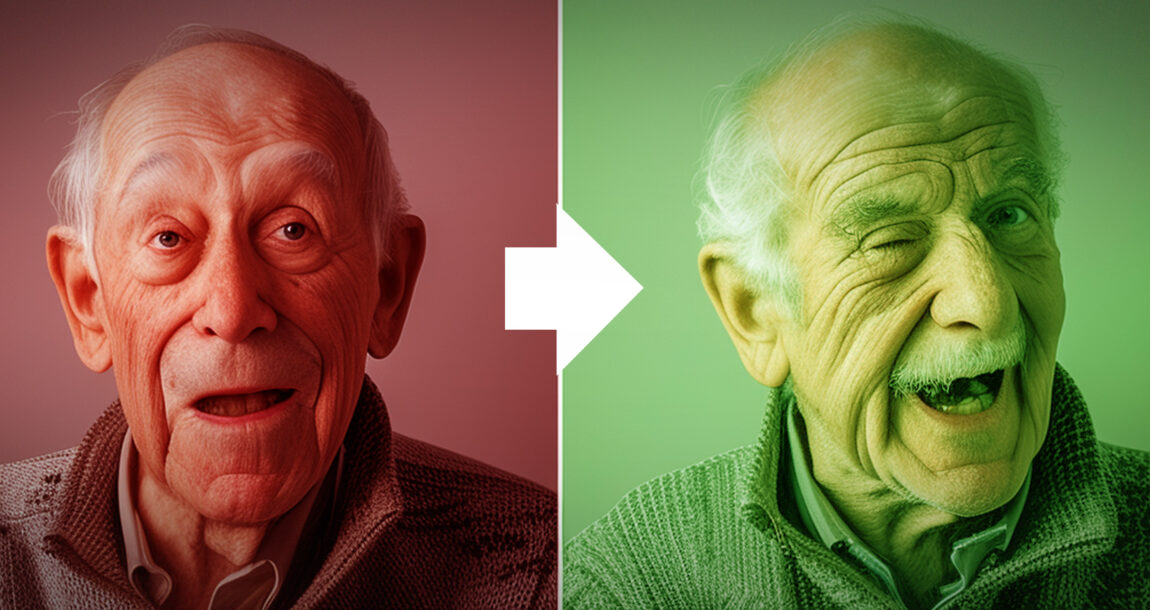

Turn your biggest critics into advocates

Customer loyalty is a critical metric to understanding customer satisfaction and retention. When you take the time to listen carefully to all customer perspectives — both those who are happy with and critical of your agency — you can learn a lot about your company’s successes and pain points, straight from the mouths of the people who impact your business the most.

Business owners know that loyal customers often spread the word about the great experiences they’ve had with a business and refer others to that business. Conversely, those with negative interactions may do the same, hurting a company’s reputation. Using and paying attention to customer feedback gives business owners the opportunity to fortify and strengthen customer relationships, as well as fortify the business.

In the insurance industry, increasing regulations, higher costs and greater competition make winning and retaining accounts more important than ever. Finding the right tools to better evaluate customer experience, along with support from their carrier partners, can help agents take a more proactive approach to account management. And in today’s competitive business-to-business environment, how you act on the insights revealed will be the key to turning some of your agency’s greatest critics into its staunchest supporters.

The value of listening

Today’s customers have high expectations. In fact, according to the 2024 GITNUX Marketdata Report, at least 80% of B2B clients expect an experience that is as good or better than a business-to-consumer one. There are many different ways that you can evaluate your clients’ experience with you, including:

- Client surveys and chats: These sources allow for the collection of feedback from clients about their experiences with your company, products and services. The resulting data can be used to identify areas of success and those needing improvement, as well as to track client satisfaction trends over time.

- Social media monitoring: Social media offers another way to identify trends, concerns and opportunities to improve client experience. Analytics platforms that specialize in social media make it easier to track and measure the reach and engagement of social media posts, highlight key topics and messages mentioned, and pinpoint patterns in client behavior and sentiment across multiple platforms.

- Customer relationship management systems: CRM systems enable the recording and management of customer interactions and data. This information can be used to identify loyal clients, track engagement and develop targeted outreach.

- Net promoter score: NPS is a metric that measures client loyalty based on how likely clients are to recommend your company to others. A high NPS score indicates that clients are satisfied with your company and are likely to be loyal customers.

- Customer lifetime value: CLV, which measures the total value of a customer over their lifetime, helps identify your most valuable clients and develop retention strategies. CLV is based on the customer's average purchase value multiplied by the number of times they purchase from you throughout the relationship.

When used together, these customer listening posts and sources of feedback can give you a powerful, well-rounded picture of client needs and preferences, as well as actionable areas of improvement along the client journey.

Why the critics matter

Customers who are overly critical of your business may only be a small percentage of your audience, but they can have the most impact on your reputation, sales growth and revenue. Sitel Group research found that one-third of consumers considered ending a relationship with a brand, while another 65% severed ties, due to a poor customer experience.

Although brand critics are more apt to contribute to churn (the rate at which customers stop using a product or service over time), they are also more likely to be engaged. CustomerGauge survey findings concluded that these critics spend 36 seconds longer to complete surveys and leave a reason for their survey opinions 64% of the time. This shows that critics care enough about a brand to share more about their experience — even when it’s not positive. As such, this feedback presents an opportunity to gain a better understanding of client needs, make necessary improvements to address their concerns and restore a healthy relationship.

How partnering with your insurance carrier can help

Now that you know more about the value of listening to your clients and evaluating their experiences with you, how can you convert agency critics to advocates? A good place to start is connecting with your insurance partner when an issue emerges. Carriers work hard to be a seamless extension of their client’s business — when we work together, a plan can be developed to address any challenges and meet mutual customer needs.

In general, it’s important to:

- Have ongoing discussions with your carrier partner to convey any changing client needs or preferences so that a proactive strategy can be developed to address them.

- Have a clear understanding of any less-than-positive client feedback received and be timely in sharing it with your carrier partner.

- Request high level summaries of usage reports developed so that findings can be reinforced with the client.

- Provide opportunities for carrier representatives to have greater exposure to the client — let them do the work for you.

Additionally, educating your clients on an insurance partner’s offerings can go a long way in curbing challenges before they start. Although it’s not possible to know every detail about all the insurers you represent, the goal should be to have solid knowledge about each insurer’s main products (including any add-ons), what employer resources exist and any unique offerings.

In the end, both insurers and brokers are in the business of creating remarkable experiences for their customers — and having a better understanding of client needs and wants can determine what is working and where adjustments can be made. And when negative experiences do occur, there’s an opportunity to improve, grow and demonstrate value.

When your client wants to borrow from their life insurance

Financial freedom is worth protecting

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

More Life Insurance News