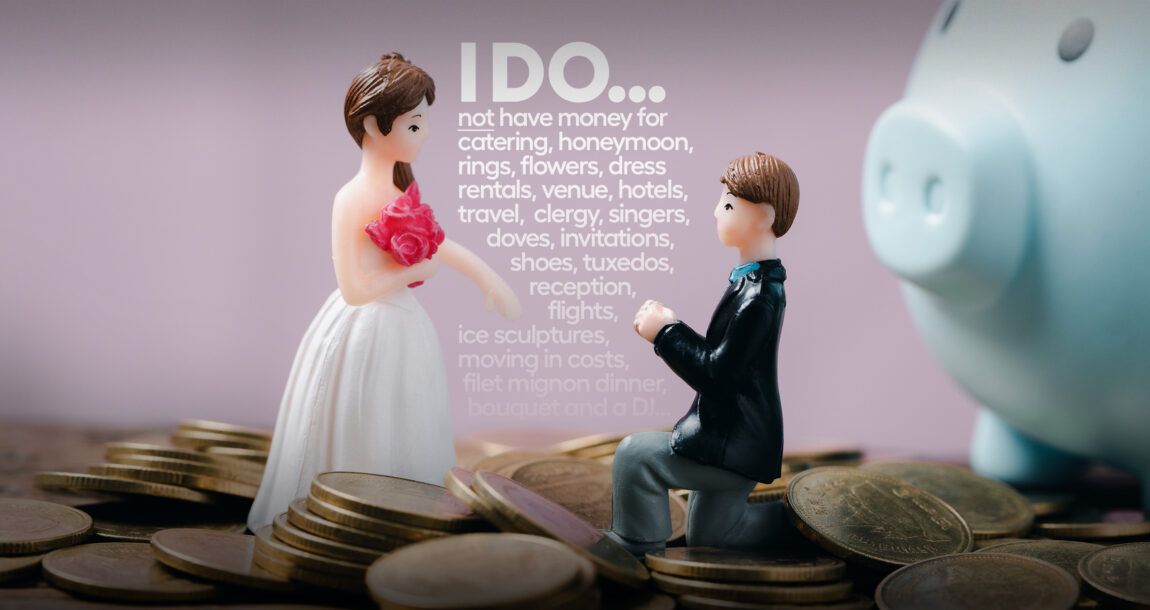

Wedding costs a worry for couples’ financial well-being

The vast majority of engaged couples surveyed fear their wedding costs may adversely impact their financial well-being.

More than 8 out of 10 engaged couples surveyed say the increasing cost of expenses associated with hosting a wedding will have an impact on their financial well-being, according to a Provident Bank survey. And 53% have spoken or plan to speak with their bank or financial advisor about financing options for their wedding.

"The survey provides a unique perspective on how consumers are modifying their wedding budgets and seeking financial solutions in response to the evolving economic landscape,” said Vito Giannola, Provident Bank’s executive vice president and chief retail banking officer.

“Weddings are a significant, and oftentimes costly, milestone and come with various financial considerations. The findings from our survey offer valuable insights for banks as well as customers, as we found that couples are turning to their banks and financial advisors during major financial decision-making moments for suitable options tailored to their needs."

Having a wedding can be very expensive these days. When Zola, an online wedding registry, wedding planner, and retailer surveyed thousands of engaged couples to find out about their wedding-planning experiences (First Look Report), it found that the average wedding expenses for couples getting married in 2023 total around $29,000. This is up slightly from $28,000 in 2022.

Cutting costs

Faced with these significant costs, many couples are deciding to modify their wedding budgets. Respondents to the Provident Bank survey were asked to choose from a list of factors that contributed to their budgetary modification (respondents could choose as many factors as they wished that applied to their situation).

The results revealed that 31% cited insufficient personal savings, 35% cited medical or emergency expenses, 17% attributed a change in budget to a recent job loss or financial setback, and 29% reported limited access to loans or credit.

As to how they plan on paying for their weddings, respondents selected the following options:

- 46% said they would be relying on personal savings.

- 22% said they would be paying for their wedding by taking out a personal or home equity loan.

- 21% said they would be paying for their wedding with funds borrowed from a pension and/or a 401(k) plan.

- 18% said they would be paying for their wedding by crowdfunding.

According to Zola, 29% of couples are also optimizing credit cards, 26% have saved for years before getting engaged, and 24% are adding cash funds meant to supplement wedding costs to their registries.

When asked what changes they made to stay within their budget or save money on their wedding, respondents to the Provident Bank survey said they were opting for cost-saving wedding attire, “downsizing” their guest lists, doing the decorations themselves, using a cash bar, and eloping. In addition, over half of couples said that they were cutting out traditional wedding customs to reduce costs.

Other survey findings

Additional findings from the Provident Bank survey include:

- 72% of respondents said their budgets would be under $50,000.

- Among the respondents who adjusted their wedding budget because of rising costs caused by high inflation and insufficient personal savings funds, they selected all options that applied:

o 40% are opting for cost-saving wedding attire

o 34% are getting married on a weekday, a Sunday, or during off-peak times

Among the couples who said that they would be getting rid of traditional wedding elements and/or customs to reduce the costs of their wedding celebrations, respondents selected all of the following options that applied:

- 33% are opting out of a honeymoon

- 40% are cutting out wedding favors

- 49% are not having a formal dinner

- 34% are not giving out bridal party gifts

- 31% are not using printed invitations and/or stationery

The 2023 National Wedding Spending Survey was conducted by Pollfish, a market research provider, on behalf of Provident Bank. The findings are based on 1,000 responses.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at amseka@INNfeedback.com.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

NCOIL ponders dental MLR model to force set spending on patient care

Helping clients whose families are in the world’s crisis regions

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

- Grant Cardone, Gary Brecka, settle dueling state lawsuits

- 9 in 10 put off health screenings and checkups

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News