The Likelihood And Cost Of LTC May Be Higher Than You Think

We often hear conflicting statistics about the likelihood of clients needing long-term care, what kind of care they are likely to need and — most importantly — how much that care will cost. But there are a number of variables that go into the estimates of the cost of LTC and how likely a client will need care. Here are some factors that go into those estimates.

The likelihood and cost of LTC depend on the definition of LTC. There are two ways to estimate the likelihood and cost of LTC, and several factors that determine those estimates.

Method 1: Strict HIPAA definition.

Estimates of the likelihood and cost of LTC are usually based on criteria established by the Health Insurance Portability and Accountability Act of 1996. A person requires LTC if a licensed health care practitioner certifies they need assistance with at least two of the activities of daily living for 90 days or more or need supervision because of severe cognitive impairment. Medicaid and some financial services companies use this definition to determine eligibility for LTC benefits.

This approach underestimates the true likelihood and cost of LTC because people who need care at pre-HIPAA levels of disability are not counted.

Method 2: When care is first needed and costs are incurred.

This approach estimates the likelihood and cost of LTC from the perspective of care recipients and family caregivers. The stages identified here were created solely for the purpose of this discussion.

» Stage 1 (IADL care). Help is needed and expenses may be incurred because of difficulty performing the instrumental activities of daily living, including cooking, housework, laundry, managing finances and medical care, phone and computer use, shopping, and transportation.

» Stage 2 (standby care). Medical conditions worsen or cognitive ability declines. Paid caregivers may be needed. Stage 2 is when many people indicate their first need for LTC, regardless of the HIPAA criteria. (See Stage 4.)

» Stage 3 (hands-on care). More care is needed and more expenses are incurred. Paid caregivers are often needed. Stage 3 still doesn’t meet HIPAA criteria. (See Stage 4.)

» Stage 4 (HIPAA-level care). A health care provider certifies that LTC is needed according to the HIPAA definition.

Research published by the Urban Institute shows one in four people (26%) who pay for care and almost three in four (71%) who receive only unpaid care are not included in most LTC statistics because their disability does not meet HIPAA criteria.

What Is The Likelihood That LTC Will Be Needed?

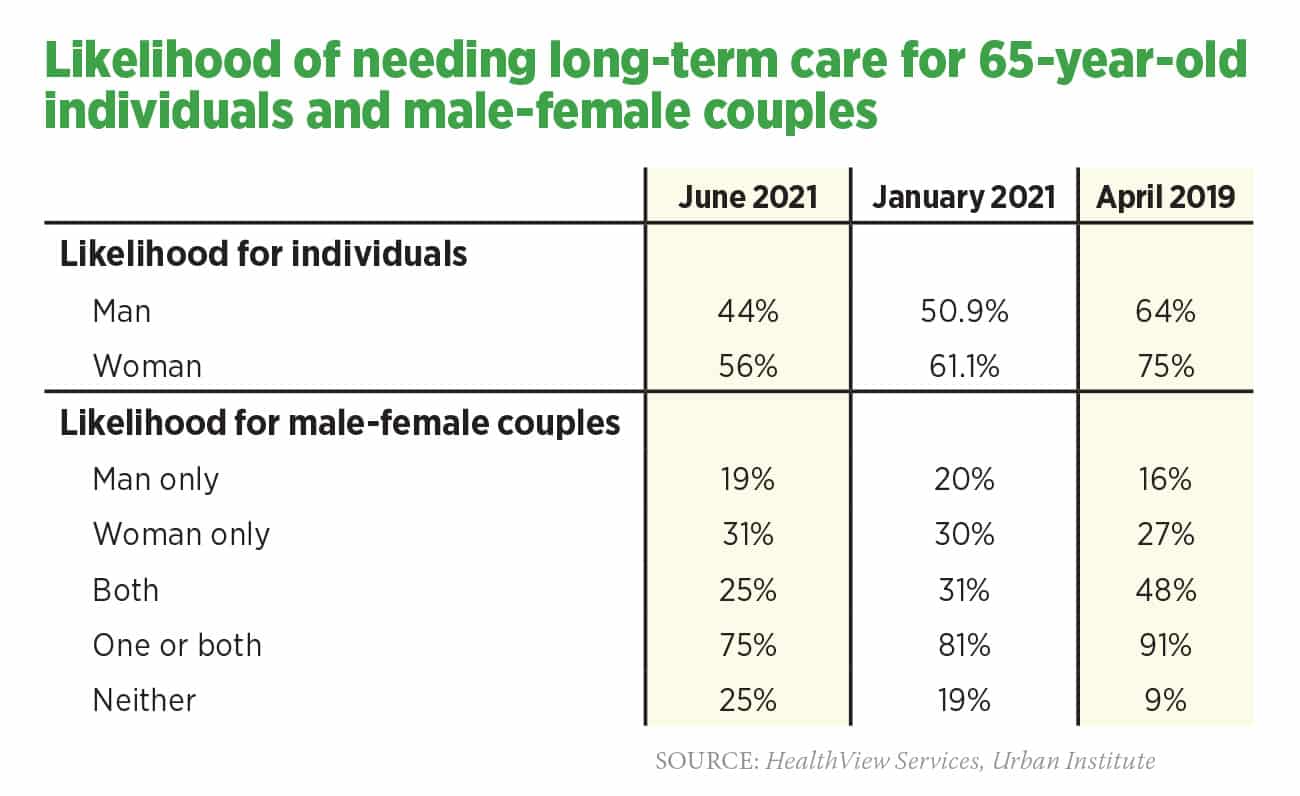

Table 1 displays recent estimates of the likelihood of LTC for individuals and couples. In 75% to 91% of couples, one or both people (joint probability) will need LTC.

