Want ‘Diamond Hands?’ Buy An Annuity!

The meme culture has produced a new class of investors and some important lessons for financial advisors and their clients. The Reddit crowd is seemingly unfazed by extreme volatility in stocks like GameStop or AMC because of a cherished talent they call “Diamond Hands.”

Diamond Hands is the ability to stomach all of the risk, losses and drama surrounding their equity position in an effort to get to an end goal. Most investors, however, don’t subscribe to the you only live once (YOLO) lifestyle.

Each year, Dalbar publishes its Quantitative Analysis of Investor Behavior. This report shows how individual investors consistently underperform the market. The statistics in the analysis point to what a Wall Street Bets participant may label as having “Paper Hands.” This individual is the opposite of someone with Diamond Hands. They have the same end goal but just can’t stomach the volatility.

To be successful, our clients need sound investment strategies and the confidence to stay invested. This is especially true for those in or nearing retirement. After all, members of this group no longer have the earning capacity required to overcome a poor investment decision.

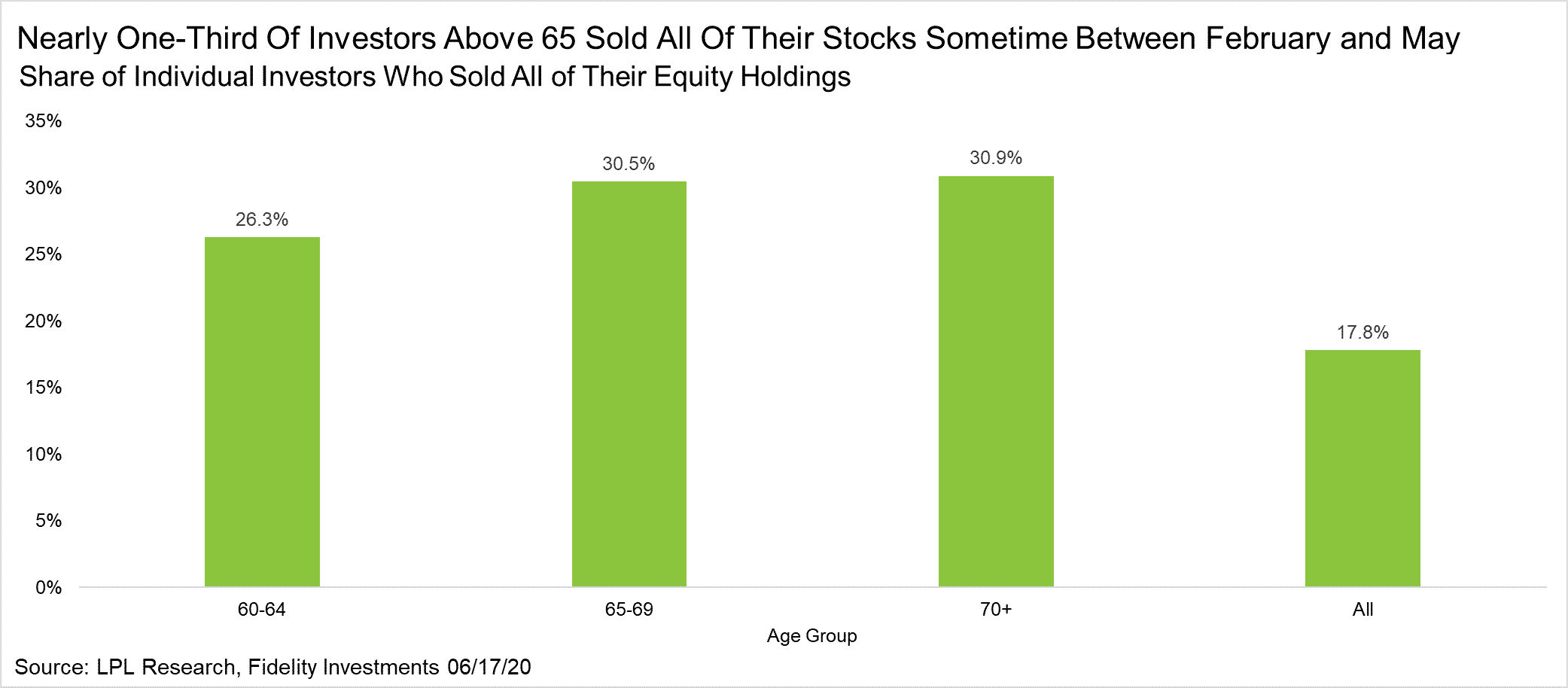

According to LPL Research/Fidelity Investments, nearly one-third of investors over 65 years old sold all of their equity holdings between February and May of 2020. During the height of uncertainty over the pandemic, many seniors panicked, turning fear of missing out (FOMO) into OH-NO.

The consequences of the emotional buying and selling that’s done in up and down markets grow exponentially as we age. The question to ask ourselves is, “What should we do about it?” A simple solution to this complex problem can be found in the fixed annuity marketplace.

Balancing the risks of an equity portfolio with the guarantees that can be offered in an annuity can make a world of difference to your clients’ attitudes toward risk. To the moon? Not quite, but there’s no denying the power of just knowing. Knowing a portion of their income could be guaranteed for life.

Knowing some of their portfolio returns could be guaranteed. Knowing a certain amount of their nest egg may never go down. Just knowing can allow clients to sleep at night, think long-term, and reduce the cost of panic.

In today’s rate environment, a multi-year guaranteed annuity provides a compelling alternative to traditional safe investments. Fixed indexed annuities are more robust than ever, with many offering enhanced participation rates, a lifetime income stream, and the potential for future increases to help keep up with inflation.

Single premium annuities and deferred immediate annuities can be structured in any number of ways. Remember the primary pricing mechanism for immediate annuities is your clients’ life expectancy with interest rates playing a secondary role. These mortality credits make a huge difference for clients looking to maximize their cash flow in retirement.

The best thing we can do as financial professionals is to make sure our clients’ portfolios are structured to help them weather any storm. Adding a layer of certainty, by transferring risk to an insurance company with an annuity, helps provide peace of mind to your clients, and stability to your book of business.

John M. Neumann, CFP, ChFC, CLU, CRPC, is an annuity wholesaler with Crump Life Insurance Services. He may be contacted at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Colorado Leads The Nation In Auto Thefts, NICB Reports

The Need For Life Insurance Has Never Been Greater

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Is cost of health care top election issue?

- Indiana to bid $68 billion in Medicaid contracts this summer

- NFIB NEW MEXICO CHAMPIONS SMALL BUSINESS REFORMS TO ADDRESS RISING HEALTH INSURANCE COSTS

- Restoring a Health Care System that Puts Patients First

- Findings from University of Nevada Yields New Data on Opioids (Aca Dependent Coverage Extension and Young Adults’ Substance-associated Ed Visits): Opioids

More Health/Employee Benefits NewsLife Insurance News