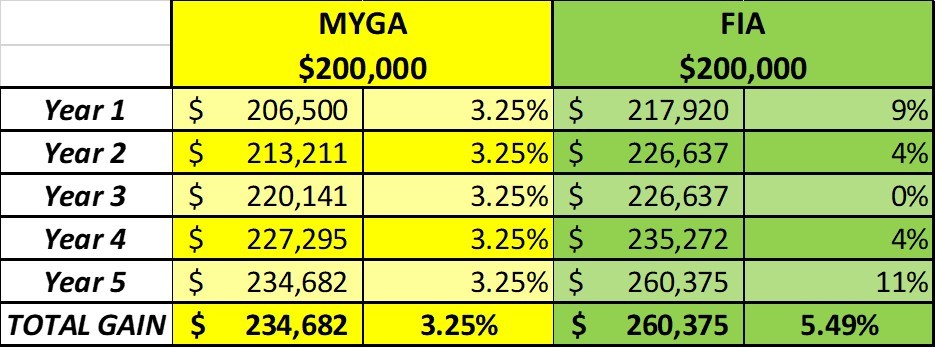

Historically speaking, the increases in the market index have outperformed the guaranteed fixed amounts of a MYGA, which is why the FIA has grown so dramatically in popularity. The following is an example of an actual MYGA vs. an FIA offered by an A-rated carrier using a variation S&P 500 index for the FIA over the previous five years from 2013 to 2018.

There are multiple benefits to this: not risking any principal in down markets, not having to decide when to buy or sell. But the most significant benefit is that the interest credits are locked in as realized gains and you don’t have to sell shares to achieve them.

Here’s a question: If I have a mutual fund with $100,000 invested in it and the fund rises to $125,000, how much have I made? The answer is: I’ve made nothing until I sell. Furthermore, I am also suffering from something called unit depletion when I sell. If I have 1,000 shares of a mutual fund, stock or ETF and I want to capture some gains, then I would have to sell some shares. Let’s say I sell 100 shares to capture gains, I now have only 900 shares. Even if the stock price rises, I will have a diminishing opportunity to capture future gains. Fast-forward a few years, and assuming your client is selling shares every year, either to fund retirement or to capture gains, they could be down to 50 percent of their original shares. This is the effect of unit depletion, and it is eliminated with an FIA. With an FIA, all gains are simply a payoff of interest credited to your client’s account, and the options purchased for this payoff were generated through the interest of their premium, not by using any of their actual principal.

So how important is it to eliminate negative returns in the market? In 2018, the markets finished the year lower than they started. The S&P 500 index started 2018 at 2,696, but finished the year at 2,507, which represents a drop of 189 points, or 7 percent. So if your client had $200,000 invested in the S&P 500 at the start of 2018, by the end of the year it would have decreased to $186,000. Compare that to having $200,000 in an FIA, and your client would have lost nothing.

If the market continues to drop in 2019, a traditional portfolio exposed to stocks would continue to drop, but an FIA would never experience negative market crediting. In this sort of scenario, you can see how even a zero percent return, when compared to a sustained down market, can be far superior and demonstrates the power and safety of an FIA.

Sean A. Ruggiero is president and founder of SafeMoneySmart.org, a nonprofit that advocates for alternatives to the stock market in retirement. Sean may be contacted at [email protected].

© Entire contents copyright 2019 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Nevada Fiduciary Duty Proposal Has Strength, Needs Defining: Analysts

Commentary: Meet Clients’ Needs By Finding Your ‘Why’

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- New Insurance Study Findings Have Been Reported from University of South Carolina (Brokering a new path: navigating administrative burdens in the health insurance Marketplaces): Insurance

- Medicaid disenrollment spikes at age 19, study finds: University of Chicago

- How might carriers respond to drop in ACA enrollment?

- CalOptima reports steep membership drop as providers brace for surge in uninsured patients

- Why Hospitality Owners in South Carolina Need Specialized Group Health Insurance Guidance

More Health/Employee Benefits NewsLife Insurance News