These projections underestimate the likelihood that care will be needed because the projections don’t include people who live beyond their life expectancy or who never reach HIPAA-level disability.

» June 2021. Likelihood that healthy 65-year-olds will need some level of LTC by the time they reach actuarial life expectancy for males (age 86) and females (age 87).

» January 2021. Likelihood of needing LTC from age 65 to death. These are future (prospective) probabilities based on the HIPAA definition of LTC.

» April 2019. Likelihood of needing LTC from age 65 to death. These are historical (retrospective) data based on self-reported need for HIPAA-level LTC.

Cost Of LTC Based On HIPAA-level Disability (Stage 4)

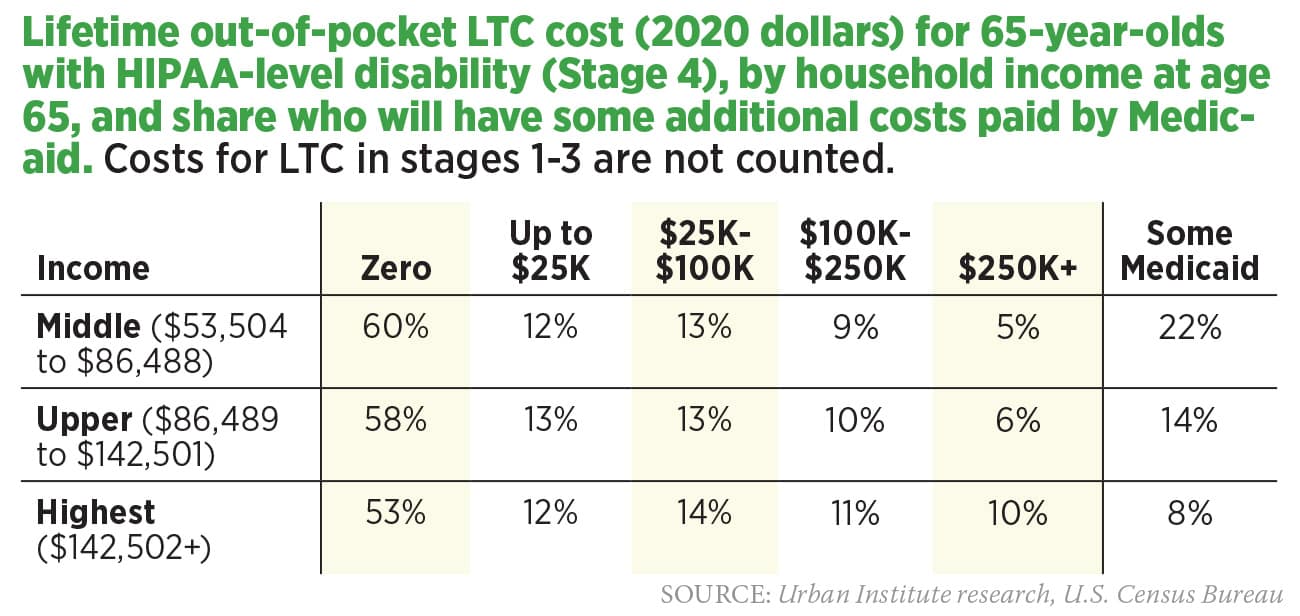

Table 2 displays the January 2021 government-sponsored estimate of the cost of LTC. These projections underestimate out-of-pocket costs because expenses incurred before reaching HIPAA-level disability (Stage 4) are not included.

Some people in each income group (based on income at age 65) become eligible for Medicaid by the time they need LTC. Reasons include decades of general inflation, plus wage and cost inflation for LTC services; reduced value of Social Security benefits because Medicare premiums (which are deducted from Social Security checks) often increase faster than cost-of-living increases; more taxes paid on Social Security benefits (the share of Social Security benefits included in taxable income is increasing because threshold levels for including benefits in taxable income are not currently indexed for inflation); and increased longevity (some people with a relatively high income at age 65 qualify for Medicaid when they reach their mid-90s because they spend down their assets).

Let’s break down the various income groups and their costs of care. Why do some groups have higher out-of-pocket costs than others?

» Middle income ($53,504 to $86,488)

60% are projected to have zero out-of-pocket costs. Some people with zero costs never need care (costs are truly zero); some incur significant expenses for care in stages 1-3, but these costs are not counted (only HIPAA-level expenses are included in the study); and some become Medicaid eligible before spending any of their own money. 9% incur costs of $100,000-$249,999, and 5% spend $250,000 or more. 22% have some LTC expenses paid by Medicaid.

» Upper income ($86,489 to $142,501)

58% are projected to have zero out-of-pocket costs. Some people with zero costs never need care, some need care but never reach HIPAA-level severity, and some become Medicaid eligible before spending any of their own money. 10% incur costs of $100,000-$249,999, and 6% spend $250,000 or more. 14% have some LTC expenses paid by Medicaid.

» Highest income ($142,502+)

53% are projected to have zero out-of-pocket costs. Some people with zero costs never need care, some need care but never reach HIPAA-level severity, and some become Medicaid eligible before spending any of their own money. 11% incur costs of $100,000-$249,999, and 10% spend $250,000 or more. 8% have some of their LTC expenses paid by Medicaid.

3 Reasons Your Clients Need You To Provide Medicare Advice

What’s On The Minds Of Global Life Insurance Executives? A Lot!

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Proxy Statement (Form DEF 14A)

- Idaho Senate approves Medicaid budget

- John Oliver sued by health care boss

- Pharmacy bill passes House committee

- Lowering the cost of insurance in Colorado – a new analysis of the Peak Health Alliance

More Health/Employee Benefits NewsLife Insurance News

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- AM Best Affirms Credit Ratings of CMB Wing Lung Insurance Company Limited

More Life Insurance News