The big bite of health spending on retirees (and what Congress is doing about it)

Retirees and people nearing retirement might not have an accurate appreciation for how significant an impact medical spending will have on their Social Security income, according to a recent analysis.

Even with Medicare coverage, premiums and out-of-pocket (OOP) expenses consume 25% of Social Security income for a median of retirees, according to a Boston College Center for Retirement Research. Five percent of the retirees spend nearly all their income (89%) on medical expenses. The study did not include long-term care.

The researchers said in a study that policy analysts, and the public, look at the adequacy of retirement income based on the income itself but do not fully appreciate the impact of medical expenses, which the authors said were more relevant to purchasing power.

“With OOP health expenditures eating away at retirement income, and Part B premiums on the rise, it is understandable why many retirees likely feel that making ends meet is difficult,” according to the study brief.

The impact of expenses is greater on women, low-income people and retirees in poor health. Women do not have higher health expenses, but they tend to have lower retiree benefits. Median annual expenses totaled $4,311, according to the study, which used 2018 data.

Although premiums accounted for the largest chunk of the spending for the typical retiree, cost-sharing and uncovered services accounted for the highest spenders.

The bite keeps getting bigger

A Kaiser Family Foundation analysis showed that rising premiums and deductibles have been eroding retiree income for the past two decades. This is particularly true of Part B premiums, which grew from 6% of the Social Security benefit in 2002 to 10% in 2022. With Part A and Part B deductibles for hospital and physician services, the total has increased from 15% of the Social Security benefit in 2002 to 19% now.

The KFF noted that the reconciliation bill passed by the U.S. Senate last week would have a significant impact on seniors’ expenses. The House is expected to consider the legislation this week.

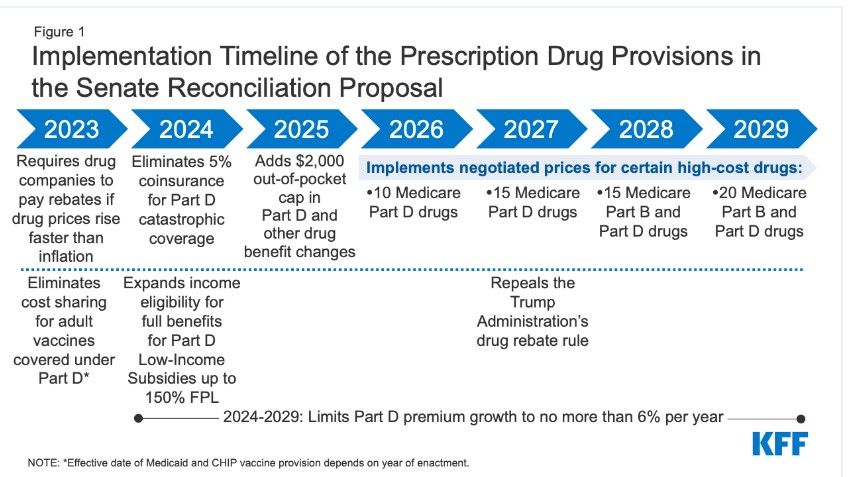

If passed, the law would lower prices on drugs for Medicare recipients by: directing Health and Human Services to negotiate drug prices on behalf of Medicare, requiring drug manufacturers to pay a rebate to the government if pharmaceutical prices rise faster than inflation and capping OOP spending for Medicare recipients. KFF researchers noted that although manufacturers could get around the inflation provision by increasing prices when drugs are introduced, overall the law would suppress runaway drug price inflation.

The law would eliminate the 5% coinsurance requirement above the Medicare Part D catastrophic threshold in 2024 and impose a $2,000 cap on Part D OOP spending in 2025. The cap would be the first substantial change to the Mediare Part D benefit since 2010.

The provisions would be implemented over several years beginning next year.

“Capping out-of-pocket drug spending under Medicare Part D would be especially helpful for beneficiaries who take high-priced drugs for conditions such as cancer or multiple sclerosis,” according to KFF. “For example, in 2020, among Part D enrollees without low-income subsidies, average annual out-of-pocket spending for the cancer drug Revlimid was $6,200 (used by 33,000 beneficiaries); $5,700 for the cancer drug Imbruvica (used by 21,000 beneficiaries); and $4,100 for the MS drug Avonex (used by 2,000 beneficiaries).”

The federal government was not allowed to negotiate drug prices as part of the Medicare Modernization Act of 2003, which established Medicare Part D for prescription drug coverage. KFF researchers noted that drug companies have said this would discourage innovation, and that the Congressional Budget Office confirmed that 1% of potential drugs would not make it to market over the next 30 years.

The law would also expand eligibility for full Part D low-income subsidies to those with incomes of up to 150% of poverty and eliminate the partial benefit now in place.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

How to get the most out of Life Insurance Awareness Month

Integrity Marketing Group acquires Richman Insurance Agency

Advisor News

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- Our View: Arizona’s rural health plan deserves full funding — not federal neglect

- NEW YEAR, NEW LAWS: GOVERNOR HOCHUL ANNOUNCES AFFORDABLE HEALTH CARE LAWS GOING INTO EFFECT ON JANUARY 1

- Thousands of Alaskans face health care ‘cliff in 2026

- As federal health tax credits end, Chicago-area leaders warn about costs to Cook County and Illinois hospitals

- Trademark Application for “MANAGED CHOICE NETWORK” Filed by Aetna Inc.: Aetna Inc.

More Health/Employee Benefits NewsLife Insurance News

- One Bellevue Place changes hands for $90.3M

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

More Life Insurance News